You Buy the Fear in Gold

Commodities / Gold and Silver 2018 Jul 22, 2018 - 12:04 AM GMTBy: Gary_Tanashian

This article does not speak to gold’s proper fundamentals, which are not yet very healthy (although some positive signs are finally gathering). For the proper counter-cyclical atmosphere to engage gold bulls would need have risk ‘on’ markets and assets crack. Yet, gold’s (and silver’s) price may well bottom before readily obvious fundamental improvement is apparent to a majority (as was the case in Q1 2016).

This article does not speak to gold’s proper fundamentals, which are not yet very healthy (although some positive signs are finally gathering). For the proper counter-cyclical atmosphere to engage gold bulls would need have risk ‘on’ markets and assets crack. Yet, gold’s (and silver’s) price may well bottom before readily obvious fundamental improvement is apparent to a majority (as was the case in Q1 2016).

Far too much analysis is put out there linking gold with inflation. It is true that gold often acts as an effective inflation hedge, but it all too often fails in that capacity.

Far too much analysis is put out there linking gold with war, terror, pestilence and other conditions of human suffering. The surest way to spot a gold promoter, if he is not pumping inflation, is his pitch for gold as a disaster hedge. Yes okay, and I have a little Unibomber shack in Montana to sell you too.

Far too much analysis is put out there linking gold with the vast “resources” and “hard assets” trades. These things are of a cyclical nature and gold is ready and waiting as the anchor of stability on the counter cycle, as cyclical assets are liquidated. At best gold under performs when resources and commodities are booming during inflationary growth phases in the global economy, and should be held only for long-term considerations at those times.

On shorter-term phases, you buy the fear in gold when many gold bulls, influenced by factors like those noted above, are puking their metal to the lowest bidder. It is an almost ritualistic “running of the gold bugs” as I call it.

The most recent liquidation was probably instigated by large speculative interests that chased the momentum of the last inflation trade, which gold did lead in December of 2015 as it bottomed 1-2 months before the tide began to lift silver, the miners, commodities and US and global stock markets. This inflation trade has been largely anti-USD, and it has weakened in the face of the recently firm USD. Simple.

But what is not so simple is the concept that as counter-cyclical forces begin to liquidate the various asset trades, the US dollar (the reserve currency counter-party to the… asset party) rises against the wishes of global casino patrons, not to mention a US president who wants his cake and would like to eat it too. The opportunity in gold and especially gold stocks comes when the gold bugs who’ve been chasing the conditions noted in the first 3 paragraphs above finally give up in despair, thinking that Uncle Buck is the enemy.

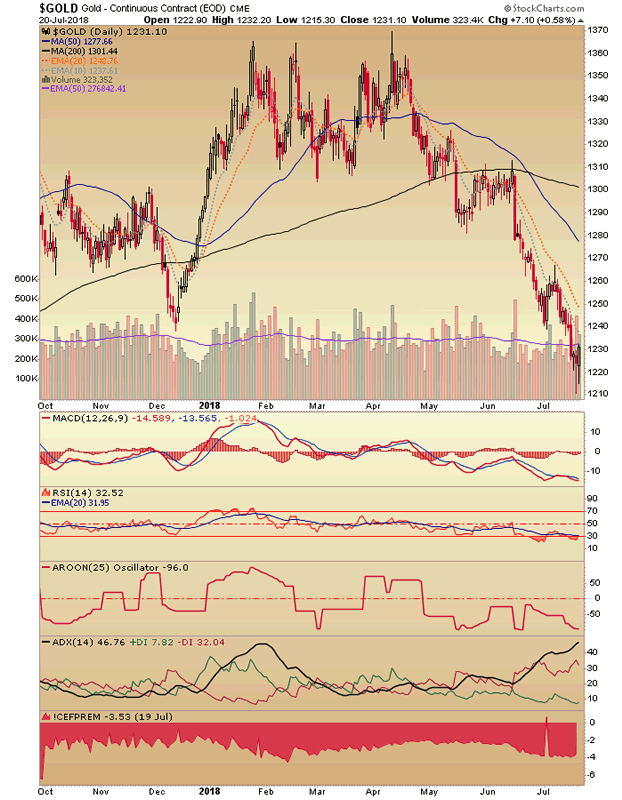

Now, I had personally expected gold to bounce after the moving average “death cross” on the chart below as so often happens when TAs warn about this scary sounding condition. Indeed, gold did bounce from 1240 into the 1260s just after the cross, but it was a pretty lame affair, after which the liquidation resumed.

I’ve been slowly adding the gold and silver bullion fund Central Fund of Canada (CEF), as noted recently in NFTRH and in-week updates. That is because the risk vs. reward proposition for gold and silver is greatly improved. How do I know that? Check out the bottom panel of this chart where I’ve added the current CEF discount to NAV of around 4%. In other words, gold bugs are not even accepting a 4% discount on CEF’s metal. Seems like a pretty good deal.

