SPX Futures Challenge the 50-day and Fail

Stock-Markets / Stock Markets 2018 Jun 28, 2018 - 02:27 PM GMT SPX futures attempted a rally, challenging the 50-day Moving Average, but couldn’t break through. They have since slipped beneath the Head & Shoulders neckline and most likely have triggered that formation. That should send the SPX beneath the 200-day Moving Average at 2666.78 and possibly beneath the lower trendline of the Broadening Wedge formation at 2625.00.

SPX futures attempted a rally, challenging the 50-day Moving Average, but couldn’t break through. They have since slipped beneath the Head & Shoulders neckline and most likely have triggered that formation. That should send the SPX beneath the 200-day Moving Average at 2666.78 and possibly beneath the lower trendline of the Broadening Wedge formation at 2625.00.

ZeroHedge reports, “US equity markets are looking to undo yesterday's bearish reversal, with index futures higher this morning, reversing the trend from earlier markets where Asian stocks flirted with a 9 month low and Europe was mixed.”

NDX futures have also slipped beneath its Head & Shoulders neckline. A more likely target may be at 6322.60, the origin of the Ending Diagonal.

VIX futures had early morning losses, but is staging a comeback.

Bloomberg reports, “Options bets on stocks and exchange-traded funds are piling up around key deadlines in President Donald Trump’s trade crusade and at least one strategist doesn’t think it’s a coincidence.

Six of the 11 most-active contracts on the U.S. exchanges Tuesday had a June 29 expiration. That’s a day before the Treasury Department is scheduled to propose restrictions on Chinese investments in the U.S. It’s also the last session before Congress can block renewal of a measure known as the trade-promotion authority, which provides for a yes-or-no vote by lawmakers on trade deals.”

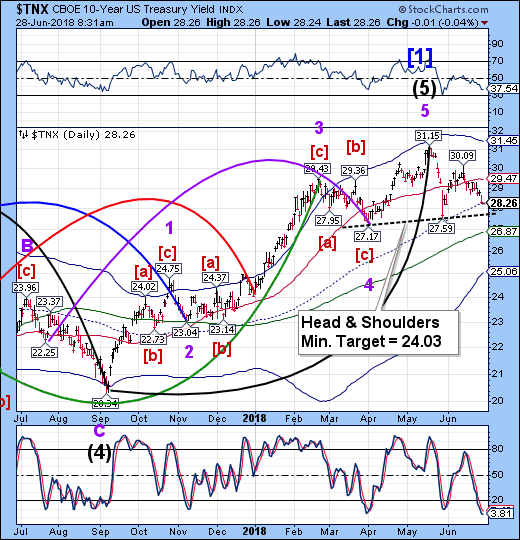

TNX appears to be stalled at mid-Cycle support at 28.26. Should a breakthrough happen, the Head & Shoulders neckline may be the next target. TNX has about three weeks until its next Master Cycle low, which may simultaneously conform to an UST high. One fly in the ointment is the $30 billion of US treasuries that need refinancing on or around June 30.

ZeroHedge comments, “It’s that time again. At the end of this month, the Federal Reserve has over $30 billion of notes maturing. I won’t rehash what this might mean for the market, rather for those not familiar, I ask you to go read Pink Tickets On QT Days.”

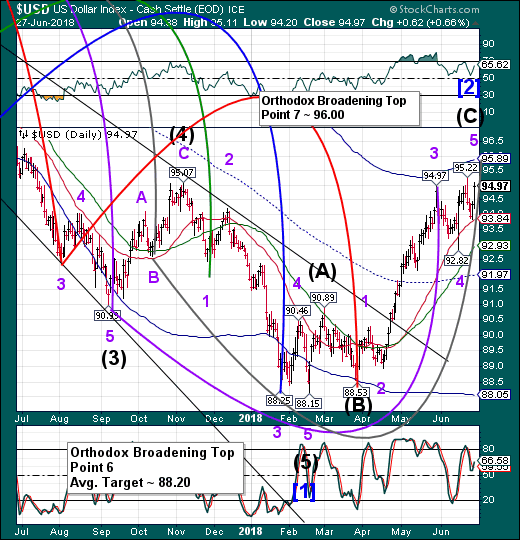

USD futures appear to be consolidating. My best analysis suggests there may be a final run-up to the Cycle Top resistance at 95.89 in the next few days. Another inverted Master Cycle high is due.

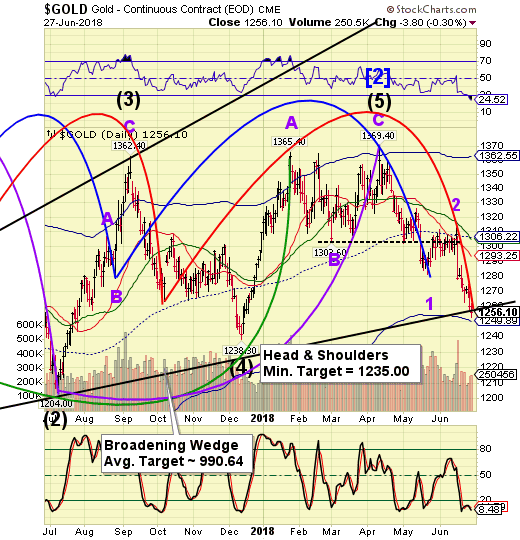

Gold futures reached a new low at 1249.80 this morning, testing the Cycle Bottom before pulling back. This may be the final low since it is overdue for a Master Cycle low. The subsequent rally may be Wave [c] of 2. The likely target may be the mid-Cycle resistance at 1306.22.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.