Esports Is Exploding—Here’s 3 Best Stocks to Profit From

Companies / Investing 2018 Sep 13, 2018 - 03:33 PM GMTBy: Stephen_McBride

57 million people tuned in to watch a recent professional video-gaming (esports) match. That’s almost 3x more than the 2018 NBA finals.

57 million people tuned in to watch a recent professional video-gaming (esports) match. That’s almost 3x more than the 2018 NBA finals.

Maybe you’re thinking it’s a stretch to call video gaming a “sport.” Call it whatever you want, so long as you understand that massive sums of cash are pouring into this booming sector.

There are now American video-gaming leagues modeled after the NBA and NFL.

And like the NFL and NBA, esports has tens of millions of hardcore fans who will happily fork over $100 or more for a ticket to watch a big game live.

Many Investors Dismiss Esports as a Silly Fad

They’re wrong, and they’re going to miss out on big stock gains.

Do you know that more than 80 American colleges now offer esports scholarships?

Or that last year, some of the world’s biggest companies like Intel, Coca-Cola, and T-Mobile spent $700 million to sponsor esports?

Or that the average salary in one American professional esports league is $320,000?

Many investors roll their eyes because it sounds like a joke.

Let me tell you a different joke—one that has investors laughing all the way to the bank with 375% gains.

WWE Was Dead Money for 17 Years

Chances are you’ve seen at least a few minutes of American professional wrestling.

I’m talking about “Hulk Hogan”-type wrestling. Where muscular guys wearing spandex hit each other on the head with folding chairs.

Juvenile, right?

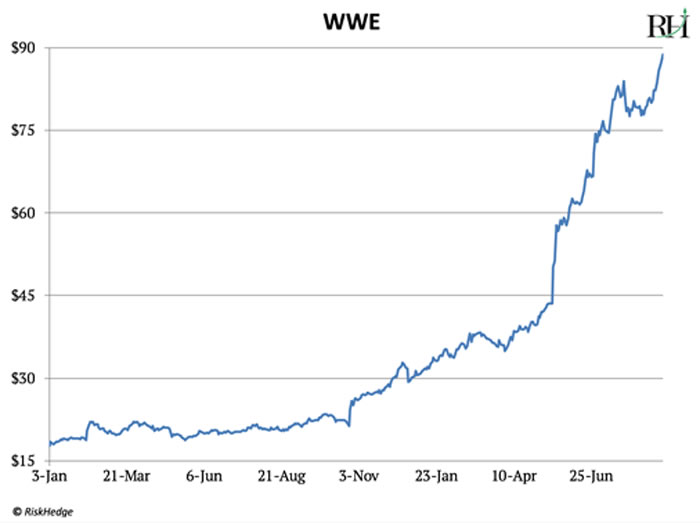

Well, look at this chart of World Wrestling Entertainment (WWE):

Source: Yahoo Finance

The WWE has turned fake wrestling into a $6.8 billion business. Investors in WWE have made 375% since January 2017. It’s the 12th best-performing medium-to-large US stock this year.

But WWE was dead money for 17 years. It went public in 1999, and its stock fell 25% through 2016.

Everything changed in 2017. As I wrote in my essays on Netflix and Disney, technology has totally disrupted the business model of TV.

In the past, big cable companies acted as gatekeepers that decided what we watched. Today, we can watch practically anything on streaming services like Netflix and the internet.

WWE took advantage of this to launch a “Netflix-style” streaming service for wrestling. By bypassing cable companies to connect directly with fans, WWE has transformed its business.

Thanks to 1.8 million streaming subscribers, its revenue has jumped to all-time highs.

A few years ago, WWE was at the mercy of cable companies. Half of its revenue came from TV contracts. Today, just one-third of its revenue comes from traditional TV.

E-Sports Has Been on “the Fringe” for Decades Too

And like WWE, streaming video is unleashing its full moneymaking potential.

