More Signs That the Stock Market Will Rally Until 2019

Stock-Markets / Stock Markets 2018 Aug 13, 2018 - 02:10 PM GMTBy: Troy_Bombardia

The S&P 500 is right under all-time highs. An upside breakout in the next few weeks/months is very likely.

The S&P 500 is right under all-time highs. An upside breakout in the next few weeks/months is very likely.

Based on where the Medium-Long Term Model is right now and the rate at which data is progressing, this bull market probably has 1 year left. Over the past week we have seen a few more signs that the stock market will probably make an important top somewhere in mid-2019.

As always, the U.S. economy’s fundamentals determine the U.S. stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

- The stock market’s long term is bullish.

- The stock market’s medium term is bullish.

- The stock market’s short term is 50-50

Let’s go from the long term, to the medium term, to the short term.

Long Term

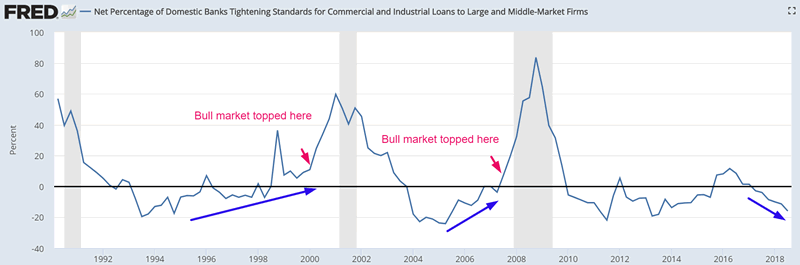

Banks’ lending standards continue to ease (trend downwards). Lending standards tend to get tighter in the last rally of a bull market.

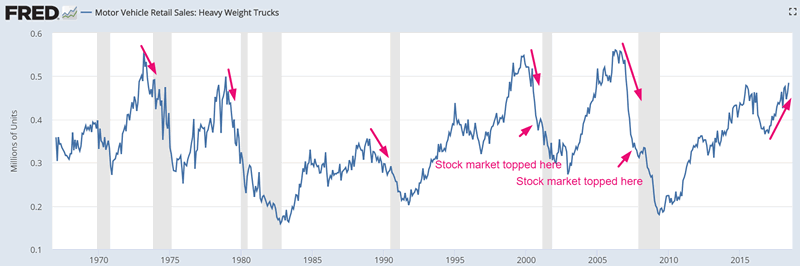

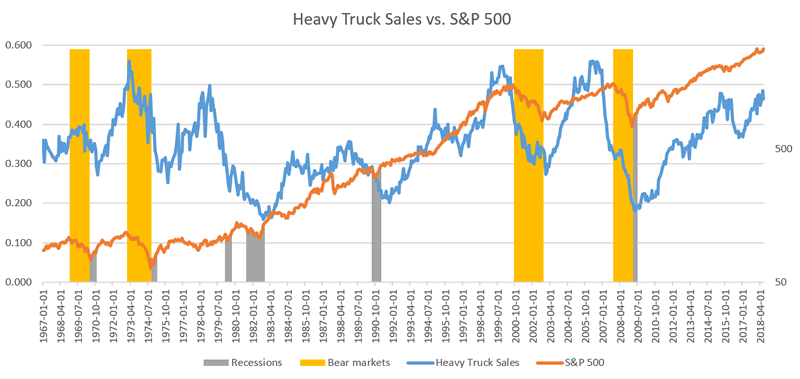

Heavy Truck Sales are still trending higher. This is a long term bullish sign for the stock market. Heavy Truck Sales tend to trend downwards before economic recessions and equity bear markets begin.

