Stock Market and Economy False Narratives That are Just Wrong

Stock-Markets / Stock Markets 2018 Aug 06, 2018 - 11:53 AM GMTBy: Troy_Bombardia

I love debunking false narratives, mostly because these narratives do nothing but hurt the investors and traders who read them. E.g. if you’re an investor who’s constantly reading permabear narratives in this environment, you’re going to miss out on the stock market’s gains.

I love debunking false narratives, mostly because these narratives do nothing but hurt the investors and traders who read them. E.g. if you’re an investor who’s constantly reading permabear narratives in this environment, you’re going to miss out on the stock market’s gains.

Here are some false bearish narratives that I’ve noticed from fintwit over the past week.

*If you haven’t already, feel free to follow me on twitter ;@BullMarketsco

False narrative #1

Brought to you from permabear David Rosenberg:

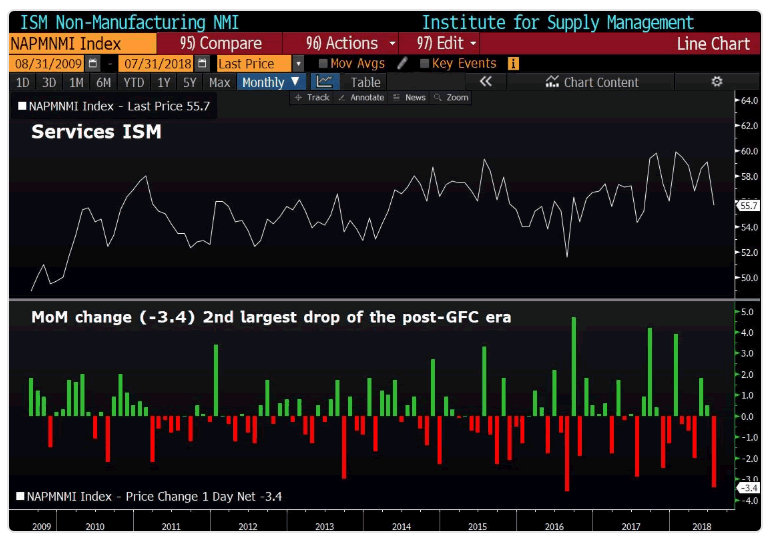

Look out below! The non-manufacturing ISM business activity index just fell the most in any month since…November 2008! Eighty percent of the time when it declines this much we’re either in recession or crawling out of one.

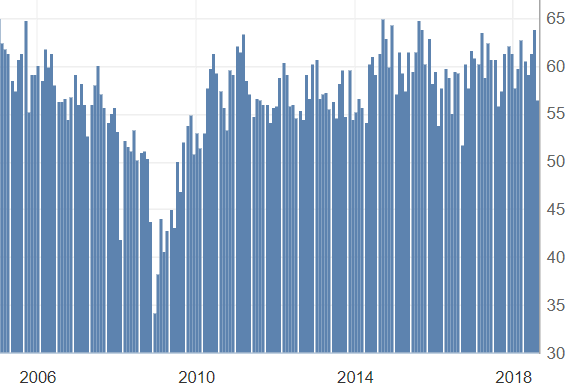

For starters, the month-to-month fluctuations in non-manufacturing ISM are notoriously noisy. Focusing on the month-to-month fluctuations = losing sight of the forest for the trees.

Also, it’s important to remember that any reading for ISM above 50 represents “growth”. ISM growth may have fallen from the month before, but it is still growing. Also, this economic indicator is not useful. It is far too noisy.

False narrative #2

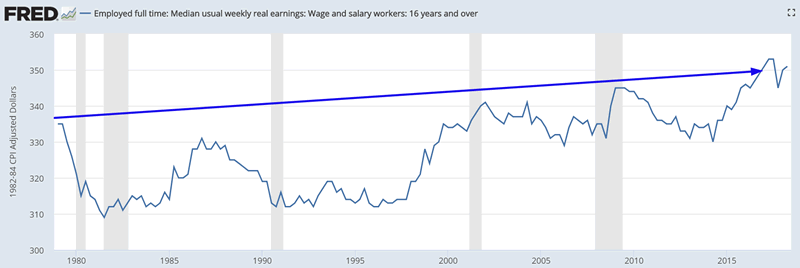

Real wage growth is nonexistent. This is bad for the stock market and economy.

Except history proves otherwise. Real wages have been stagnant for the most part of the past 40 years. Yet the stock market continues to grow and the stock market continues to go up. Why?

Because “the economy” is not real GDP per capita. It’s real GDP. In other words, an economy with zero real wage growth can still grow if its population is increasing. Moreover, not all economic growth goes towards wages. A large part of it goes towards corporate profits.

Real wage growth has very little impact on the stock market and economy. Real wage growth has been stagnant over the past 30-40 years while the stock market has soared.

