Financial Crisis 10 Years Later – No Lessons Learned

Stock-Markets / Financial Markets 2018 Sep 04, 2018 - 11:14 AM GMTBy: James_Quinn

“A variety of investors provided capital to financial companies, with which they made irresponsible loans and took excessive risks. These activities resulted in real losses, which have largely wiped out the shareholder equity of the companies. But behind that shareholder equity is bondholder money, and so much of it that neither depositors of the institution nor the public ever need to take a penny of losses. Citigroup, for example, has $2 trillion in assets, but also has $600 billion owed to its own bondholders. From an ethical perspective, the lenders who took the risk to finance the activities of these companies are the ones that should directly bear the cost of the losses.” – John Hussman – May 2009

“A variety of investors provided capital to financial companies, with which they made irresponsible loans and took excessive risks. These activities resulted in real losses, which have largely wiped out the shareholder equity of the companies. But behind that shareholder equity is bondholder money, and so much of it that neither depositors of the institution nor the public ever need to take a penny of losses. Citigroup, for example, has $2 trillion in assets, but also has $600 billion owed to its own bondholders. From an ethical perspective, the lenders who took the risk to finance the activities of these companies are the ones that should directly bear the cost of the losses.” – John Hussman – May 2009

This month marks the 10th anniversary of the Wall Street/Fed/Treasury created financial disaster of 2008/2009. What should have happened was an orderly liquidation of the criminal Wall Street banks who committed the greatest control fraud in world history and the disposition of their good assets to non-criminal banks who did not recklessly leverage their assets by 30 to 1, while fraudulently issuing worthless loans to deadbeats and criminals. But we know that did not happen.

You, the taxpayer, bailed the criminal bankers out and have been screwed for the last decade with negative real interest rates and stagnant real wages, while the Wall Street scum have raked in risk free billions in profits provided by their captured puppets at the Federal Reserve. The criminal CEOs and their executive teams of henchmen have rewarded themselves with billions in bonuses while risk averse grandmas “earn” .10% on their money market accounts while acquiring a taste for Fancy Feast savory salmon cat food.

I find the cognitive dissonance and normalcy bias regarding what has actually happened over the last ten years to be at astounding levels. As someone who views the world based upon a factual assessment of financial, economic and global data, I’m flabbergasted at the willful ignorance of the populace and the ease with which the ruling class has used their propaganda machine to convince people our current situation is normal, improving, and eternally sustainable.

When confronted by unequivocal facts, historically accurate comparisons, and proof our economic system is unsustainable and headed for a crash, the average person somehow is able to ignore the facts and believe all will be well because some “experts” in the propaganda media said not to worry. Those who present factual arguments are declared doomers or conspiracy theorists. They are scorned and ridiculed for being wrong for the last ten years.

The vast majority of math challenged citizens in this country don’t understand the concepts of real interest rates, real wages, debt to GDP, deficits, national debt, or unfunded liabilities. As long as their credit cards are accepted and they can get that pack of smokes with their debit card, all is well with the world. They’ve been convinced by the propagandist corporate media machine that acquiring stuff on credit makes them wealthier. They think their wages are increasing when they get a 2.5% raise, when they are falling further behind because true inflation exceeds 5%.

Their normalcy bias keeps them from grasping why their credit card balance rises even though they have slightly higher pay. They actually believe bloviating politicians when they declare we have the best jobs market in history. Suddenly, formerly skeptical conservatives who rightly believed the government drones at the BLS and BEA cooked the books to make the economy appear better than it really is, believe Trump’s declarations based on the same data. Root, root, root for your home team. Why let facts get in the way of a good story?

“The President says this is the best economy in “15 years”. Kudlow says we’re in a “boom”. But in the first 18 months of the Trump presidency, private nonfarm payrolls averaged 190k, the same rate of job creation in the last 18 months of the Obama tenure.” – David Rosenberg

The unemployment rate was falling during Obama’s entire presidency and has continued to fall under Trump. It’s the same story. In order to keep up with the demographic growth of the labor market we need to generate 200k new jobs per month. But even though we’ve added less than 200k per month for the last three years, the unemployment rate has fallen because the BLS drones say a few million more working age stiffs have willingly left the labor force, bringing that total to just below 96 million people with their feet up on the couch watching The View.

They must be living off their non-existent savings and accumulated wealth. The cognitive dissonant masses, who believe the BS peddled by CNBC, etc., don’t seem to question why their real wage increases have ranged between 0% and 1% since the Trump reign began (it was 2% during Obama’s last two years). Real wages couldn’t be falling if the unemployment rate was really 3.9%. But, why spoil a good narrative with inconvenient truth.

