SPX Testing Its First Support Level

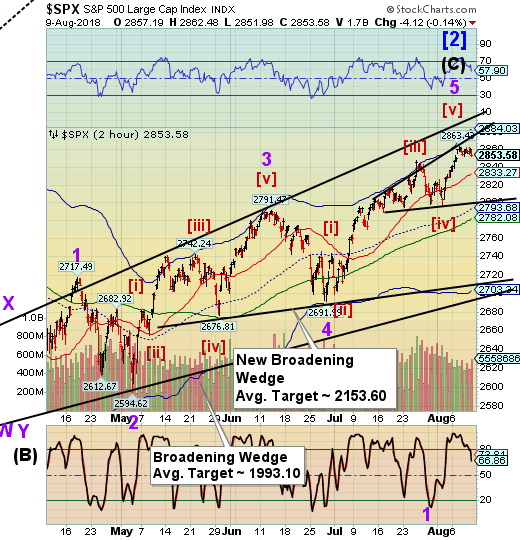

Stock-Markets / Stock Markets 2018 Aug 10, 2018 - 03:22 PM GMT SPX futures appear to have visited Shot-term support at 2833.27 this morning, but haven’t put up a challenge, yet. The sideways consolidation is over without making a new high. Now we must establish that a new downtrend has taken hold. All the Cyclical indicators say that the rally is over.

SPX futures appear to have visited Shot-term support at 2833.27 this morning, but haven’t put up a challenge, yet. The sideways consolidation is over without making a new high. Now we must establish that a new downtrend has taken hold. All the Cyclical indicators say that the rally is over.

ZeroHedge reports, “For once it's not about trade wars... but the alternative is hardly better.

European stocks tumbled most in a month, following Asian shares lower following contagion fears that Turkey’s economic problems will spill over into the euro zone and beyond. The Euro sank, while the safe haven dollar advanced alongside Treasuries, with the 10Y back under 2.90%. The Turkish Lira initially plunged and fell 45 big figures, with the USDTRY hitting a record high of 6.3005, or up more than 11%, before holding below 6.0 for the bulk of the session.”

This is frustrating many professionals who have been made to look stupid by this market. ZeroHedge observes, "Don't ask me what you should figure out yourself," is the blunt message from former fund manager and FX trader Richard Breslow this morning.

“What do you think?” is a question you hear over and over again in the trading world. At least some people are still asking at a period of time when you are more likely to get, “Do you agree with me or not?” Still, the proper answer should be “Why do you want to know?”

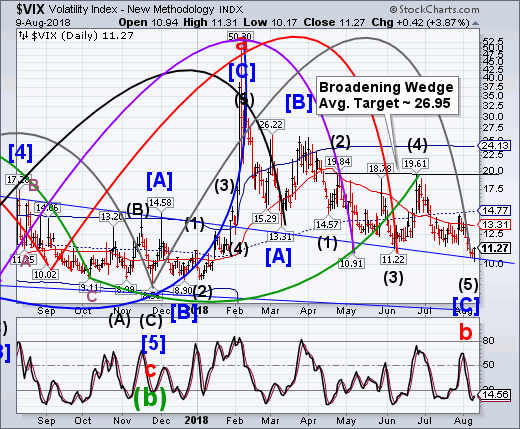

VIX futures are climbing in a classic reversal out of a Master Cycle low. No one appears to be paying attention, since the big play is to be short the VIX. The shorts are starting to feel the pain with the biggest move in the VIX in two months.

The Commitment of Traders tells us that both large and small speculators are short the VIX with 109,595 contracts as of July 30 with the commercials on the other side of the trade. This is not a timing tool, since the reports are delayed, but it can tell us which way the wind is blowing.

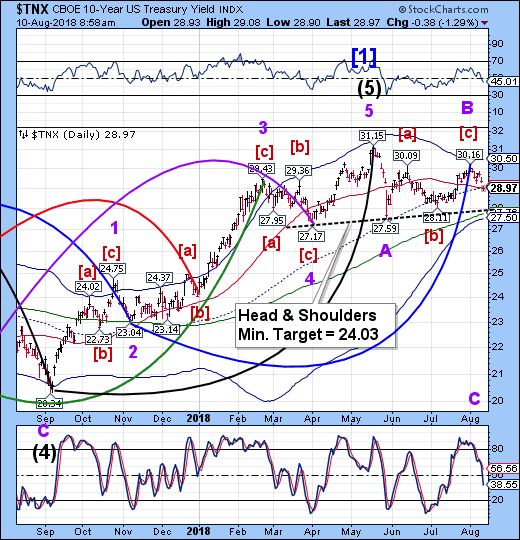

TNX has plunged beneath the mid-Cycle support at 29.00, creating a sell signal for TNX. This tells us that liquidity is favoring treasuries. The most likely source is the proceeds from the stock sell-off.

