China is Now Officially at War With the US and Japan

Stock-Markets / Financial Markets 2018 Jul 22, 2018 - 12:06 AM GMTBy: Graham_Summers

It is not a war of guns and soldiers, but a war of finance.

It is not a war of guns and soldiers, but a war of finance.

The Trump White House is aggressively going after China on trade. Every other month we are seeing a new round of tariffs announced on hundreds of billions of dollars’ worth of Chinese exports.

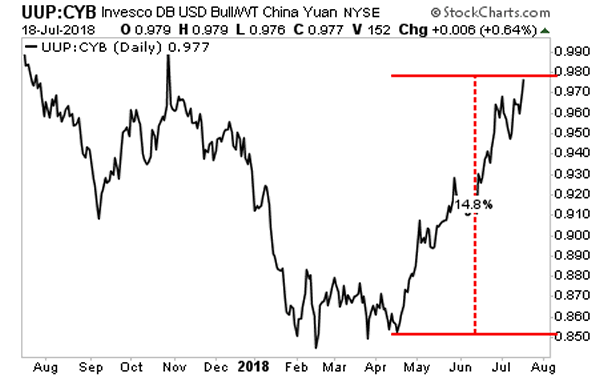

China is retaliating by devaluing the Yuan against the US Dollar at a pace not seen since early 2016. In real terms, the 10% in tariffs the Trump administration will implement on Chinese goods has ALREADY been negated by China’s 14% Yuan devaluation.

A 10% tariff won’t add up to much when China’s currency is nearly 15% cheap relative to the US Dollar.

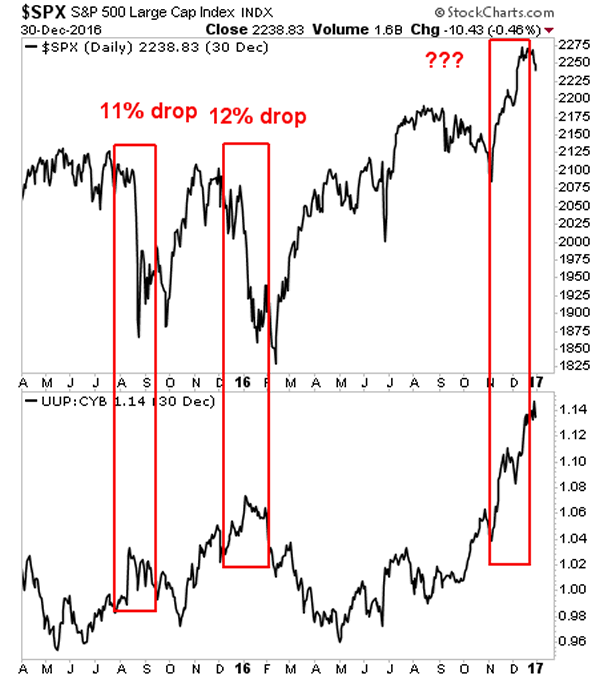

There is a second component here… China is well aware that President Trump takes GREAT pride in the fact US stocks have rallied since his election in 2016. With that in mind the Yuan devaluation can be seen as a direct attack on US stocks: the last two times the Yuan was devalued at this pace, the S&P 500 dropped 11% and 12% respectively.

So who does President Trump call to defend the S&P 500?

Japan.

One country has been noticeably absent from all the Trump speeches, tweets and tariffs this year… that country is Japan. According to the Trump White House’s rhetoric, Mexico is a problem, Canada is a problem, China is a problem, the EU is a problem… but Japan doesn’t even get a mention.

This is not coincidence.

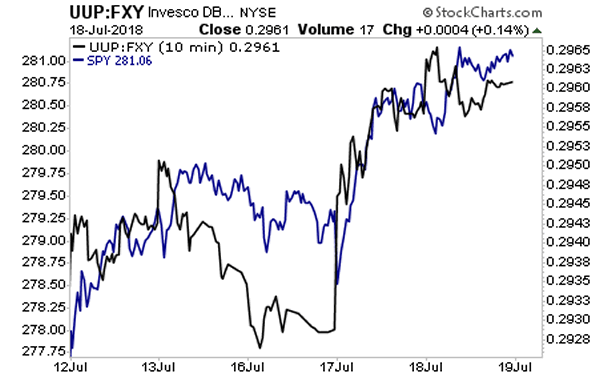

The Bank of Japan is now actively using the Yen carry trade to prop up US stocks. Every single day we are seeing interventions in the $USD: Yen pair trade to prop up the S&P 500. It’s gotten to the point that the “market” is no longer even a market but just one giant rig.

You can see this in the chart below. The S&P 500 is tracking $USD: Yen pair almost tick for tick.

Put simply, the Bank of Japan is doing this to counter China’s attempts to crash the S&P 500 by devaluing the Yuan. In return, the Trump White House refrains from attacking Japan on trade issues.

So we’ve got Japan working with the Trump White House to prop up President Trump’s darling stock market…while he runs an aggressive trade negotiation strategy on China… which is devaluing its Yuan to A) negate the tariffs and B) crash US stocks.

Put another way, the financial markets have become one gigantic battle in which the three largest economies are attacking one another via the currency markets.

Regardless of which side you’re on, you have to accept that this won’t end well. This kind of interventionist game never does. And it’s ordinary investors who will get hurt the most.

The time to prepare for this is NOW before the carnage hits.

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.