After a volume spike and washout yesterday, today painted a positive candle in gold, silver and CEF as well. We’ll see if this marks a bottom or not. But we are talking risk vs. reward, not trying to pick an exact bottom.

Graphics below from Sentimentrader.com and snalaska.com (markups and ‘exhibit’ notes mine).

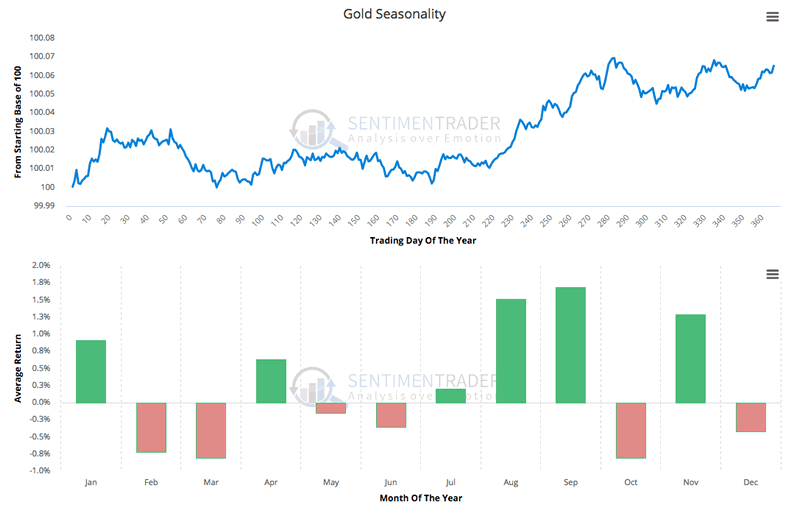

As we’ve been noting in NFTRH for the last few weeks, the seasonal average turns positive in July. Nothing is a given, but it can’t hurt to have the probabilities on your side.

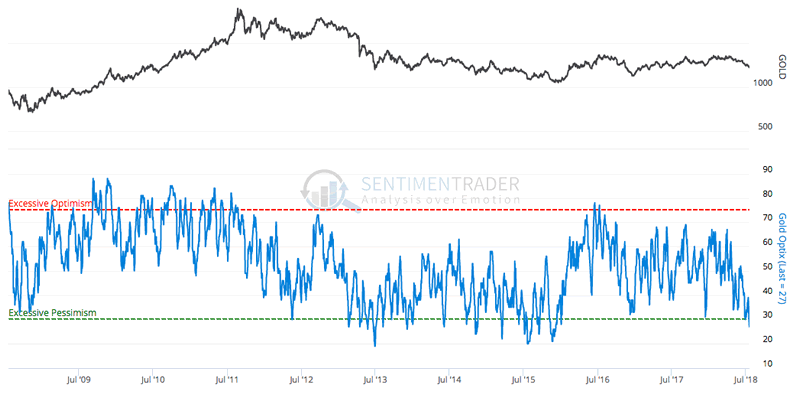

Public and CoT sentiment indications are contrary positive as well.