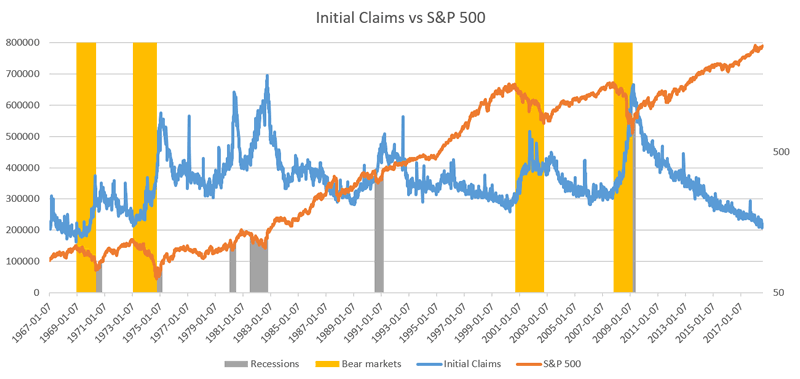

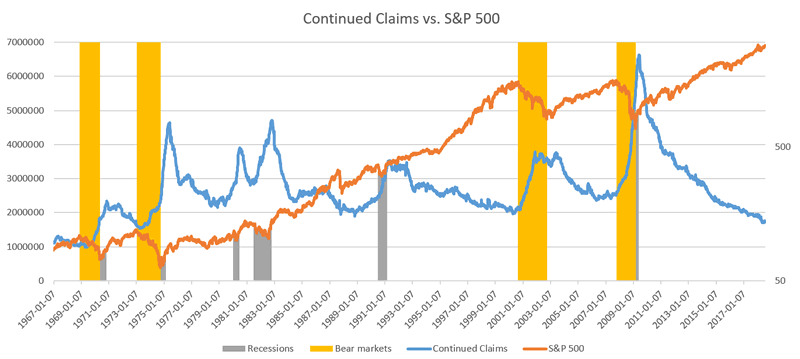

Initial Claims and Continued Claims are still trending lower. This is a long term bullish sign for the stock market. Initial Claims and Continued Claims tend to trend higher before bear markets begin.

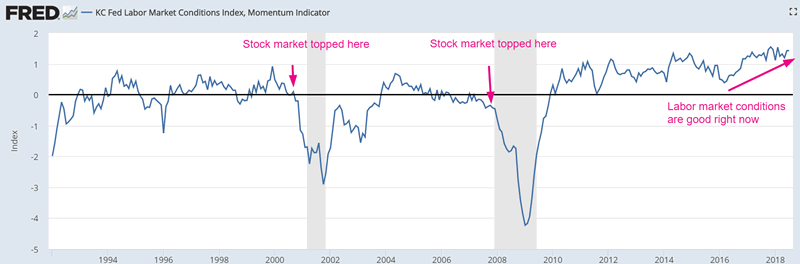

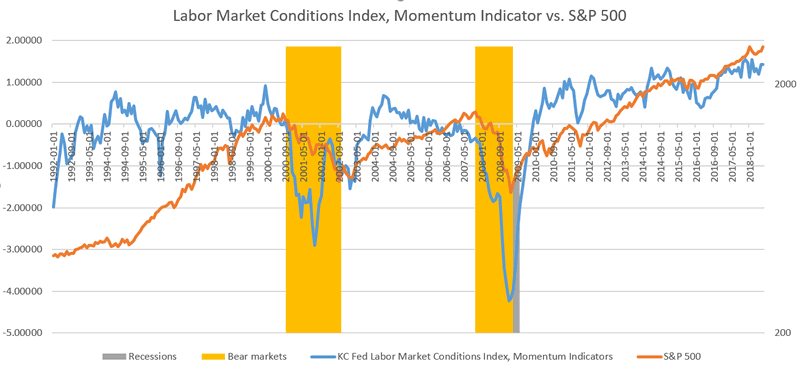

Labor Market Conditions are still healthy. This is bull market behavior. Bear markets start when Labor Market Conditions are much weaker.

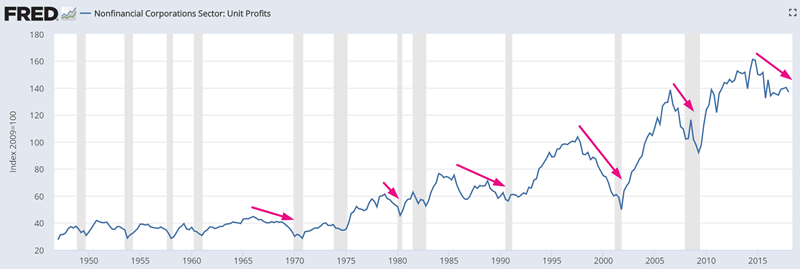

However, this bull market doesn’t have many years left. We are definitely in the late stages of this bull market. Corporate Unit Profits tend to peak in the middle of a bull market and economic expansion. Corporate Unit Profits peaked in 2014.