With stagnant real wages since the Wall Street created financial crisis, a critical thinking person might wonder how an economy whose GDP is 70% dependent on consumer spending could grow for the last nine years, with corporate profits at all-time highs, consumer confidence at record highs, and the stock market at record highs. The Deep State/Ruling Class/Powers That Be or whatever you want to call the real people pulling the strings behind the curtain boldly assumed their propaganda machine and the years of dumbing down the populace through their public education system could convince the American public to utilize cheap plentiful debt to re-inflate a new bubble to replace their last criminal enterprise.

You would think after being burned with 50% losses twice in the space of eight years, the average American would have learned their lesson. Debt kills. Consumer debt, which collapsed under an avalanche of Wall Street write-offs (paid for by you the taxpayer) in 2009/2010, has regained all-time high levels and is accelerating as we enter this final phase of blow-off top euphoria. When the next inevitable financial collapse occurs these heavily indebted suckers will be blind-sided with a baseball bat to the skull again. It seems Americans never learn.

Total household debt topped out at $14.5 trillion in 2008 and proceeded to fall by almost $1 trillion as a tsunami of foreclosures swept across the land. But a funny thing happened on the way towards Americans approaching debt with the appropriate caution – QE1, QE2, QE3 and propped up Wall Street banks doling out loans to anyone capable of fogging a mirror and scratching an X on a loan document. The Deep State oligarchs realized the only way to keep their ponzi scheme economy afloat was to lure in more suckers with debt that could be re-circulated to make the economy appear solvent.

College students, after over a decade of government school indoctrination, were the perfect dupes. From 2009 until today the government has doubled student loan debt from $750 billion to over $1.5 trillion. Everyone likes a shiny new car, so the financial industry took auto lending from $700 billion to over $1.1 trillion over the same time frame. The re-ignition of the housing bubble, through Wall Street engineered supply suppression, has driven prices far above the 2005 peak in most major markets.

With household debt at record levels, real wages stagnant and being in the ninth year of economic recovery a positive sign for the future? Do you believe the Fed has conquered economic cycles and have eliminated recessions? Have we entered a new permanent prosperity paradigm? We’ve also heard about how corporations are swimming in profits (turbocharged in the last nine months by the Trump tax cuts). This narrative is used to resolve the excess stock valuation dilemma.

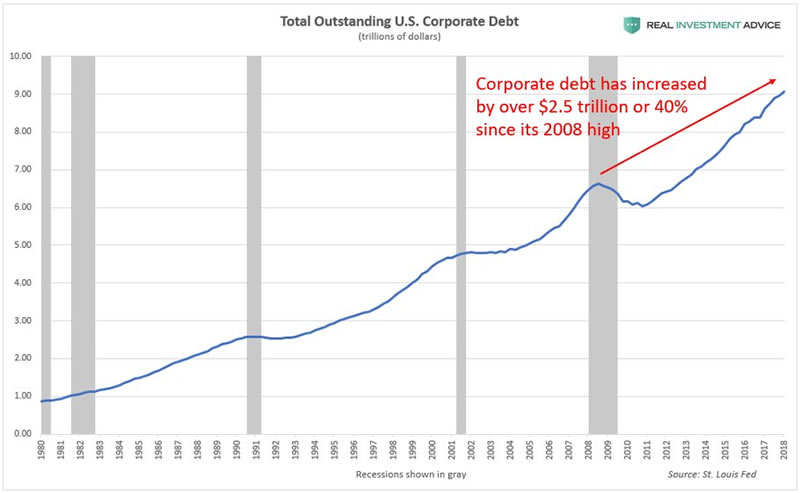

If corporations were swimming in profits, why have they added $2.5 trillion of debt above the pre-collapse high in 2008? It seems they have been incentivized to take on mountains of debt because the Fed inflicted ZIRP upon the economy. Did American companies use this debt to expand facilities, invest in new capital projects, or raise wages for their workers? Don’t be silly. They had a better idea.

In what passes for the normal exercise of crony capitalism in this warped deviant shitshow we call America, the biggest corporations in the world took the free money created by the Federal Reserve and proceeded to “invest” it in their own stock rather than investing it in their operations and workers. Borrowing at near zero rates and using the proceeds to buy back hundreds of billions of your own stock had multiple benefits for greedy feckless Harvard MBA CEOs. Reducing shares outstanding juiced their earnings per share, resulting in a false profit picture to investors, who bid their stock prices higher.

