Don’t Get Too Bullish on Gold

Commodities / Gold and Silver 2018 Jul 19, 2018 - 02:45 PM GMTBy: Troy_Bombardia

Gold has been getting crushed recently, and now sits near several support levels.

As a result, gold’s weekly RSI has become “oversold”.

Meanwhile, NUGT (gold miner’s 3x leveraged ETF) just spiked. This has some people thinking that big buyers are turning bullish on gold in anticipation of a relief rally.

So should you turn bullish on gold?

No.

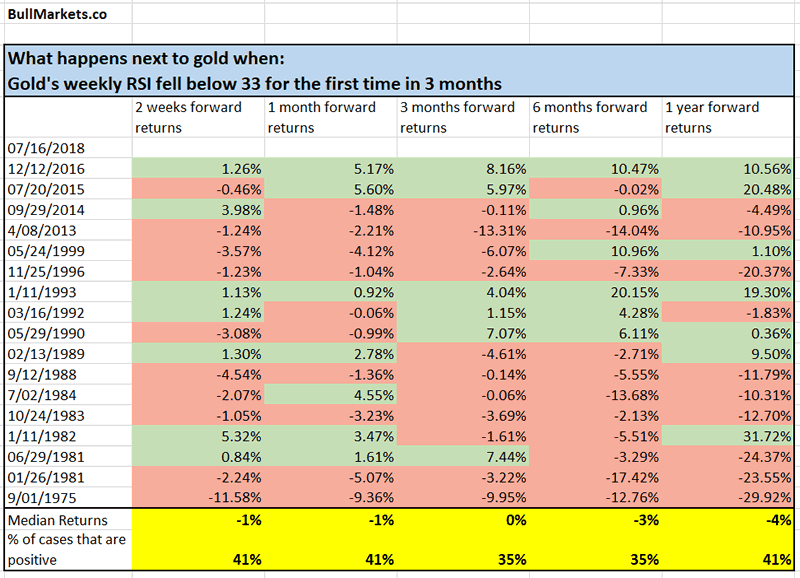

Here’s what happens next to gold when its weekly RSI (momentum indicator) falls below 33 for the first time in 3 months.

Click here to download the data in Excel.

Conclusion

When gold’s weekly RSI falls below 33, it tends to go down in the next 3 – 6 months. This is because gold doesn’t usually experience such weak momentum during bull markets. Weak momentum like this signals that gold is still in a bear market. Hence, it will probably make a bullish weekly RSI divergence before bottoming.

This is a medium term bearish sign for precious metals.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.