The Bullish CoT Setups in Gold and Silver

Commodities / Gold and Silver 2018 Sep 08, 2018 - 03:02 PM GMTBy: Gary_Tanashian

You may know me as the guy using weird planetary alignments while assigning proper fundamentals to the gold sector, and recently even doing the same with a somewhat subjective and philosophical view of gold as an important counterweight or insurance component to a sensible portfolio. Or you may know me as the guy who confuses you with too many market indicators or annoys you with too many exposés of the more promotional and/or manipulative entities out there.

You may know me as the guy using weird planetary alignments while assigning proper fundamentals to the gold sector, and recently even doing the same with a somewhat subjective and philosophical view of gold as an important counterweight or insurance component to a sensible portfolio. Or you may know me as the guy who confuses you with too many market indicators or annoys you with too many exposés of the more promotional and/or manipulative entities out there.

Or you may not know me at all.

If that is the case, let me introduce myself. My name is Gary and today I have a very simple post for your consideration. We will look at the now compelling views of the Commitments of Traders (CoT) data for gold and silver. While the prices of the metals are and have been technically bearish and the fundamentals are and have been poor, sentiment (CoT is ultimately a sentiment thing, after all) setups like those shown below should not be ignored. We are talking historic in silver and merely compelling in gold.

Along with noting the poor fundamentals, I have been writing about positive contrarian sentiment in gold for many weeks now. That is because, well… sentiment has been contrarian positive! While public opinion data have jumped around a bit, I think CoT is the ultimate sentiment indicator because it shows how the primary movers of these markets are positioned. So let’s get to it.

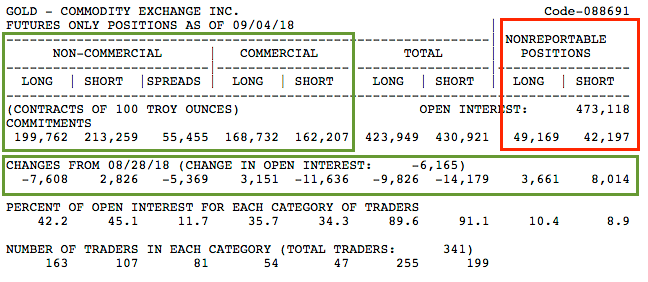

This afternoon CFTC released the data as of Tuesday the 4th and on that day an already positive data set had become more so. For gold the upper green box I’ve drawn in shows a contrarian bullish configuration of net short large Speculators and net long Commercials. The lower green box shows last week’s improvement with large Specs reducing longs and increasing shorts while Commercials did the opposite. This is rare and bullish positioning. The red box is a very minor negative as the little guy (small Specs) remains net long, although he did press the short side last week.

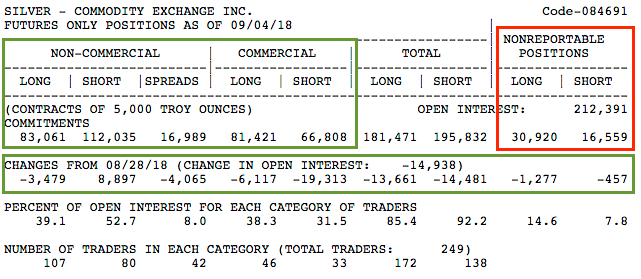

The silver situation shows a hefty net long by Commercials and net short by large Specs and that is just fantastic. The more notable (than gold’s) caveat here continues to be that the small Specs are still significantly net long (although they too faded just a bit last week).