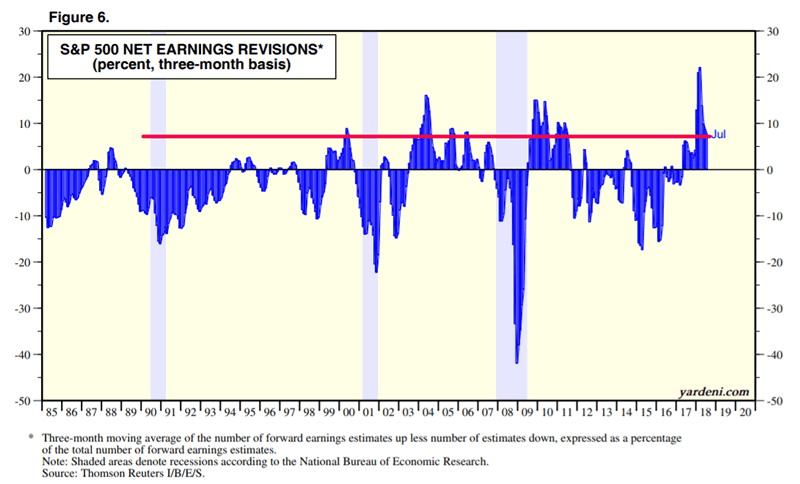

Net Earnings Revisions are still significantly above zero. Net Earnings Revisions tend to approach zero just before a bear market begins.

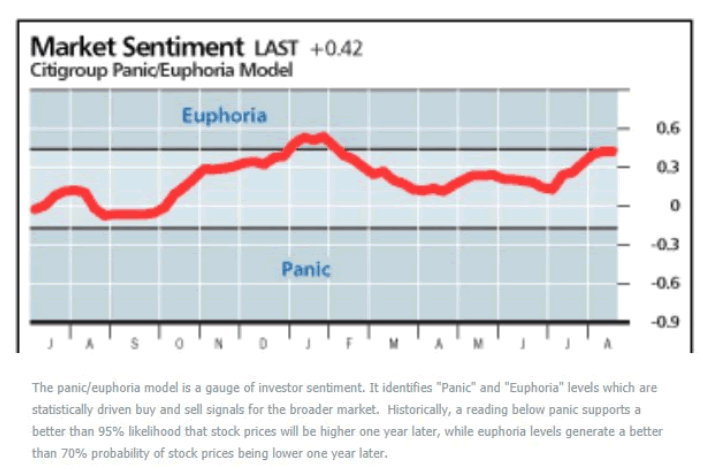

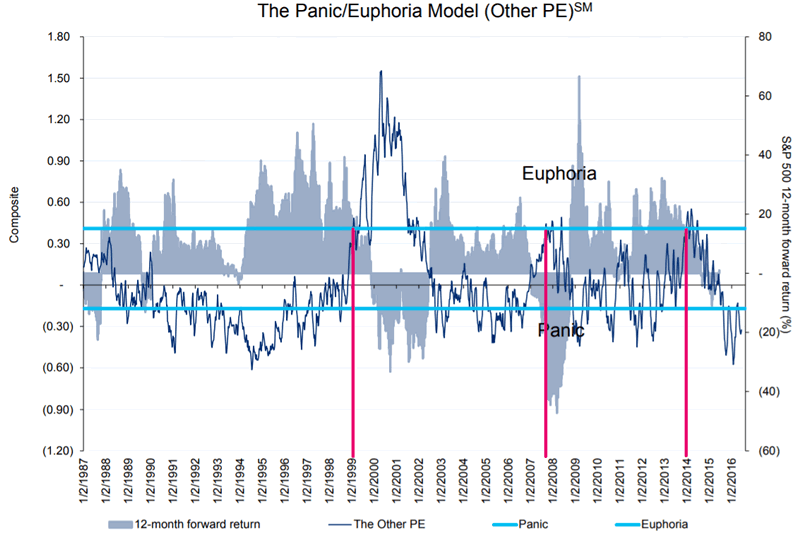

And lastly, Citigroup’s Panic/Euphoria model is starting to show signs of Euphoria. In the past, Citigroup’s Model has been early in calling the stock market’s major tops.

If Citigroup’s model continues to register “euphoria” readings for the rest of 2018, then the stock market will probably make an important top in 2019.

Medium term

The medium term remains bullish, which suggests that the S&P 500 (U.S. stock market) will go up in the next 3-6 months. Since there are only 4.5 months left in 2018, this means that the stock market will probably go up for the remainder of 2018, although it may do so in a choppy manner.