Corporate executives tied their compensation to stock performance and reaped extravagant salaries and bonuses. This same scenario played itself out in 2007 – 2009. These brilliant CEOs bought back a record amount of stock just before the financial collapse. Using their borrowings, along with Trump’s tax cut windfall, current day S&P 500 company CEOs are saying “Hold My Beer”. They are on pace to buy back $1.2 trillion of their stock at all-time highs. When stock prices are cut in half again, these greed monkeys will pay no price for their reckless stupidity. All of this idiocy has been aided and abetted by the Fed with their near zero interest rates a decade after the crisis supposedly ended.

The messengers for the Deep State, put forth on the propaganda news networks, are paid to spin the narrative that debt is under control, GDP is soaring, inflation is non-existent, unemployment is at record lows, and America’s economy has never been better. Despite retro-active upward adjustments to GDP and personal income by government drone agencies to obscure the truth, even the fake data reveals debt levels at extremely dangerous heights. U.S. corporate debt as a percentage of GDP is currently the highest in history.

Previous peaks occurred at the bubble peaks in 1990, 2001 and 2008, just before recessions hit. Due to Fed monetary recklessness, irresponsibility, and enslavement to Wall Street bankers, we now have an “Everything Bubble” consisting of stocks, bonds, commercial real estate, and housing market. With corporate and personal debt at record levels, rising interest rates, and a slowing global economy, the dominoes are lined up once again. If you don’t know what happens next, you’re the dupe.

If you think corporations and consumers have been on debt binge, check out what the rest of the world has done since 2007. There should be no disagreement the global financial catastrophe of 2008/2009 was caused by excessive un-payable debt creation by global financial institutions in conspiracy with the Federal Reserve, Washington politicians, and corporate America. Trillions in faux wealth was obliterated in a matter of months. Rather than learn a useful lesson from this orgy gone wrong, the shadowy figures in smoky back rooms decided the solution was ramping debt to levels never imagined.

Using “Big Lie” propaganda and central bank printing presses across the globe, they have managed to add $71 trillion of global debt in the last ten years, up 43% from pre-crisis levels. And the most mind-boggling aspect of this growth is that $42 trillion of the new debt was in emerging markets, up 200%. Venezuela, Argentina, and Turkey are considered emerging markets. No risk of contagion there. Right? Trying to solve a debt problem by creating far more un-payable debt is like trying to cure stomach cancer with a gunshot to the scrotum. How the average person can not see the insanity of these actions by their political and financial leaders is beyond my comprehension. Or am I the crazy one for questioning our ruling oligarchs?

In order to prop up the criminal banking cabal, the Fed, ECB and Bank of Japan took their balance sheets from less than $4 trillion in 2008 to over $14 trillion today – and still rising. Make no mistake, this “money” (debt) was created out of thin air by captured bureaucrats doing the bidding of bankers, billionaires and the rest of their Deep State cronies. Believing the false narrative this was done for Main Street USA is a sign of willful ignorance or pure stupidity, as proven by the following chart.

While central bankers have more than tripled their balance sheets and funneled the fantasy bucks to Wall Street banks and mega-corporations, virtually none of it trickled down to Main Street. The only trickle is the piss running down our backs from the ruling elite. The massive debt creation has been nothing more than a last-ditch effort to prop up the crumbling financial/political paradigm. The current state of affairs is unsustainable. It is failing. And it will fail. This turkey will ultimately hit the ground like a wet sack of cement.

“Instead of doing the right thing and fund the tax cut through spending restraint, government expenditures have ballooned 10% in the past year. Treasury borrowing in July at $130 billion was the most ever outside the 2008/09 recession.” – David Rosenberg

I voted for Donald Trump in 2016 because he wasn’t Hillary and he had voiced what I considered positive stances on economic and global issues. He ridiculed the government data regarding unemployment and inflation. He trashed Yellen and the Federal Reserve for creating bubbles with their recklessly low interest rates. He railed against excess government spending and deficits. He declared the stock market was a bubble (7,500 Dow points lower than today). He had criticized our military involvement in Afghanistan, Syria and Iraq.

As we know, he got elected and proceeded to forget all of his positions from the campaign. His Supreme Court choices have been stellar. Reducing regulations and taxes is a good thing. Fighting the Deep State and his own intelligence agencies takes balls. And his contempt and ridicule of the fake news media is to be applauded. But his 180 degree reversal on rational economic stances and feeding the war machine has been disappointing and will ultimately contribute to the next financial crisis.

