Trump Destroying US Empire in Trade War Against China, Europe and Canada

Politics / China US Conflict Jul 06, 2018 - 05:36 AM GMTBy: Nadeem_Walayat

And so the Trade War begins as Trump delivers on his 'America First' election slogan where at the top of his agenda is for a destructive Trade War against not just China but the whole world, which Trump sees as correcting decades of erroneous US trade policies that saw the Chinese totalitarian state literally handed trillions of dollars to invest in it's civil and military infrastructure, modernising it's third world economy at an unprecedented lightening speed, trillions of dollars coupled with valuable intellectual property stolen from the West that has put China on the fast track towards ultimately threatening US global supremacy with their own Empire that Trump chaotically has tasked himself towards preventing.

And so the Trade War begins as Trump delivers on his 'America First' election slogan where at the top of his agenda is for a destructive Trade War against not just China but the whole world, which Trump sees as correcting decades of erroneous US trade policies that saw the Chinese totalitarian state literally handed trillions of dollars to invest in it's civil and military infrastructure, modernising it's third world economy at an unprecedented lightening speed, trillions of dollars coupled with valuable intellectual property stolen from the West that has put China on the fast track towards ultimately threatening US global supremacy with their own Empire that Trump chaotically has tasked himself towards preventing.

Firstly, people need to be aware that there are in fact TWO Trump's, there is election Trump who basically told everyone in simple terms exactly what he intended to do as President, and then there is 'showman' Trump who enjoys playing the part of being Mr President, hence the showmanship that we see most of time coming out of the White House, one of signing executive orders that don't tend to amount to anything of much, meetings with the the likes of the North Korean dictator that was followed with worthless declarations of having made peace, when in reality the meeting resulted in nothing of substance. That is what people will see perhaps 80% of the time, 'showman' Trump which is why the mainstream media tends to get so easily confused and wrong about what are the most probable outcomes.

The REAL Trump

I mapped out in my Trump Reset series of what to expect from the 'real' Donald Trump BEFORE he took office, where the key theme was that the US was inevitably trending on an accelerated path towards War with China and why one needs to look at events taking place under Trump through prism of the collision between the world’s TWO military and economic super powers. The United States as the defacto global super power brushing up against the emerging Chinese super power seeking to break out of the 400 or so US military bases that encircle China and that ultimately seeks to displace the United States with its own Chinese Empire.

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

- 04 Jan 2017 - CIA Planning Rogue President Donald Trump Assassination? Elites "Manchurian Candidate" Plan B

Analysis which I had planned to periodically update into a series of Trump Reset War with China videos that mostly have remained pending. However, now which Patreon has given fresh impetus towards resuming the completion of.

The Trade War

In December 2016 I mapped out how I expected the Trump Trade War would play out not just against China but even against America's allies such as Canada and the EU, whilst most economists and political pundits refused to take Trump statements seriously, treating as just electioneering, especially given his post election grandstanding and so have been taken by surprise this year when he actually started to implement what he warned of during the 2016 election campaign, all of which are contained within my analysis of December 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

ECONOMIC WAR - JOBS

The reality is that the United States and much of the rest of the West have effectively been employing hundreds of millions of low paid chinese slave workers for decades, all without the labour laws or environmental consequences resulting in very cheap goods in western shops, low inflation maintenance of purchasing power for the western masses mostly for the purpose of buying the latest junk imports from Chinese factories designed by western corporations, and by doing so have completely transformed the Chinese economy from inconsequential GDP of $300bln 30 years ago to $12 trillion today, and thus exponentially strengthening a totalitarian state ruled by a communist dictatorship that increasingly seeks to spread its tentacles beyond its borders.

Remember that the Soviet Union was defeated not militarily but through economic warfare. The current economic trend trajectory has the Chinese dictatorship clearly winning the economic war as the Chinese economy converges towards becoming the world’s largest economy within the next 10 years unless action is taken to halt this trend.

"First, the North American Free Trade Agreement, or the disaster called NAFTA. Second, China’s entry into the World Trade Organization. NAFTA was the worst trade deal in the history – it’s like – the history of this country. And China’s entrance into the World Trade Organization has enabled the greatest job theft in the history of our country." Donald Trump

The cost of cheap Chinese goods in the shops has been western unemployment and depressed wages. For instance an estimated 20 million US jobs alone have been offshored by US corporations to China resulting in the employment of approx. 100 million Chinese workers i.e. Apple alone employs 750,000 Chinese workers. So at least President Trump will attempt to rectify the jobs theft to some degree as he seeks to dismantle the mechanisms through which China has prospered in terms of jobs creation at Western workers expense. However there will be a price to pay for this and that will be in much higher priced goods in the shops whilst the benefit will be many millions of new jobs created in the US.

