Return of Stock Market Volatility: More Short term Weakness Ahead

Stock-Markets / Stock Markets 2018 Oct 05, 2018 - 03:23 PM GMTBy: Troy_Bombardia

As you would recall, I said in late-September that the stock market’s volatility would probably spike in October. Volatility was extremely compressed, which set the stage for an expansion in vol.

Yesterday, the stock market went down and volatility spiked a little.

Spikes in volatility are usually larger than this, so perhaps the stock market will experience some more short term weakness.

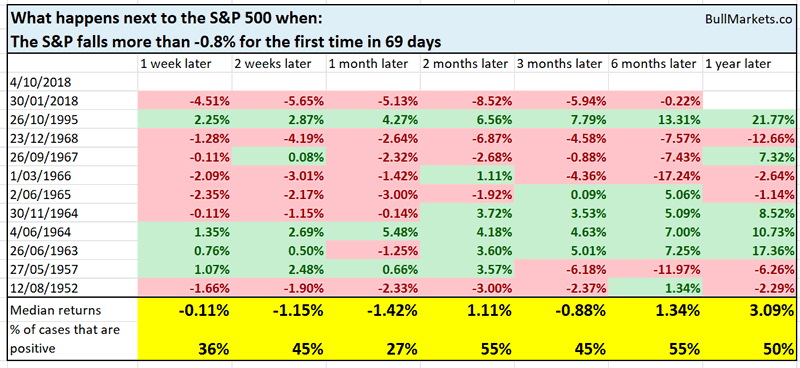

Yesterday was the first time in 69 trading days in which the S&P fell more than -0.8%. In other words, an end to low volatility. Historically, this has been a short term bearish sign for the U.S. stock market.

*See the S&P’s 1 week – 1 month forward returns

I want to look at volatility from a medium-long term perspective.

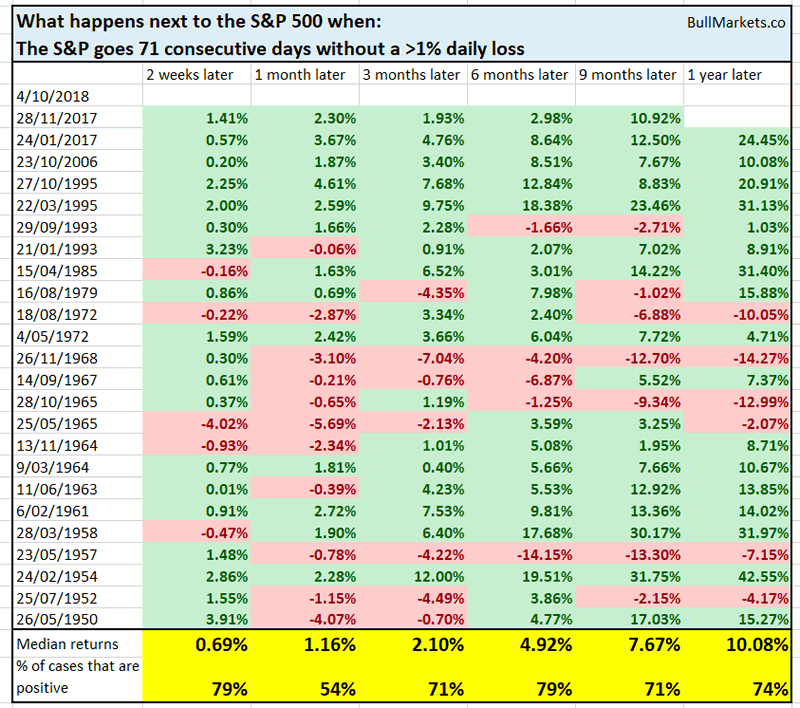

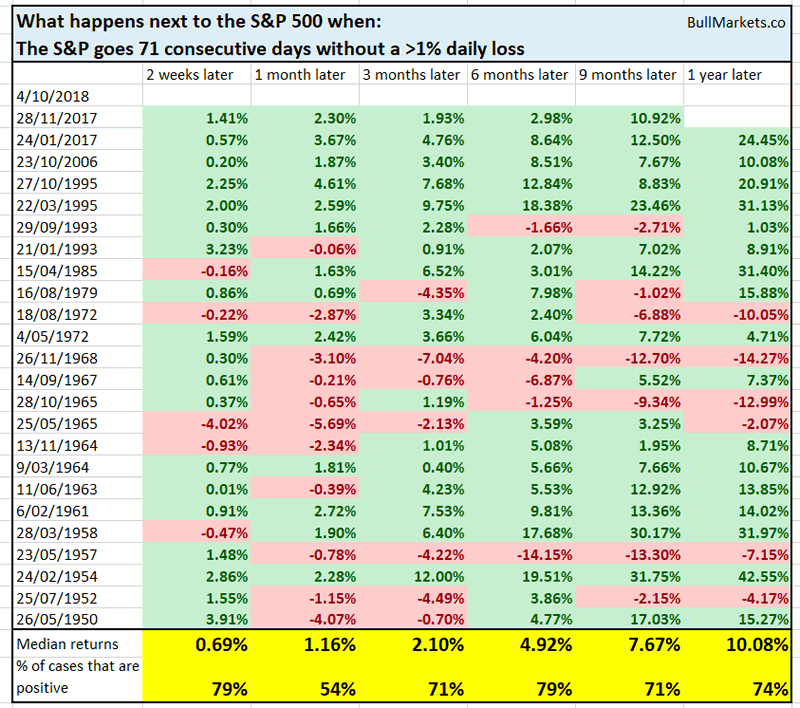

The S&P 500 has now gone 71 consecutive trading days without a >1% daily loss. When this happens, the stock market’s short term (2 week forward returns) aren’t bad. After that, forward returns are no better than random.

However, using “the # of >1% daily changes” is not the best way to measure volatility. We can look at VIX (or we can calculate volatility on our own).

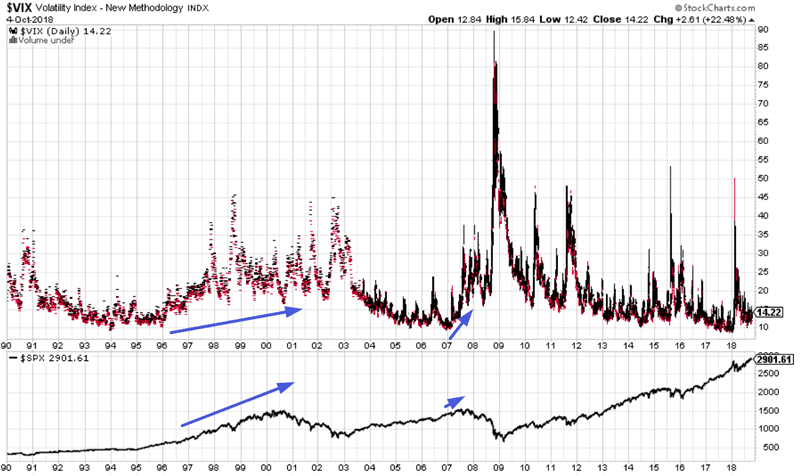

As you can see, VIX has spiked from an extremely low $. This tends to happen AT LEAST 1 year before the end of a bull market (i.e. the rally still has some room to go). Why?

Because volatility tends to INCREASE during the last rally of a bull market. Volatility and the stock market tend to go up together. Volatility isn’t usually this compressed when the stock market tops.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.