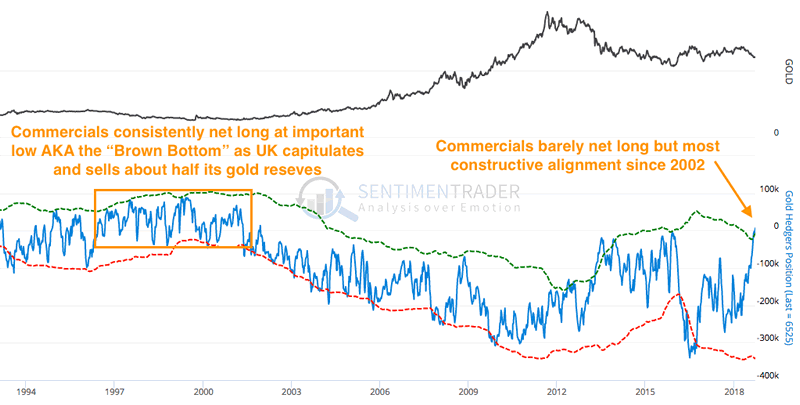

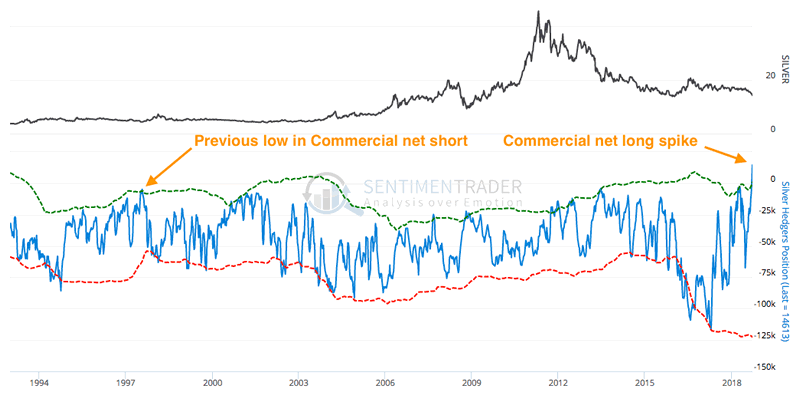

So with the status of the little guy the only cause for any level of concern in the CoT data, let’s take a look at the historical positioning of the all-important Commercial Hedgers (data courtesy of Sentimentrader, markups mine).

Gold just ticked Commercial net long by a teeny and that is something it has not done since 2002. This is the most constructive the CoT situation has been throughout the current bear market. As a side note, the chart makes a little fun of Gordon Brown who some would say singlehandedly launched the big gold bull market that began during the 1999-2001 period. A caveat here is that CoT was very bullish for a long long time (as in, years) before the price caught on and the bull market became obvious.

So with that thought in mind, we will still have to pay close attention to the proper fundamental backdrop because if it does not start to come in line there is every chance that this situation could take years as well (hey, if you want only pompoms there are plenty of cheerleaders out there at the ready).

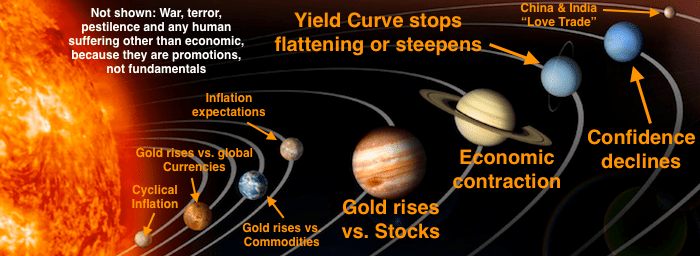

Okay, I lied. Here is the newly spiffed up Macrocosm of gold and gold sector fundamentals that actually matter for a prospective buyer. While the planet sizes are not perfect (Yield Curve & Confidence are as important as Gold/Stocks and the Economy) the larger the writing the more important the fundamental consideration. As for the smaller fry, Au/Currencies and Au/Commodities are actually pretty important. The “love trade”? Ha ha ha…

Back on message and that message is the CoT. I saved the best for last. Silver’s Commercial Hedgers have just spiked to a degree of net long not seen in the history of this data going back to 1993. Indeed, in all that time they had not been net long, only less net short at varying times.

Now considering that during rallies in the precious metals complex silver usually leads gold this would appear to be an important indication. So while we have been noting that the 2 Horsemen (Gold/Silver ratio & USD) have been riding as silver gets drubbed in gold terms, if a fire is to get lit under the precious metals or even the wider commodity complex, it would probably start with Silver. That spike in Commercial net longs may be a wick.

Bottom Line

Commitments of Traders data are not only not standing in the way of a precious metals rally, they are practically begging for one. It is best to have the fundamentals at your back when buying the precious metals and while September has a chance to bring some changes in that area they are not yet in place. Still, I have started to buy some quality sector items, including the Silver Bullet as noted in the NFTRH real time Trade Log.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter @BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.