The real big loser here will be China, for China has gone out of its way to maintain the current trade flow system to its huge advantage, allowing it develop at an unprecedented pace through several primary mechanisms such as currency manipulation which is why China holds $1.3 billion US government debt and many other dollar assets so as to force the Chinese Yuan lower against the US Dollar so that more Chinese jobs will be created whilst at the same time more US jobs will be destroyed. So yes, China has been engaged in an economic war against the west and winning it through mechanisms such as currency manipulation amongst many others.

So much of that which Trump has been spouting is actually true. China does not play fair, and in exchange for Chinese junk that fills up western garages, China has destroyed at least 20 million US jobs alone! Though it should be noted that ALL nations central banks manipulate their currencies, after all that is what the policy of the zero interest rates for the past 8 years means.

Thus Trump's economic war will cause Chinese unemployment to rise and thus economically and socially destabilise China, especially if the rest of the West decides to take a leaf out of Trumps economic warfare book by enacting similar anti-China dumping policies that will put the communist dictatorship on the defensive as China lacks safety valves such as free and fair elections and referendums to cope with social unrest.

Whilst on the other side of the equation is the estimated $1.3 trillion of US government debt held by China the steady sale of which will contribute towards higher US interest rates as the market supply of US government bonds increases, a trend that is already well underway. So the key message from Trumps economic war on China is to expect a lot higher INFLATION!

And where economic war is concerned it won't be just limited to China for Trump has made clear during the election campaign that Mexico is also up there with China on Trumps economic hit list, and so the list will probably extend to include the likes of Japan, South Korea and Germany. Friend or Foe does not matter Trump's economic war will go global!

And here we stand in Mid 2018 with Trumps Trade War against China literally about to start today as the first of a series of tariffs are due to kick in on $34 billion of Chinese goods, some of that mountain of stolen western tek that the Chinese have been selling back to the West at knock down prices courtesy of never having to undertake the R&D costs involved. Whilst China will soon after implement it's own retaliatory tariffs on mainly US agricultural products targeting Trump voters. And given the announcements made earlier this year, then this Trade War between the US and China could easily spiral to over $300 billion maybe beyond $400 billion in tit for tat escalations, something which the mainstream press still fails to realise even at this late stage, that it's not just about trade, it's all about two competing empires! Instead putting hopes on the trade dispute fizzling out here.

Trade War Time Line 2018 :

Jan 2018

Trump starts the trade war going by announcing steep 30% tariffs on solar panels and washing machines aimed at China's dumping of subsidised solar panels onto the US market.

March 2018

Trump resumed his Trade War rhetoric against China by err targeting Europe, Canada and Mexico as well as China with 25% steel tariffs worth about $50 billion though initially exempting Canada and Mexico.

April 2018

See's tit for tat responses between China and the US, China warns of targeting Trumps agricultural voter base. Whilst the US plans to target technology products, again totaling about $50 billion. Whilst Trump presses the pause button on the implementation of 25% steel tariffs until June 1st.

May 2018

Japan, Russia and Turkey warn of retaliation against the steel tariffs.

June 2018

See's US steel tariffs kick in with a lot of tit for tat announcements from China of additional $50 billion of tariffs. Even India joins in by announcing tariffs on some US goods. Then on 22nd June comes the big one, Trump threatens European car manufacturers with a 20% tariff (up from 2.5%). That towards the end of June prompted a retaliatory response from the European Union threatening tariffs on $300 billion US goods.

Overall as things stand this suggests the US vs the world faces average tariffs of 20% across about $500 billion of goods this year that would cost the US $100 billion and likewise the rest of the World a similar amount. So the global economy on face value takes a $200 billion hit, which is basically a pinprick given its $78 trillion size. However, obviously sectors are clearly going to be hit hard resulting in much disruption, such as the auto manufacturers and Trumps agricultural base. And an belligerent Trump is clearly nowhere near done yet! So this Trade war has got a long, long way to run, especially if Trump intends on wiping out the near $400 billion trade deficit with China.

How did we Get Here?