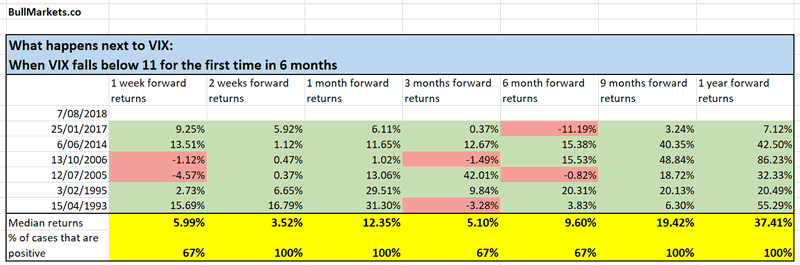

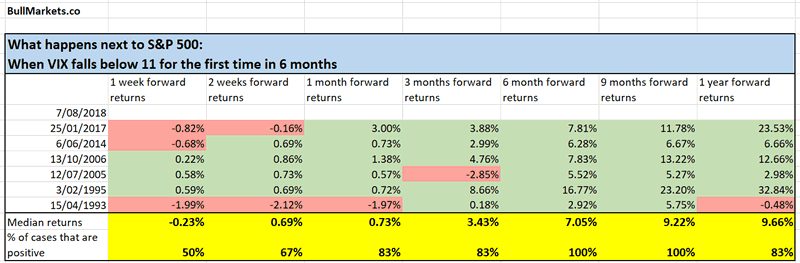

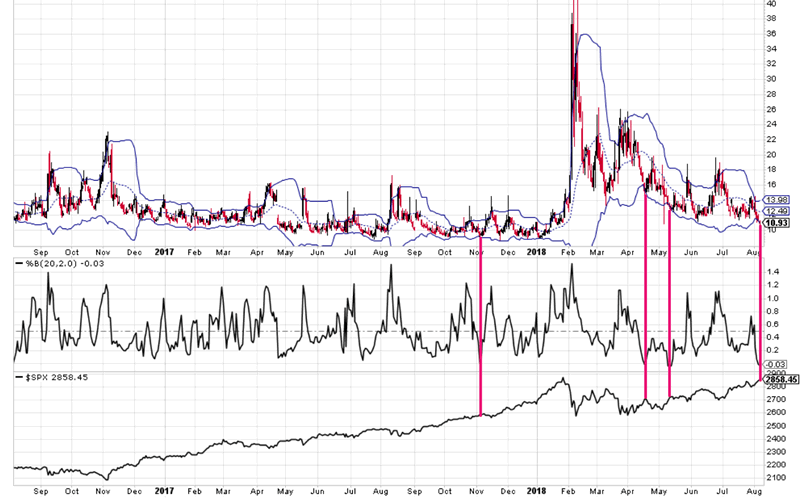

First of all, VIX has completely collapsed from its February 2018 high. The stock market’s volatility has disappeared. When this happens, BOTH VIX and the S&P 500 (U.S. stock market) tend to go up in the next few months.

