Ignore the Stock Market “midterm election year”, Which is “supposed” to be Weak

Stock-Markets / Stock Markets 2018 Aug 09, 2018 - 02:33 PM GMTBy: Troy_Bombardia

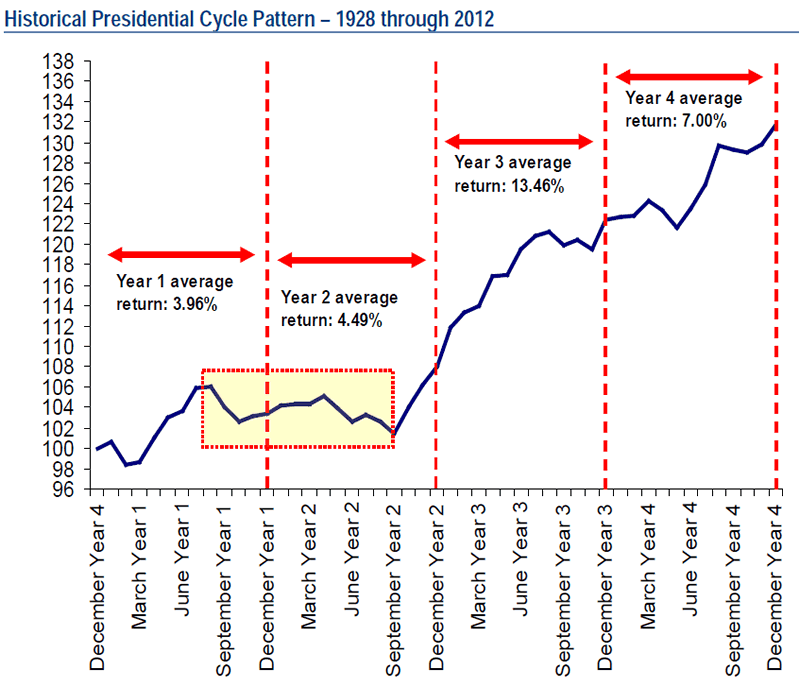

October 2017 – September 2018 (i.e. this year) is the 2nd year of the “presidential cycle”, also known as the midterm election year.

October 2017 – September 2018 (i.e. this year) is the 2nd year of the “presidential cycle”, also known as the midterm election year.

According to conventional seasonality, the midterm election year is “supposed” to be weak (bearish).