Does every new president get brought into a room where they are told what to say about the economy, or else? Mr. Concerned about government spending and deficits signed one of the largest tax cuts in history (mostly to corporate America) while simultaneously ramping up military spending and cutting absolutely nothing. The result is trillion dollar deficits for as far as the eye can see. The fake government data he once scorned, he now boasts about on a daily basis. It seems he now loves low interest rates and bubbles.

He threatens the Federal Reserve Chairman about raising rates. Even though the stock market is 45% higher than when he declared it a bubble, he takes credit for its ascension to record highs. Saber rattling and threatening war around the globe is now par for the course. It seems Trump thinks he can run our economy like a NYC real estate mogul. He does have experience with bankruptcies. That may come in handy.

As a country, we’ve allowed our elected and unelected rulers to do the exact opposite of what should have been done in 2009. We allowed criminal banks who were too big in 2008 to get bigger and now, Too Big To Control. Not one criminal banker was jailed, despite proof of the greatest financial fraud in history. We allowed ourselves to become addicted to low interest rate debt. We now view $1 trillion deficits as normal, when the highest annual deficit in history prior to 2008 had been $413 billion.

Ivy League educated intellectual yet idiot financial experts argue a negative real Federal Funds rate during a “booming” economy is logical. Everything about our economic system and financial markets is abnormal. And whenever a sober minded person questions this insanity, the spokesmodels for the establishment point to the record stock market as their proof all is well.

The arrogance and hubris of those who have benefited from Fed handouts and rigged market gains has reached epic levels. They’ve now convinced average Joes and Janes to venture into the markets at all-time highs. Equity exposure was only higher at the Dot.com peak. Consumer confidence is the highest since 2001. Irrational exuberance abounds. Whenever forthright honest financial analysts use factual historical data to prove stock valuations are at excessive levels, they are attacked and ridiculed for being wrong for the last decade. The old Wall Street adage that “being right but early is the same as being wrong” applies.

What the hubristic MBA stock trading savants fail to acknowledge is the longer this nine- year bull market goes, the closer to its demise. The unsustainable will not be sustained. Back in 2008 only 20% of market assets were passively managed through Index and ETF funds. That number now stands at 40%. This works well on the way up. It will create a cascading crescendo of selling on the way down.

I wonder how the 30-year-old big swinging dicks will handle that situation. To be confident about substantial upside at these levels is not rational, but whoever claimed Wall Street traders were rational? Reason and rationality will eventually assert themselves. Dark humor will have to sustain honest men for now.

“If margins are 2x the norm, valuations are 2x the norm, and mean regression is still a force of nature, we are looking at an 80% correction. Of course, if an 80% correction whacks revenues, then it could start to get ugly.” – Dave Collum

Warren Buffet’s favorite indicator of stock market valuations now exceeds the Dot.com peak.

Shiller’s cyclically adjusted P/E ratio is far above 1929 and 2007 crash levels. Only the Dot.com bubble saw a higher level.

Those who continue to point out inconvenient facts about our economy and financial markets will continue to be branded doomers and conspiracy theorists. Scorn and ridicule will be the weapons used by the Deep State to undermine confidence in reality- based analysis. Newsletter writers and money managers will be accused of fear mongering to attract subscribers and investors. I’m neither a newsletter peddler or investment professional. I’m just a dude who gets up every morning and drives to my job to support my family. I benefit in no way financially by taking a stand against the corrupt, lying, propaganda peddlers for the establishment.

The entire purpose of creating The Burning Platform was to inform those who wanted to hear the truth about our unsustainable financial, social and political systems. I’ve tried to do that to the best of my limited abilities for the last ten years. I’m frustrated because the majority have learned no lessons from the 2008/2009 catastrophe. The ruling class has double downed on the same policies and actions which created the disaster. Those in control may have successfully delayed the day of reckoning, but they have insured it will be far worse than it needed to be.

We are only halfway through this Fourth Turning and the coming financial collapse will be the catalyst for the looming conflicts and clashes which will determine the future course of our country. If you choose not to acknowledge the inevitability of financial collapse and imminent conflict, you haven’t been paying attention. Lessons not learned in the past decade will be learned the hard way in the next decade. To paraphrase Mencken, they deserve to get it good and hard, and they will.

“Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II.” – Strauss & Howe – The Fourth Turning – 1997

If you feel you’ve received some value from this article and this blog dedicated to free speech and truth in the face of lies, corruption and fake news, feel free to make a Donation to keep the lights on at The Burning Platform.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2018 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.