Gold / Copper Miners Miners Interesting Ratio

Commodities / Gold and Silver Stocks 2018 Jun 29, 2018 - 01:22 PM GMTBy: Gary_Tanashian

The GDX/COPX ratio has broken above the 50 & 200 day moving averages and is still going, despite gold’s ignominious state at the moment.

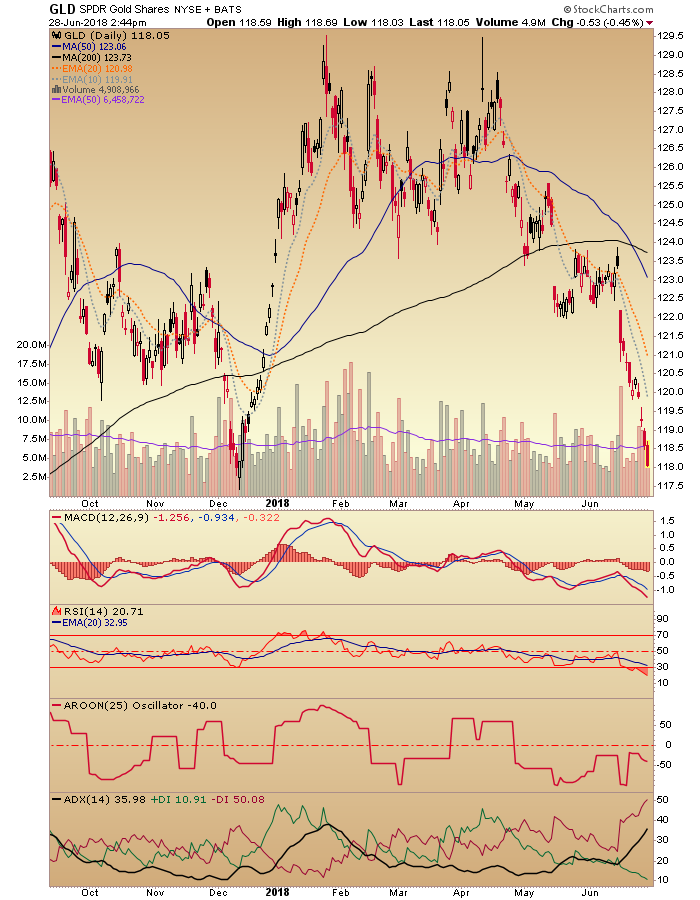

Here’s what gold (GLD) looks like today.

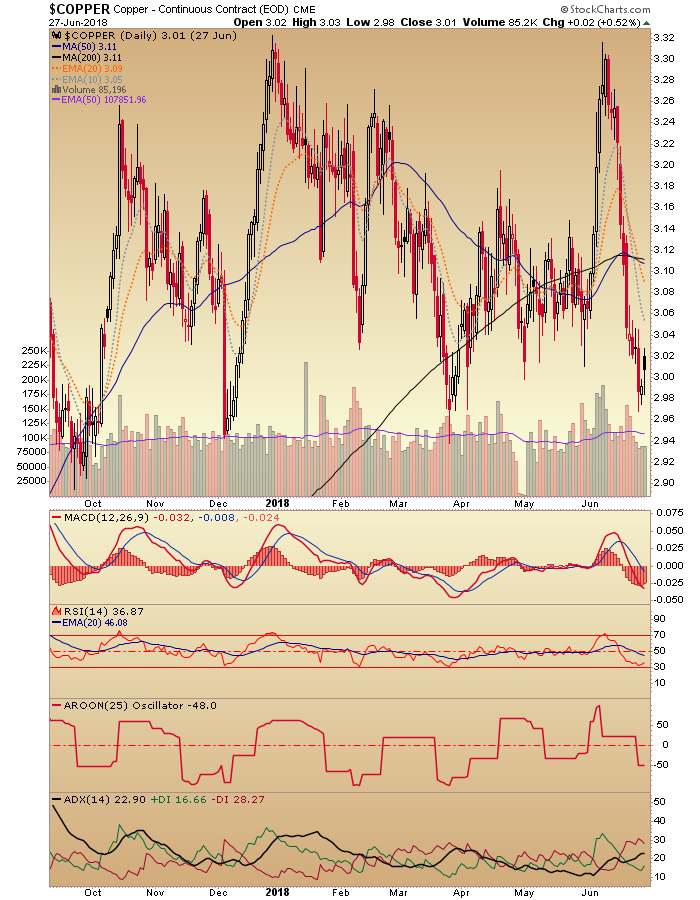

Here is what copper looked like at yesterday’s close (in-day today it is a hair under 3, at 2.9981/lb). And yes, that is important support.

Against the broader Industrial Metals complex GDX is weaker. But XME includes – you guessed it – gold miners and gold royalty companies along with metal service centers and the like. In other words, it’s not just a pure play on IM miners.

All in all, I do not have an overly bearish feeling about gold and its miners at this time. In fact, I don’t have a bearish feeling at all, even though traditional sector indicators like HUI/Gold and Silver/Gold have sagged over the last few days. That is because with the gold sector you think about being brave when the blood is flowing, not when the inflationary gold bug touts are leading the charge.

Bottom Line: Though both are weak, miners of a counter-cyclical metal are doing better than miners of a cyclical metal in June.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.