So how did we reach the current situation where the United States and the rest of the West scored a massive own goal by handing third world China the means to construct its own economic and military empire. The answer lies with the banking crime syndicate and their instable thirst for profit. The banks have been playing this game long before China started to open up to capitalism during the early 1980's. The banking crime syndicate IS the real enemy of the peoples of the United States, Britain and the rest of the west. They are directly behind the trend for globalisation, for corporations offshoring jobs to China, India and to the rest of Asia. But still despite all of their crimes against the people, the bankers in large part have gone unpunished, continuing to do business as normal. And it's only with the disruptive force that is Donald Trump that there appears to be a day of reckoning of sorts, though it remains to be seen if he can effect a permanent change in the globalisation trend or just be a temporary blip as is the most probable outcome.

Can the US Win a Trade War Against China, and Other Big Deficit Nations?

The rest of this analysis was first being made available to my patrons who support my work, if you want immediate access to this and ALL of my in-depth analysis and detailed trend forecasts including the following schedule of analysis that includes an in-depth look at the stock market, US and UK housing markets, US dollar, gold etc... then please consider supporting my work at just $3 per month (https://www.patreon.com/Nadeem_Walayat).

Rewards for patrons include:

FIRST access to my ahead of the trading and investing curve analysis. Usually 5 days ahead of the public, including KEY detailed trend forecasts!

Also, I will keep my patrons informed of when my latest analysis is due for completion and what I am going to be working on next.

PLUS my Patrons get to vote on my schedule for analysis AND join my Patreon community Q&A on my market analysis and forecasts.

------ Rest of this article was made available below on 11th July 2018 -----

Well, the simple answer is YES, if the US targets the trade war against all those nations where the US has a large trade deficit, such as China, Germany, Italy, Mexico etc. However the problem is that the European Union is one block, a buffer for the German Economic Empire that basically dilutes the the economic force that the US can exert on China, as it allows China to give concessions to the EU and other nations in attempts at expanding access to markets so as to offset the impact of a tit for tat trade war with the US.

In totality the US exports $2.2 trillion of goods and services whilst importing $2.75 trillion, resulting in a large annual deficit of about $550 billion. Where the main culprit is of course China against which the US has consistently had a large trade deficit for decades that currently stands at an annual $350billion that China manages to maintain through manipulation of its currency by keeping the Chinese currency WEAK relative to its key export markets i.e. the US and Europe. The cost of which has been the loss of at least 10 million US manufacturing Jobs to China. So Trump is right that China has stolen millions of Jobs from the US, with perhaps a net 4 million having been lost to the rest of the world. Therefore according to Trumponomics he can bring these 10 million jobs back home to America.

So logic dictates that a targeted trade war against China co-ordinated with America's allies could be relatively easily won that would put the emerging Chinese Economic Empire on the defensive. Unfortunately, I foresaw that this is not how the Trade War would play out under President Trump who clearly never thinks things fully through, instead reliant on the likes of Fox News sound bites for this 'intelligence briefings' and research, so of course he would turn his trade tariff guns onto Americas allies such as the EU, Canada, South Korea and Japan. Which he has as he is unable to see past the following table, whilst completely missing the big picture.

US Trade Deficit $566 billion

- China $375 billion

- Mexico £71 billion

- Japan $69 billion

- Germany $65 billion

- Canada $18 billion

For some reason the Trump regime never considered that the US slapping tariffs on European and Canadian goods would result in retaliatory tariffs that appears to have caught the Trump White House by surprise triggering a belligerent response of escalatory tariffs as Trump announces several more rounds of tariffs targeting at the likes of European auto manufacturers, a tit for tat Trade War that has now ballooned towards targeting a huge $500 billion of global trade with the US, with typical tariffs of 20% again targeting the Trump voter base such as Harley Davidson's.

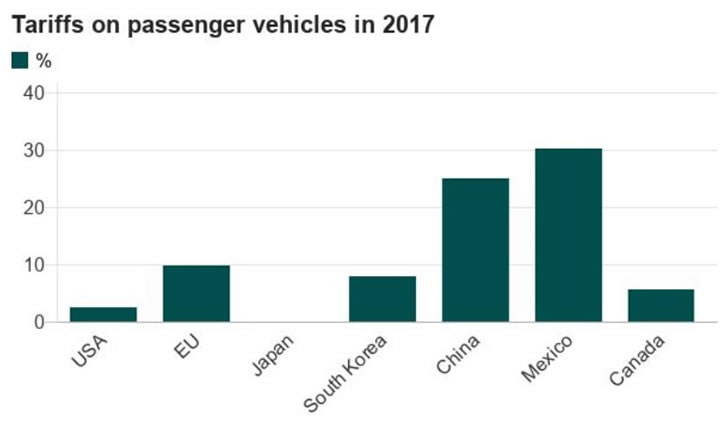

Whilst the reality of auto sector trade tariffs illustrates that the US should be working WITH the EU and Canada AGAINST the likes of China and Mexico instead of threatening to slap 20% trade tariffs on European auto's imported into the United States.