Yesterday ZeroHedge wrote, “After a poor 3 Year auction on Tuesday, a strong, and record-sized, 10 Year auction yesterday, at 1pm the US Treasury sold $18 billion in 30 Year bonds at a yield of 3.090%, 0.3bps above the When Issued 3.087% - this was the 3rd consecutive 30Y tail - and higher than July's 2.954% if below the May and April equal highs of 3.13%.

The auction was mediocre with the Bid to Cover sliding from 2.337 last month to 2.274, below the 6 auction average of 2.357 and the lowest since February's 2.257.

…Overall, an unremarkable auction which despite some weakness on the top line and a decline in overall interest, saw foreigners step up once again to keep the US government machine well funded.”

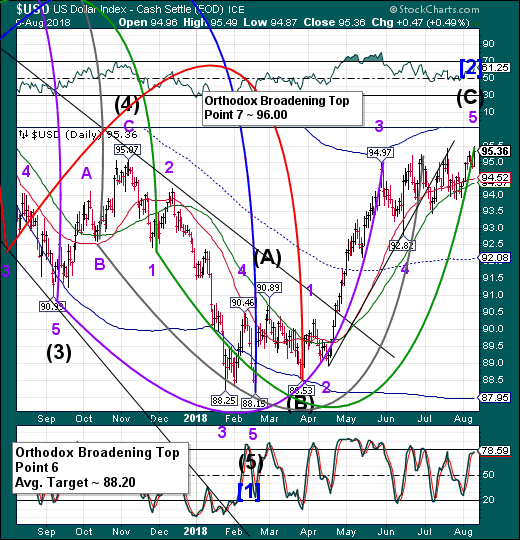

USD futures hit a new high of 96.03, putting a lock on the “point 7” target.

Today shows the most strength in the Cycles Model, but the turn may not come until Monday.

(Reuters) - The euro sank to its lowest levels in more than a year on Friday after a report that the European Central Bank (ECB) was growing concerned about the exposure of banks to a dramatic slide in the Turkish lira.

The plummeting lira, caused by a deepening rift with the United States and worries about Turkey’s economy, has sent ripples across markets. Nervous investors jumped into the safe-haven dollar, yen, and Swiss franc and dumped riskier currencies like those in emerging markets.

The euro was hit hard after the Financial Times reported on Friday, citing two sources, that the ECB had concerns about banks in Spain, Italy and France and their exposure to Turkey’s woes.

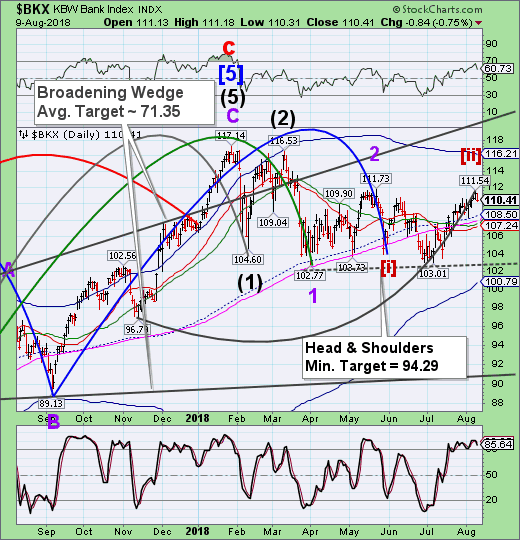

Banks won’t be exempt from the sell-off. Yesterday happened to be the last day of Cyclical strength for BKX…and a Master Cycle high. This sets up BKX for its next Master Cycle low in mid-September. The EW pattern appears to give us the “wind-up” for a mighty decline during that period.

Bloomberg opines, “In the decade since the collapse of Lehman Brothers, regulators around the world have taken steps which, they argue, have greatly strengthened the resilience of the financial system. Buoyant asset prices and rising bank shares suggest that investors largely believe them. Unfortunately, the effectiveness of these measures remains uncertain. That will only become clear in a real downturn, rather than a simulated stress test.

The focus on raising collateral requirements exemplifies the problem.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.