Stock Market VIX & S&P: This Bearish Study isn’t as Bad as You Think

Stock-Markets / Stock Markets 2018 Sep 04, 2018 - 11:39 AM GMTBy: Troy_Bombardia

VIX and the S&P trend higher together during the final innings of a bull market.

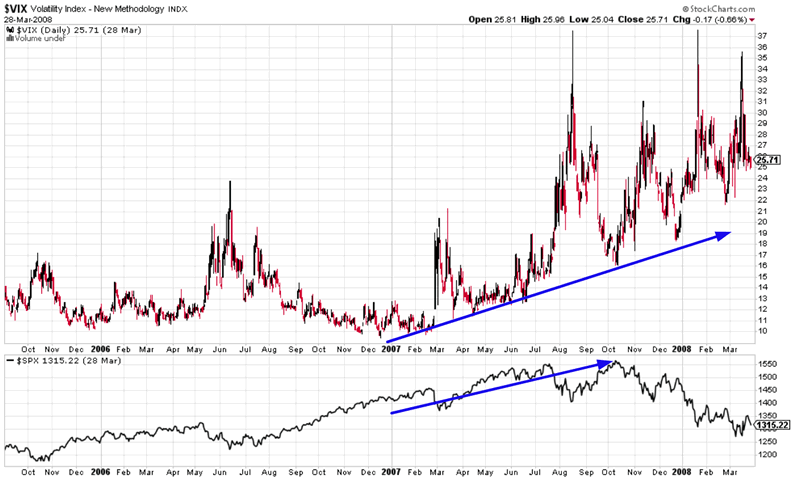

Here’s VIX and the S&P 500 before the stock market’s top in 2007.

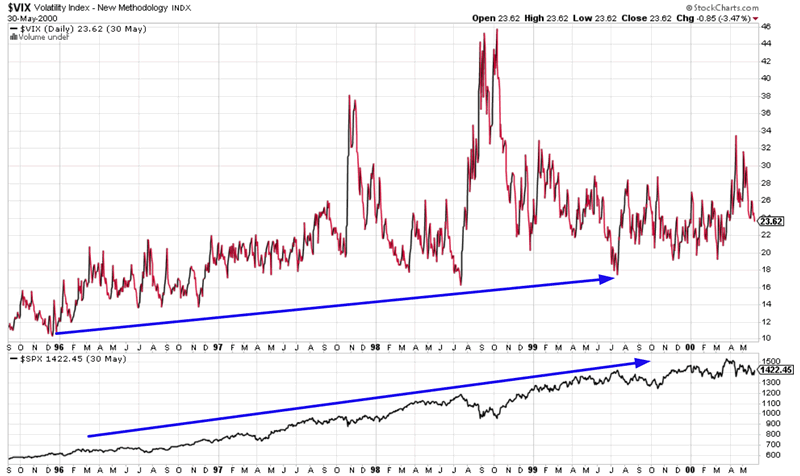

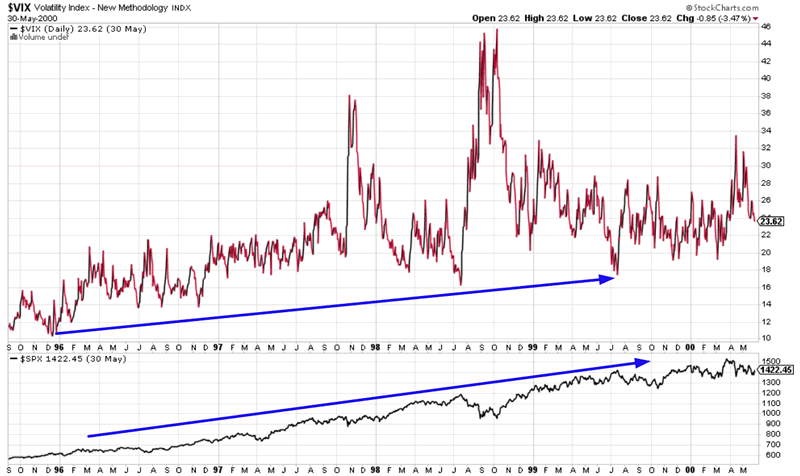

Here’s VIX and the S&P 500 before the stock market’s top in 2000.