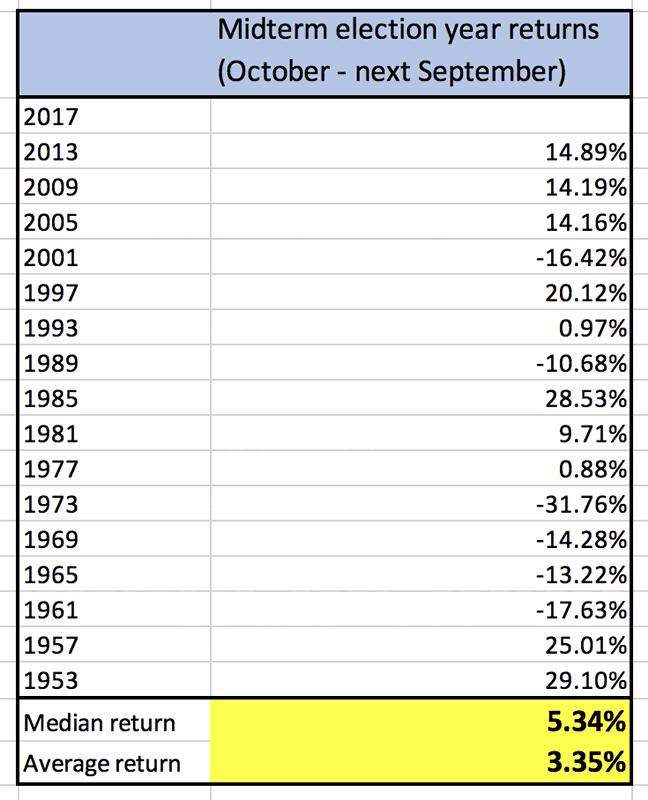

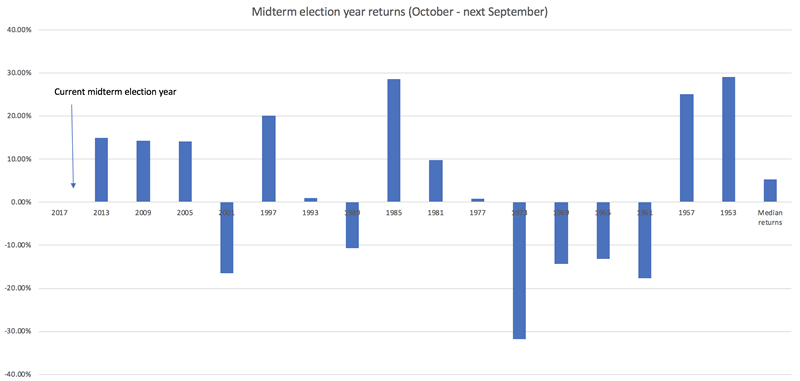

However, when we look at the data from 1950-present, the midterm election year isn’t as seasonally bearish as you think.

As you can see, the S&P 500’s median return during midterm election years (October to next September) is 5.34%. The average is 3.35%, which means that a few large bearish cases are weighing down on the average (e.g. 1973)

Remember that the S&P 500 goes up 7-8% on average per year. This means that although the stock market is “weaker” during midterm years, it still tends to go up.

I would not pay too much attention to the stock market’s relative weakness during the midterm election year. As you can see from the following chart, the stock market’s performance during midterm election years fluctuates wildly.

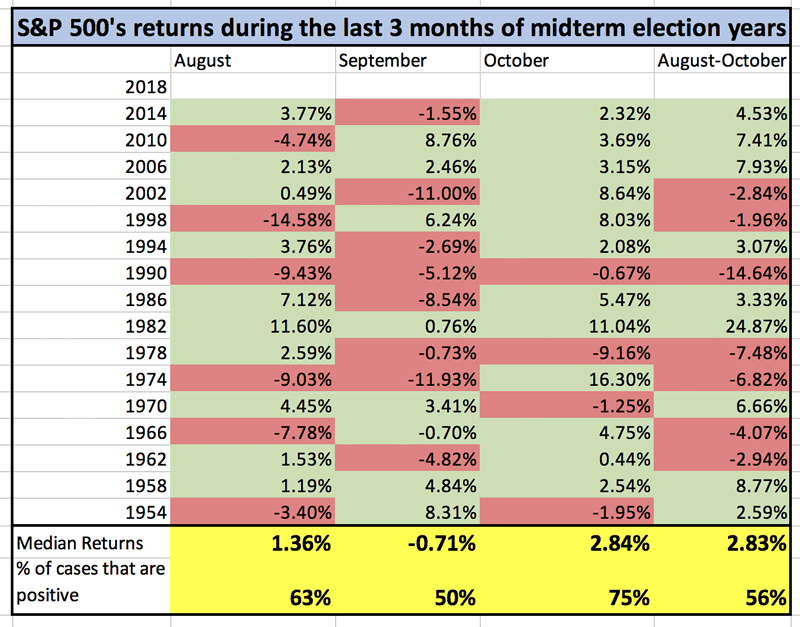

The midterm election year is now mostly over. We only have 3 months until the midterm elections: August, September, and October.

Here’s how S&P 500 performs from August – October before each midterm election.

As you can see, the stock market’s forward returns from August-October during midterm election years tend to be mostly random. This suggests that the midterm elections don’t have a consistently bullish or bearish impact on the stock market.

Conclusion

Don’t put too much emphasis on the importance of presidential election cycles for the stock market. The stock market follows the economy in the medium-long term. Politics is mostly a sideshow. The economy is the signal, politics is the noise.

Most of our recent market studies are bullish for the stock market.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.