The Consequences of Trump's FAILURE to Comprehend the Real Reason for the US Trade Deficit

1. Destroying US Dollar Hegemony

The US Dollar has remained as the worlds primary reserve currency since the end of World War 2 due to the fact that every nation needs to hold sizeable amounts of US dollars and liquid dollar assets such as US government bonds so as to maintain trade flows and currency stability against the US Dollar which given the size of its trade deficit would otherwise be continuously depreciating against the exporting nations resulting in higher inflation in the US and deflation in the exporting nations.

The graph clearly illustrates that most of that which you read about the rise of Chinese Yuan to displace the US Dollar is NOT reflected in reality. As things stand today, the Chinese Yuan is nowhere near threatening the reserve currency status of the US Dollar. In fact the only real competitor for the US Dollar is the Euro (the German Economic Empire).

Whilst Trump seeking to end the US trade deficit would result in a loss of demand and power of the US Dollar as the world's reserve currency as there would no longer be the need to hold mountains of dollars such as the $1.2 trillion of US bonds held by China alone, and this from a competing empire, let alone the trillions of dollars held by other friendly central banks, the consequences for which would be that it would become harder for the US to get away with monetizing government debt ($5 trillion), and exerting its financial dominance across the world.

Of course in an ideal world imports and exports should be in balance, but there would not be enough demand to buy US goods in exporting nations as they would not have the dollars to do so for consumption, which means a loss of economic output for the exporters and for the US as inflation rose due to higher domestic production costs thus triggering at least an inflationary recession. Therefore the US trade deficit is akin to QE for the global economy that is awash with US Dollars keeping the global economy growing where excess dollars (US government debt) are stored by the central banks of the world, so as to maintain exchange rate stability, which allows the US to finance its budget deficit at far lower interest rates than would otherwise be the case, something that Trump the 'King of Debt' fails to grasp.

2. Destroying American Jobs

One of Trump's primary Mantras was that China was Stealing American jobs which Trumps Trade War seeks to correct by bringing jobs back to the United States, which perhaps could have been possible if the Trump regime had intelligently targeted the prime culprit China given the huge disparity of how many US jobs rely on the Chinese export market against how many Chinese jobs rely on the US export market, a factor of probably 50 to 1! Whilst in total at least 10 million US jobs are reliant on global export markets. So a total collapse of Trade between the US and the World could result in the US losing as many as 10 million jobs whilst China risks losing 50 million jobs.

However, Trump will do that which produces the best sound bites, even if it proves counterproductive and results in far more US job losses than jobs brought back to the United States, which is as a consequences of the United States shrinking export markets due to retaliatory tariffs i.e. if the market disappears for instance for Harley Davidson's exported to Europe then ZERO jobs are brought back to the United States. Instead the opposite would happen as illustrated by Harley Davidson's response to Trump Tariffs and EU retaliation is to OFFSHORE US jobs to EUROPE, it's second largest market after the US, that triggered a fresh Trump Twitter storm against Harley Davidson of which the following gives a taste of -

Therefore the way Trump is running this Trade War is much like he runs his businesses, INSANELY! But of course all of the Presidents and Congress for the past 30 years have also been INSANE to allow the Chinese threat to emerge in the first place, perhaps that is what they wanted to happen all along so that the US military industrial complex could continue to justify its size and scope following the collapse of the Soviet Union and hence fostered the Chinese threat to emerge so that the defence budget can keep snaking ever higher.

3. Destroying the US Empire

Whilst I did foresee that Trump with this simplistic America First world view would target trade deficit with allies such as the EU, Canada and Japan. However, I considered this to be an epic Empire destroying mistake. For it makes the fundamental mistake of not realising that Western nations, including Japan and South Korea are actually part of the US Empire. One of where in exchange for favourable trade terms allows the US to exert itself financially, economically and militarily across the whole world. Which enabled the US to first destroy the Soviet Union and subsequently having successfully kept Russia largely contained within its borders that is until Trump took office with the help of Russia's Czar Putin.

The next big mistake of all Presidents of the past 30 or so years was instead of excluding China from the US Empire's trade club, China has been allowed to insidiously slide its way right into core of the US Empires economic system at huge benefit to China, all achieved through unfair trade practices and out right theft of intellectual property, something that the West never allowed Russia to get away with.