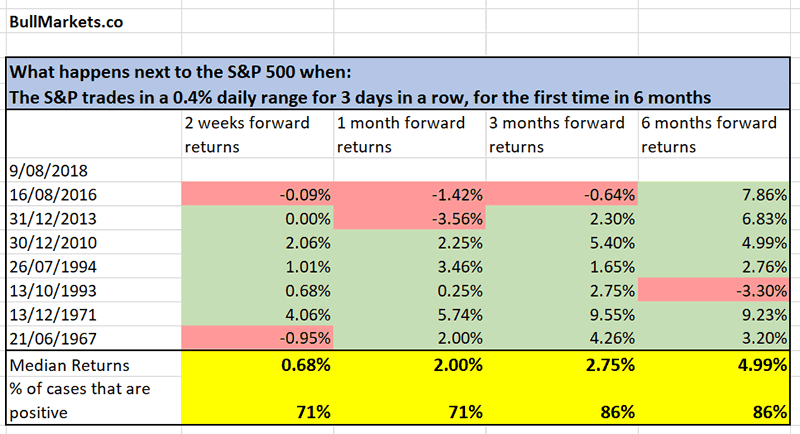

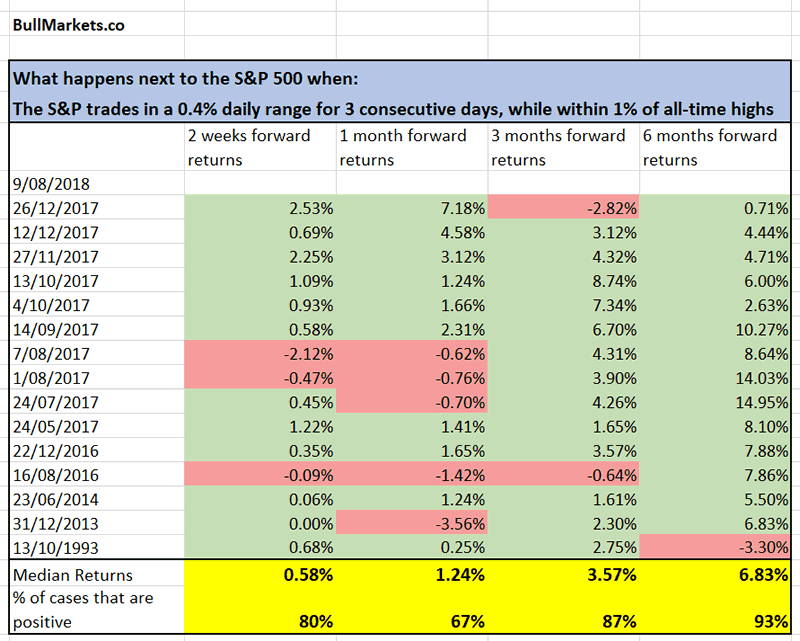

The U.S. stock market was very quiet during the beginning of last week. The saying “don’t short a dull market” is true. “Dull markets” tend to grind higher.

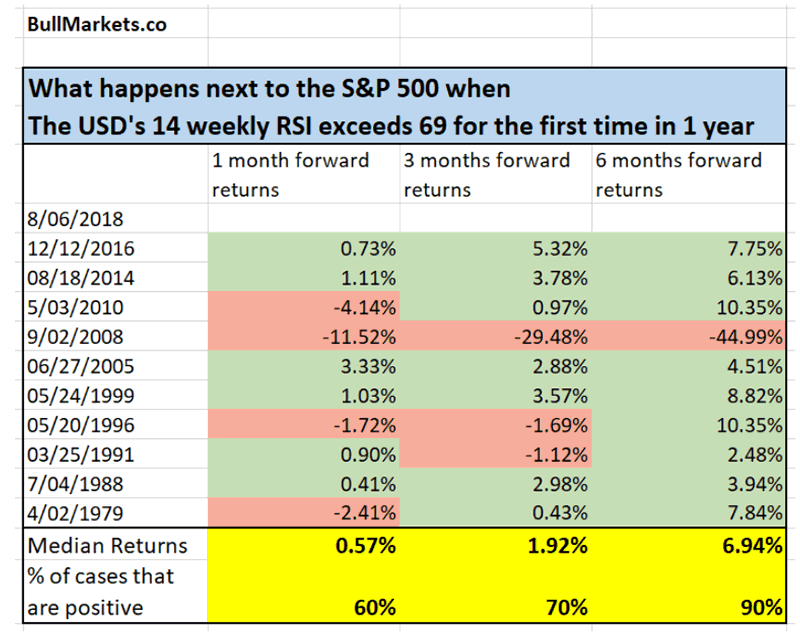

Don’t be afraid of the rising U.S. Dollar or weakness in emerging markets (“contagion”). When the USD becomes as overbought as it is right now, the U.S. stock market tends to keep going up. The probability of “contagion” is low.

Short term

Earlier last week we said that the stock market would face some short term weakness because VIX had probably made a short term bottom.

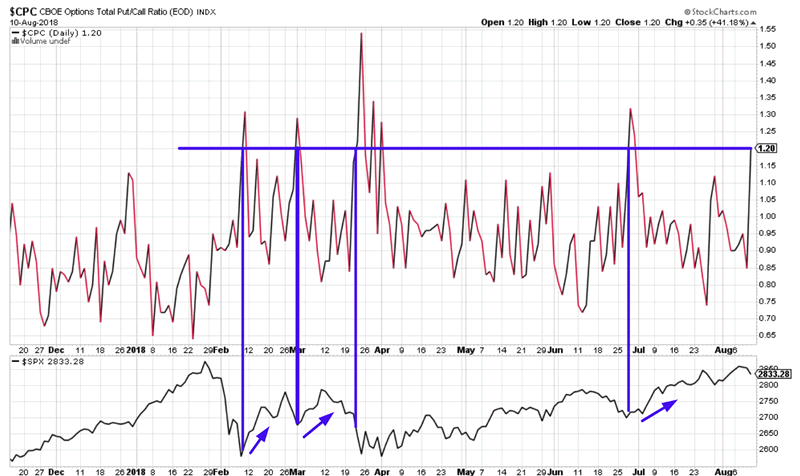

So far this short term weakness has played out. The U.S. stock market has made a small pullback. Although this short term weakness might persist for another 1-2 weeks, it is very limited. The Put/Call ratio has spiked. Year-to-date, the stock market was either at a short term bottom or close to making a short term bottom when the Put/Call Ratio was this high.

Conclusion

The stock market’s long term and medium term outlook is bullish. Short term weakness may persist for another 1-2 weeks, but the key point is that this short term weakness is limited.

I mostly ignore the short term, because no matter how certain you are about the short term, it is rarely better than a 50-50 bet. Focus on the medium-long term.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.