As I mentioned, people can now watch whatever they want on the internet. And it turns out hundreds of millions of people like to watch others play video games professionally.

Have you heard of Twitch? It’s a website owned by Amazon (AMZN) that broadcasts video game matches. More people watch it every day than CNN or MSNBC.

And that’s the key to this whole thing: Video gaming has a massive audience of engaged fans. And that’s the most valuable asset in content business.

In fact, a massive audience of engaged fans is the source of the financial strength of the NFL and NBA. It’s why the Dallas Cowboys are worth $4.2 billion and the New York Knicks are worth $3.6 billion.

They’ve each got millions of fans not only watching them on TV, but buying tickets, memorabilia, and merchandise year after year.

Based on the stats I shared with you earlier, I’m convinced the global fanbase for e-sports is bigger than the NFL and NBA combined.

This fanbase has been there for decades. But it took the disruptive force of streaming video to bring fans together online in huge numbers. E-sports is shining a light on just how gigantic and enthusiastic the video game audience really is.

I believe this industry is just in its infancy. People are going to be shocked at how fast e-sports grow in the next five years.

How Do We Profit from This?

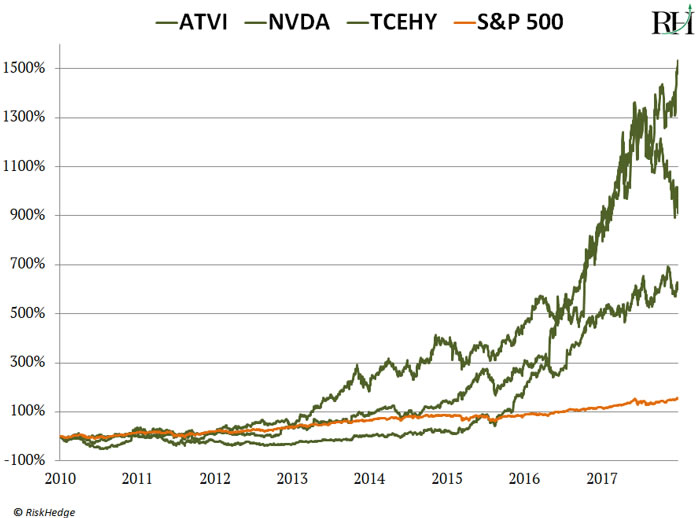

This year, people will spend around $138 billion on video games. That’s a 95% surge from six years ago. Look at this chart of my three favourite gaming stocks vs. the S&P 500:

Source: Yahoo Finance

As you can see, they’ve all beat the market. I think that’ll continue as the popularity of e-sports explodes.

Here’s a rundown of why I like each stock:

- NVIDIA Corporation (NVDA)

NVDA makes high-performance computer chips used for gaming. They can cost up to $3,000 a piece.

NVDA’s chips are the gold standard in gaming. 86% of competitive gamers use them, and NVDA has become the official hardware provider for almost every major e-sports league in the world.

- Activision Blizzard, Inc. (ATVI)

As I wrote in my other essay on Netflix and Disney, producing great content is a bigger competitive advantage today than ever before. ATVI is one of the world’s best video game makers.

It owns five franchises that have brought in over $1 billion in revenue. And its games are among the most widely played in the e-sports world.

And get this… ATVI recently struck a deal with Disney to broadcast its popular Overwatch League matches live on primetime ESPN.

- Tencent Holdings Limited (TCEHY)

Not many people know this, but Chinese social media giant Tencent is the largest gaming company in the world. Its gaming revenue is 72% higher than second place Sony.

It owns mega-hits like League of Legends, Fortnite and Clash of Clans. If you have teenage sons or nephews, you probably know that millions of kids from here to China play Fortnite.

Tencent’s bread and butter is mobile gaming, like on smartphones. Mobile gaming now makes up 51% of the global gaming market.

This article originally appeared on RiskHedge.

By Stephen McBride

© 2018 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.