NASDAQ Tech Stocks Index is like 1999

Stock-Markets / Tech Stocks Jul 26, 2018 - 05:22 PM GMTBy: Troy_Bombardia

Based on the Medium-Long Term Model, this bull market probably has 1 year left. We can confirm this theory through the stock market’s recent price action.

Based on the Medium-Long Term Model, this bull market probably has 1 year left. We can confirm this theory through the stock market’s recent price action.

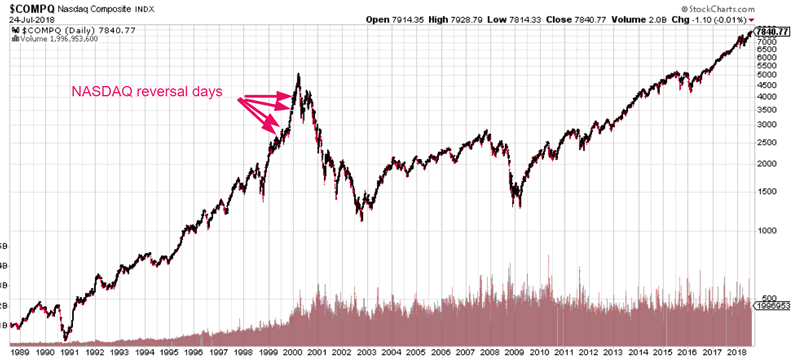

The final rally of a bull market is often marked by “downwards reversal days”. In other words, the market gaps up on the open (exuberant buying) and then falls throughout the rest of the day. We just saw a “downwards reversal day” yesterday in the NASDAQ.

The NASDAQ gapped up almost 1% on the open and then closed below the previous day’s close.

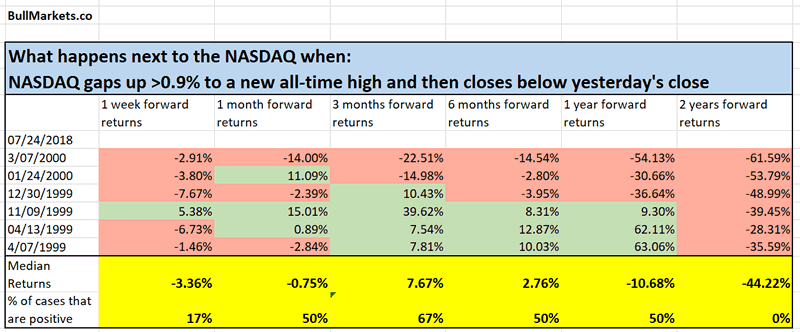

Here are all the historical cases in which the NASDAQ gapped up at least 0.9% and then closed below the previous day’s close.

Click here to download the data in Excel.

As you can see, all of these historical cases occurred in the final year of the NASDAQ’s bull market (1999). In addition, notice how the NASDAQ has a tendency to fall during the 1 week after this “downwards reversal day”.

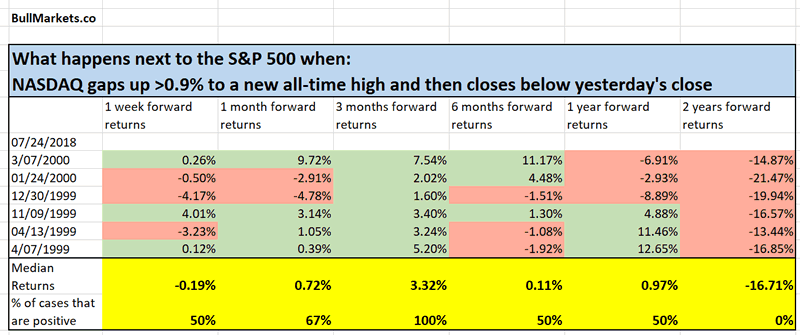

Here’s what happened next to the S&P 500 during these historical cases.

Conclusion

We are most likely approaching the final year of this bull market. The stock market is starting to exhibit signs that are characteristic of the last rally in a bull market.

However, it’s important to remember that double-digit gains are common in the final year of a bull market. Getting out too early is just as bad as getting out too late. We are not near the top yet.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.