VIX and the S&P are starting to trend higher now. VIX is still above its November 2017 low, but the S&P 500 is much higher than where it was in November 2017.

Zerohedge recently illustrated a market study that seems insanely bearish for the stock market, until you look at the details.

*It never ceases to amaze me how Zerohedge and other permabears can cherry-pick the data to fit their “the world is ending” view.

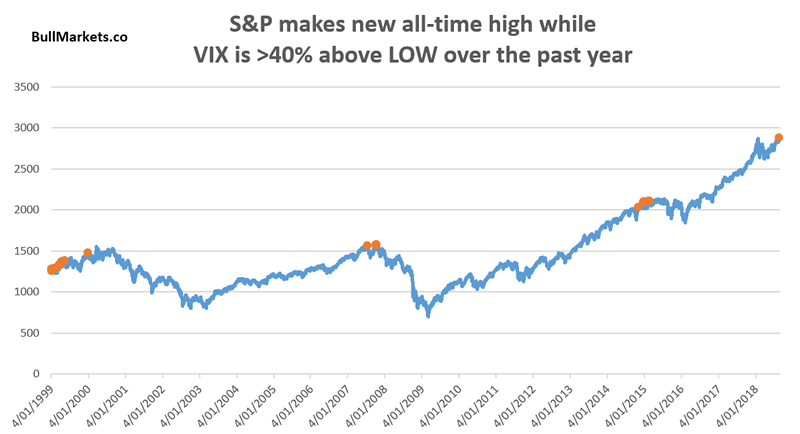

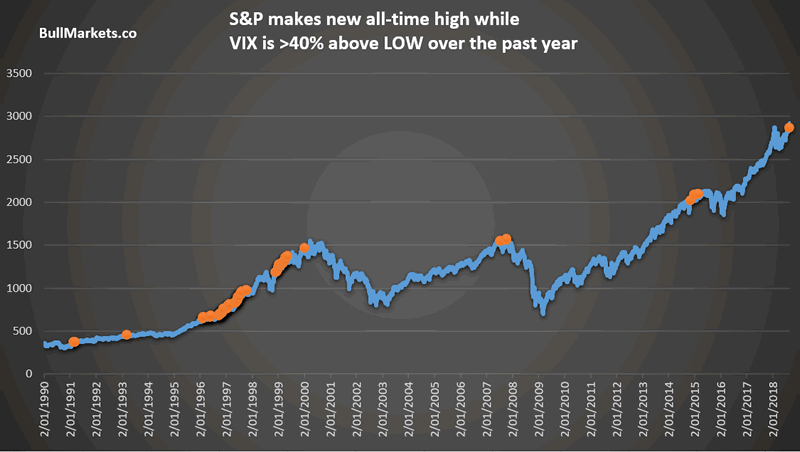

On August 21, 2018: the S&P made a new all-time high while VIX was at least 40% above its lowest point over the past year. (In other words, the S&P and VIX are going up together).

When this happened historically (from 1999-present), this was super bearish for the stock market.

- 1999

- 2007

- late-2014.

Once again, this is an example of permabears cherry-picking the data to fit their “the world is ending” view. That’s why we need to look at ALL the data.

Here are this market study’s signals, from 1990-present.

Click here to download the data in Excel

As you can see, VIX and the S&P CONSISTENTLY went up together during the second half of the 1990s. This was not bearish for the stock market in the 1990s. This indicator resulted in a LOT of false bearish signals.

Conclusion

VIX and the S&P 500 are going up together right now. This tells you that we are in the late innings of this bull market. HOWEVER, it does not tell you that the bull market will end tomorrow, next week, next month, or even next year. This is not a timing indicator.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.