The Trade War With China Could Last A While

Economics / Protectionism Sep 22, 2018 - 04:42 PM GMTBy: Harry_Dent

I agree with him!

I agree with him!

The richest man in China, Alibaba co-founder Jack Ma, reckons the trade war is the beginning of a long-term battle for supremacy between China and the U.S.

He’s sees no effective short-term solution to this big global issue.

China needs to strengthen its economy to fulfill its long-term shift to stronger domestic consumption while focusing on the real global growth markets in Southeast Asia, India, and Africa.

That’s what its huge “belt and road initiative” and global investment program is all about.

Ma’s view is likely the same as the Chinese government.

If the U.S. wants to play hardball here, they’ll just make that shift to focusing on those other markets harder and quicker, beating the U.S. and Europe to them.

Currently, Trump has the near-term advantage. His September 17 hike to tariffs on $200 billion of Chinese goods – 10% on September 24 moving to 25% on January 1, 2019 – is 3.3 times China’s retaliation of tariffs on $60 billion of U.S. imports since September 18.

But China’s top-down government has always had a long-term time horizon. That’s why they are being so stubborn.

And like I started by saying: I couldn’t agree more with Ma.

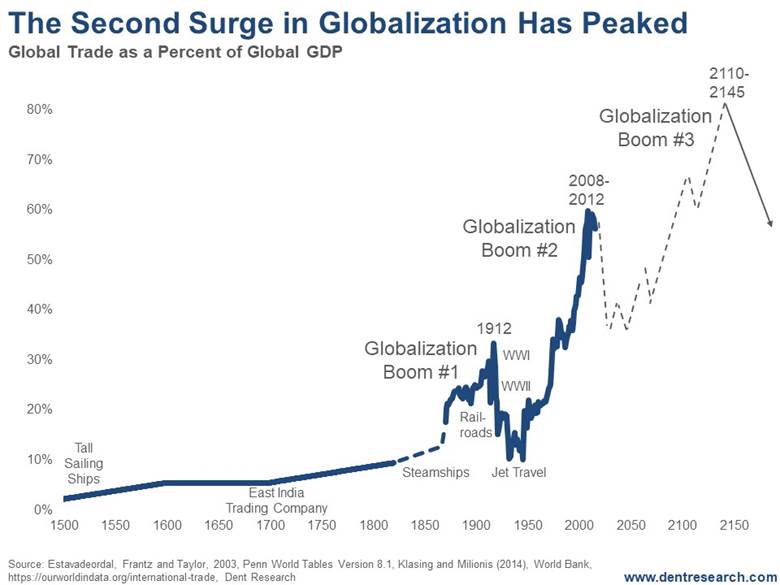

Here’s a prominent chart from my recent Zero Hour book with Andrew Pancholi of the Market Timing Report…

This chart shows that the second great surge in globalization from 1949 to 2008 has already peaked and will see a multi-decade regression similar to the one between World War I and World War II.

The first wave peaked in 1912, just before WWI.

The biggest crash in global trade came during that war because the modern world that dominated GDP was fighting… and warring nations not only don’t trade with each other, but they’re too busy producing war goods to export much.

That was a HUGE boon to the emerging U.S. We exported heavily to the allies even after joining the war later.

Then in the Great Depression, countries reacted like today. With a shrinking pie, they became increasingly protectionist. There was even a populist revolution back then, that Hitler and Mussolini led.

The tariff wars then just made the Great Depression worse. That was the second shock to global trade. The third shock in WWII was the mildest as global trade had already contracted over 60%.

The second and even steeper surge in global trade came after WWII into around 2008. The decline since then has only been minor but the steepest crash in trade here is likely to come in the next global depression we forecast for 2020 to 2023-24.

Of course, there are likely to be repercussions for many years to follow as China takes the biggest fall from massive overexpansion and debt implosion…

Then the third surge should take us to full globalization, urbanization, and middle-class saturation by around 2145.

Three very projectable cycles converge and peak between 2140 and 2150:

- Urbanization at 90%.

- The 500-year Mega Innovation Cycle.

- And the 165-East/West Cycle with peak Asian dominance by then.

As much as demographic cycles of aging and falling births project increased slowing forever into a black hole… that is NOT going to happen as these other cycles are more dominant and would strongly suggest another revolution in our life expectancies in the decades ahead that would trump falling births!

But near term: don’t take a likely compromise in the U.S./China trade war as sustainable.

This is a bigger trend – and a necessary step on the way up to greater globalization and prosperity.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.