So to be clear China is a corrupt thieving regime out to steal western technology on a grand scale which then dumps cheap copies of western goods onto western markets resulting in the theft of tens of millions of western jobs as the West has a far higher cost of living and thus could never compete against Chinese slave wages that the likes of Apple has embraced. All whilst the Chinese economic empire continues to expand the size of it's military ready for the emergence of the Chinese Military Empire.

Yes, Chinese theft of western technology and intellectual property is rampant and NO ONE! Not America, Not Europe Not You NOR ME is immune from the state sponsored theft actions of the Chinese state, corporations and individuals!

Trumps actions in office, are not just limited to the highly damaging trade war against America's western allies with whom Trump should be coordinating the Trade War against China, but his actions are undermining the very pillars on which the US Empire has stood for 70 years such as NATO. Which as I warned in December 2016 not only risks destroying the fundamentals of the US Empire but risks giving birth to new competitor Empires by unleashing the likes of Germany in Europe and Japan in Asia to re-arm and once more and embark upon their own military and economic agendas in the name of defence, where in Europe the emerging Fourth Reich (already in existence economically) would see the reason for its militirisation as a deterrence against a belligerent Russia as US guarantees could no longer be relied upon.

Whilst in Asia we have Japan also re-arming due to lack of credibility of US military guarantees in deterrence of the ever expanding Chinese Empire. Though as these two NEW competing empires emerge and grow then undoubtedly they would seek to displace US influence in their regions, thus Trumps actions are splintering the world into multiple competing military and economic blocks as the United States empire remains primarily focused on the Chinese threat, thus turning a blind eye to the emerging threats of Germany and Japan that would once more see the western Pacific as Japan's back yard. Which is probably what a short-sighted Trump wants to happen because it means the US does not need to spend as much money on containing China as the Japanese would increasingly do the job, all without realising what Japan would do with its vastly expanded military.

The consequences of dismantling of the US Empire and unpleasing Japan and Germany is clearly something that Trump completely fails to comprehend given his simplistic Fox News world view.

However, all is not lost, which despite the fact that the US is on an inevitable trend towards War with China that the Trump Presidency is acting as an accelerant of. As Trump's other disruptive actions that are resulting in the weakening of the US empire are likely to prove temporary, where just as Trump sought to undue many of President Obama's policies, so the next President regardless of party will likely undue many of Trumps disruptive policies in respect of having weakened the US Empire as I don't see Trump being granted a second term in office by the American people.

The bottom line is that President Trump is surrounded by yes men who have no choice but to agree with whatever spouts from his mouth else being "YOUR FIRED!" Trump is systematically dismantling corner stones of what American Power is built upon, of which the trade deficit is an important component and thus acts to undermine that which the US has used to keep the likes of the Russian Empire in check, that up until Trump took office was barely able to exert itself beyond its borders given its pin head economy. And so similarly Trumps trade actions in Asia will likely embolden China to break out of the containment of 400 US military bases, whilst emboldening the Japanese to re-arm as US economic power diminishes across the globe. America has possibly another 2 more years to run under Trump so it remains to be seen what further damage Trump can do to America's long-term interests as he randomly takes America 1 step forward and then 2 steps back.

Implications for the Stock Market

The unfolding Trump Trade War has been one of the main reasons why I have have been skeptical for the prospects for the stock market this year, as the stock market discounts the future, so whilst early in the year Trump was announcing small change tariffs on goods of say $35 billion, I expected the stock market to discount where this path ultimately leads, especially given that his rhetoric was not just aimed at the Chinese, but EVERYONE! Friend and Foe! Which definitely adds major costs to doing business for US corporations BOTH domestically and abroad.

09 Feb 2018 - Stock Market Roller Coaster Crash Ride Down to Dow Forecast 23,000

The stock market has remained relatively weak all year, firmly within a trading range with a downward bias as the market tries to come to terms with Trumps Trade War and its various consequences.

China Your FIRED!

The strong statements out of China of tit for tat responses to US Tariffs should be taken with a giant pinch of salt for the performance of the Shanghai index makes it crystal clear of who is the big loser in this Trade War. China is and WILL continue to LOSE this Trade War! So it is highly likely there will at some point be a Trade War induced financial panic in China.

My next in depth analysis will be focused on the prospects for the stock market for much of the remainder of 2018 that will be FIRST made available to my patrons. So do consider supporting my work at just $3 per month. https://www.patreon.com/Nadeem_Walayat

Your analyst,

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.