Sector Rotation Continues. Bullish for Stocks

Stock-Markets / Stock Markets 2018 Sep 25, 2018 - 06:39 PM GMTBy: Troy_Bombardia

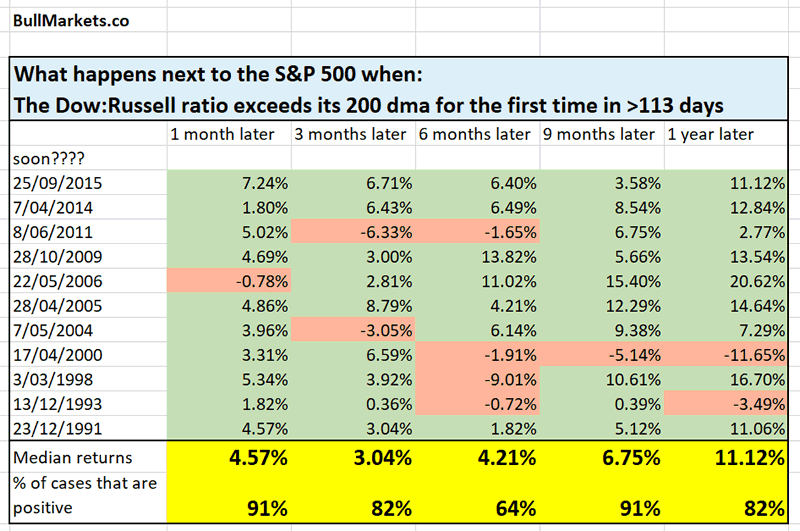

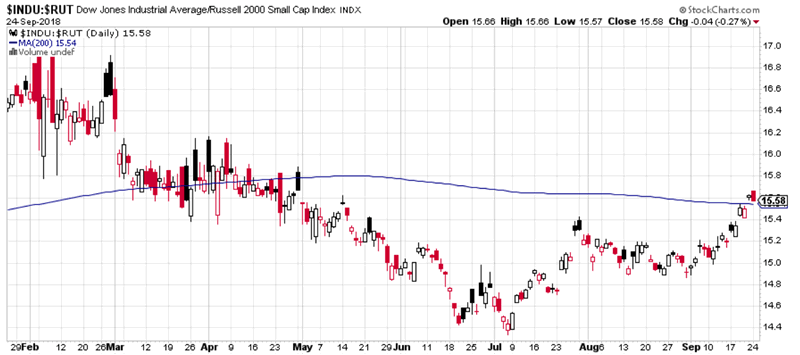

We’ve been looking at sector rotation quite a bit recently here at BullMarkets. Last week we mentioned that the Dow:Russell ratio (large cap vs. small caps) is about to cross above its 200 day moving average for the first time in a long time.

This means that the Dow is starting to outperform the Russell 2000 for the first time in a long time.

The Dow:Russell ratio has now officially crossed above its 200 day moving average.

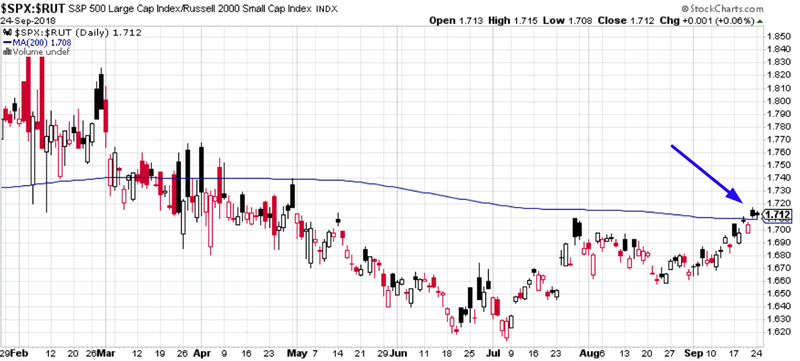

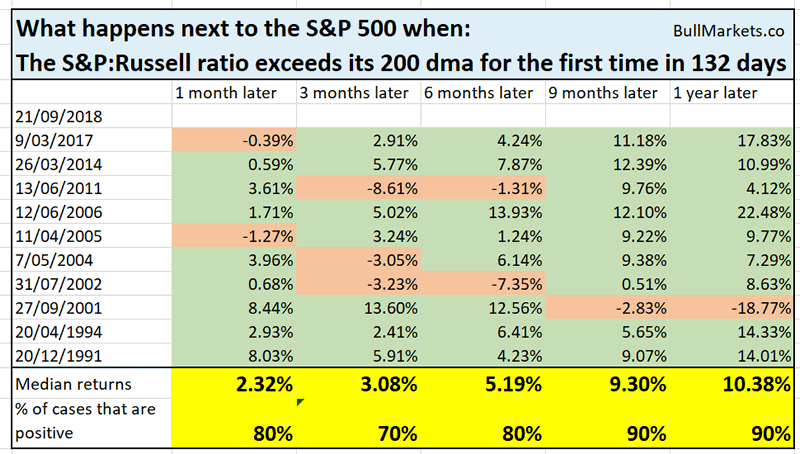

Likewise, the S&P:Russell ratio has crossed above its 200 day moving average for the first time in 132 trading days.

Here’s what happens next to the U.S. stock market (historically)

Conclusion

As you can see, sector rotation is mostly a short term, medium term, and long term bullish factor for the U.S. stock market.

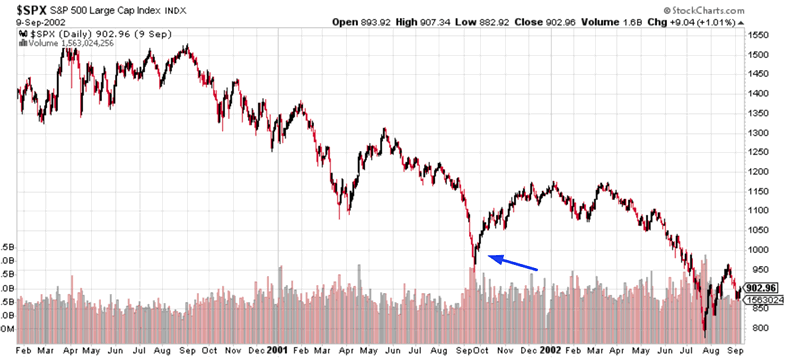

There is only 1 real bearish case out of these 10 historical cases: September 2001.

That historical case doesn’t really apply to today. It occurred AFTER the S&P had already fallen -35% in the 2000-2002 bear market. With the S&P near all-time highs today, these are clearly 2 different market environments.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.