False narrative #3

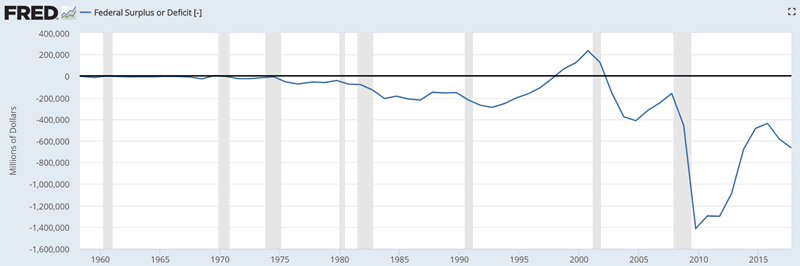

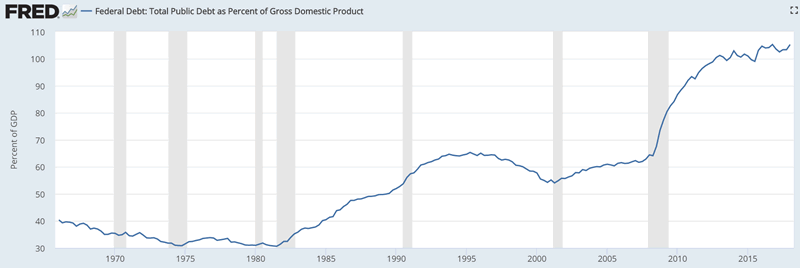

The federal debt and deficit are exploding! The economy and stock market will blow up!

People said the exact same thing in the 1980s when Reagan’s exploding deficits were supposed to be “disastrous”. 30 years have come and gone, yet the U.S. economy and stock market have not been “destroyed”.

The rising U.S. federal debt and deficit have not stopped in the stock market from going up in the past.

False narrative #4

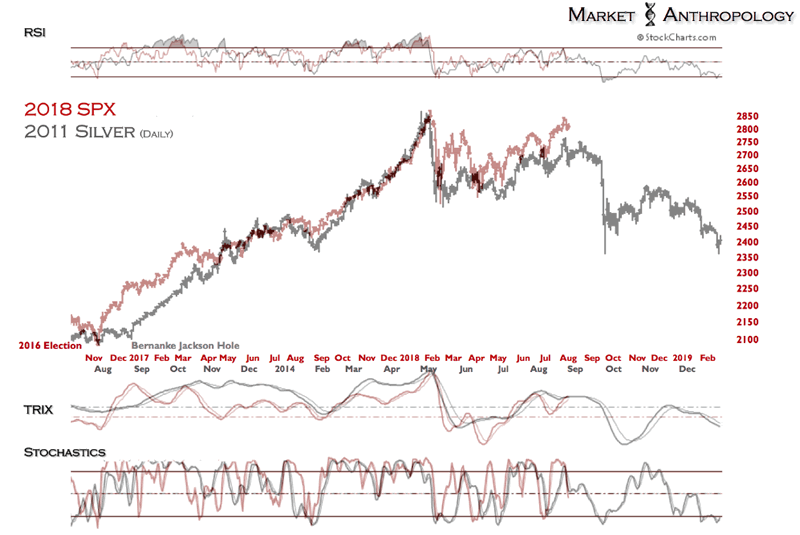

The stock market’s analogue is “copying” a crash pattern

Most analogues are just silly. The market doesn’t have a mind of its own. It doesn’t want to “copy” another market.

Here’s an example of a “the stock market will crash” analogue. This analogue is ridiculous. Silver in 2011 has nothing to do with the stock market today. These are 2 completely unrelated markets.

You can always make the market “look like” it’s going to crash by squeezing, compressing, or stretching completely unrelated markets.

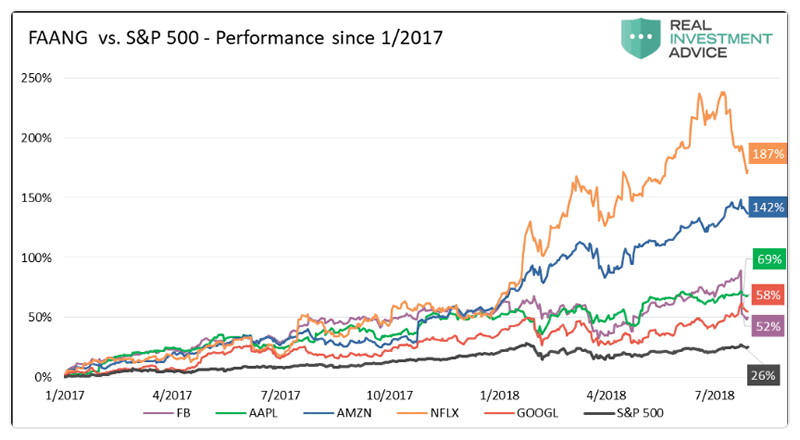

False narrative #5

“If the stocks that have been leading the bull market start to break down, that is a major sign the market has topped.” -William O’Neil

FANG stocks have led the stock market’s rally, and are now falling. This is not bearish. The leaders don’t always stay the same in a bull market. Sector rotation is completely normal. Sometimes sector X will lead, then sector Y will lead, then sector Z will lead, then sector A will lead. There is nothing bearish about “the leaders starting to break down” because new leaders will emerge.