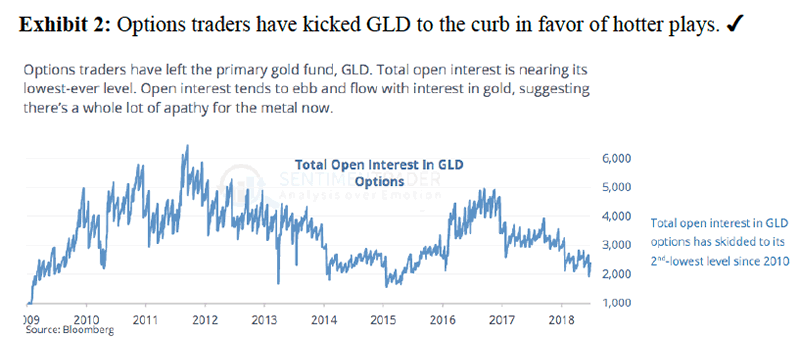

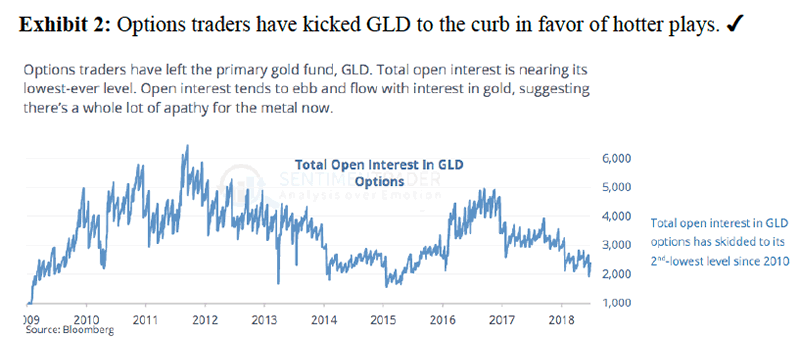

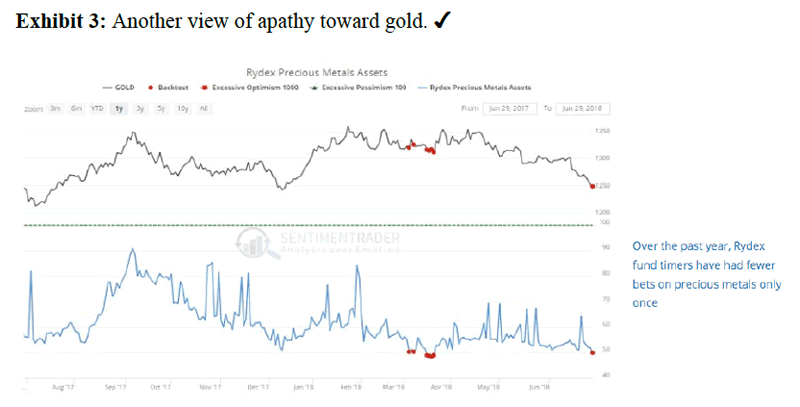

The public hates itself some gold.

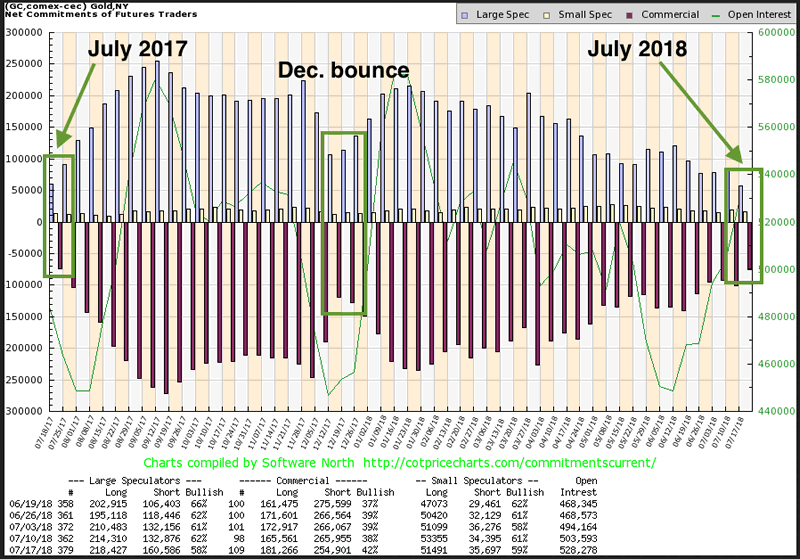

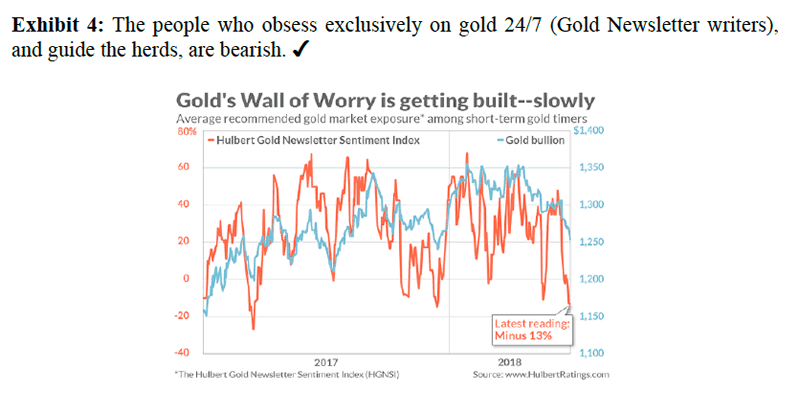

And the Large Speculators are puking out as the Commercial Hedgers take the other side of the trade. Everybody knows there’s no inflation, after all. <sarcasm alert>. Gold’s CoT structure is similar to 1 year ago, when a good rally was sprung (there’s that seasonal in action). Leading to this juncture we (NFTRH) spent months noting an incomplete trend to a positive alignment. Boink!

Additionally, 3 weeks ago in NFTRH 506 we noted the following exhibits to a gathering positive risk vs. reward situation in gold.

It was certainly better for us to have considered this situation in advance and NFTRH subscribers have been kept abreast every step of the way, both with the bearish fundamentals and the not-bullish technicals, which became very bearish amid the contrary sentiment indications noted above. In other words, we were prepared while many others swallowed the incorrect perceptions noted in the opening, finally puking over the last month.

Gold is almost never a ‘buy’ when it is both loved by the gold “community” (as a well known leader of the bugs calls it) and the cyclical backdrop is positive. It is almost always a ‘buy’ when it is hated by the gold “community” and the cyclical backdrop is counter, bleak and/or not inflationary. This article illustrates that Thing 1 (gold is hated) in play and Thing 2 is yet to be established. We’ve been preparing for a pretty good bounce at least and if the macro turns, a major move at best.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.