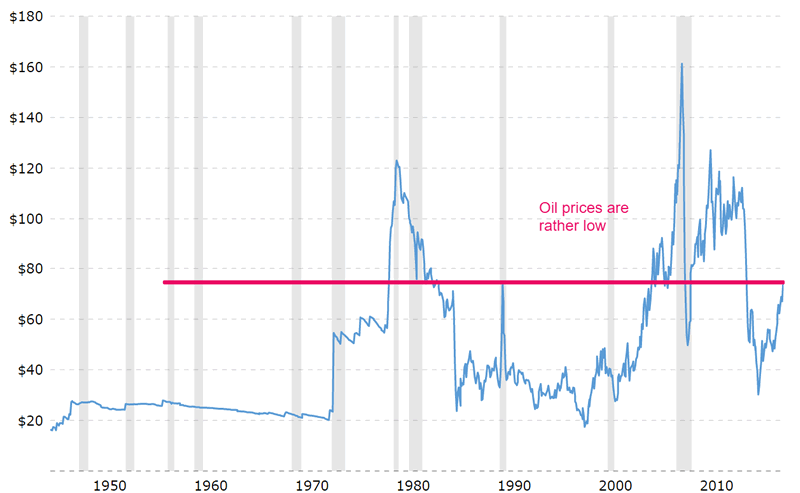

False narrative #6

Oil is a drag on the economy and stock market

For starters, oil prices have not “exploded to $100”, contrary to what the doomsayers predicted (remember Jeff Gundlach’s prediction a few months ago?). Moreover, real (inflation-adjusted) oil prices are still lower today than where they’ve been for most of this economic expansion. If anything, oil prices are rather low right now. This is not a drag on the economy or stock market.

False narrative #7

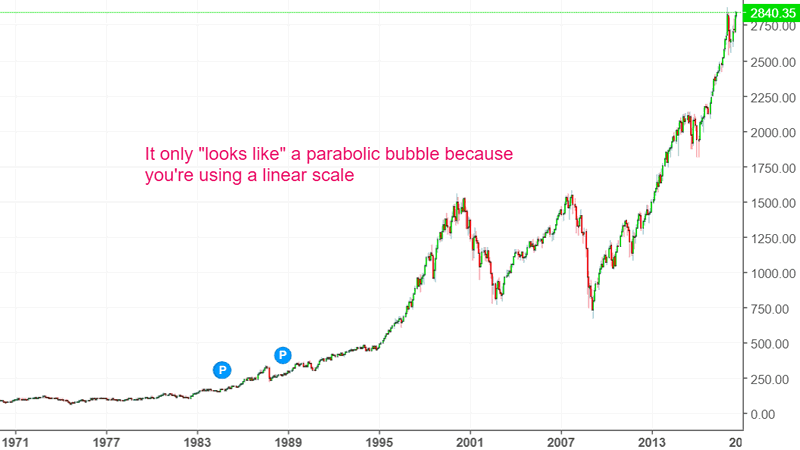

The stock market “looks like” it’s in a bubble because it’s going parabolic.

This is just stupid. Anything “looks like” a bubble when you use a linear scale. Here’s the S&P 500 on a linear scale.

False narrative #8

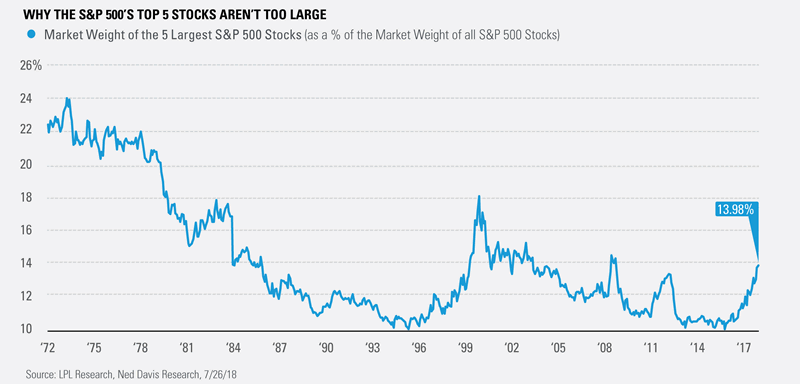

The stock market is completely relying on FANG. If FANG is done, the entire stock market is screwed.

Yes, FANG companies are big (Facebook, Amazon, Apple, Netflix, Google). But as a percentage of the S&P 500’s total market cap, there’s nothing usual about FANG’s weighting. The stock market isn’t “completely relying on FANG”.

Conclusion

A little common sense goes a long way. Unfortunately, common sense isn’t always abundant in the finance industry. This is partially because people lose sight of the forest for the trees. The other part is that the finance industry has an incentive to scare you – bearish headlines drive 5x the number of clicks vs. bullish headlines.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.