Global Warming (Assuming You Believe In It) Does Not Affect Gold

Commodities / Gold and Silver 2018 Oct 18, 2018 - 12:26 PM GMTBy: Avi_Gilburt

When the market, represented by SPDR Gold Trust (NYSEARCA:GLD), broke down below 117.40, and then followed below the next support in the 114 region, we were hyper-focused on the 109 region. Thus far, that is where GLD has bottomed out (in overnight action). From there, we were expecting a rally, and the market has not disappointed.

When the market, represented by SPDR Gold Trust (NYSEARCA:GLD), broke down below 117.40, and then followed below the next support in the 114 region, we were hyper-focused on the 109 region. Thus far, that is where GLD has bottomed out (in overnight action). From there, we were expecting a rally, and the market has not disappointed.

For the last two weeks, I have been outlining how the metals complex was bottoming out and setting up to rally to a minimum target of 116.25 in the GLD. But, if you read my analysis carefully, you would know that I am viewing this rally as a corrective rally, until the market is able to prove otherwise.

That means that as long as we hold the resistance I cite in the various products I track, we are setting up a decline into the end of the year. In fact, this decline will likely wipe out any vestiges of bullishness that may still be hanging around in this complex. And, when bullishness completely washes out, then we are ready for a major rally to take us beyond the highs struck in 2016.

In the GLD, I had the 116.25 level as the minimum target for the rally for which I was calling for the day before the rally began. On Thursday, the GLD struck a high of 116.04. So, I apologize for being off by 21 cents – so far. But, as long as we hold over 115, we can stretch as high as 117 next.

However, there are two levels you should now be watching whether you are a bull or a bear. As long as we remain below 118.25, I am looking back down to the 109 level, and even as deep as the 105 level in GLD in the coming months. And, an impulsive (5-wave structure) break down below 115 will signal that we have begun that decline. Alternatively, should the bulls be able to take us strongly through 118.25, then we have a strong signal that the bottom is in place for the GLD, and we should be heading back up towards the 121 region post haste.

I have to warn you that I have a strong leaning towards this only being a corrective rally, setting up a final decline. While I am certainly quite cognizant of where I change my leaning, for now I am looking down more than up. But, rest assured that should the market tell me otherwise, I will be listening quite intently and acting accordingly. And I suggest you maintain enough of an open mind and understanding of the non-linear nature of the market to do the same.

Now, I have to tell you that while I thought I heard it all when it comes to gold analysis, I stand corrected. Friday, I read an article that actually claimed that global warming will be a proximate cause for gold to rally: Global Warming Will Help Push U.S. Deficits (And Gold) Higher.

The main premise in the article suggests that deficit increases through global warming effects will cause gold rallies.

Personally, I have written many times in the past as to why one must stay away from correlations. You see, many make the mistake of assuming correlation is akin to causation, and that is simply a fallacy that can get you into trouble.

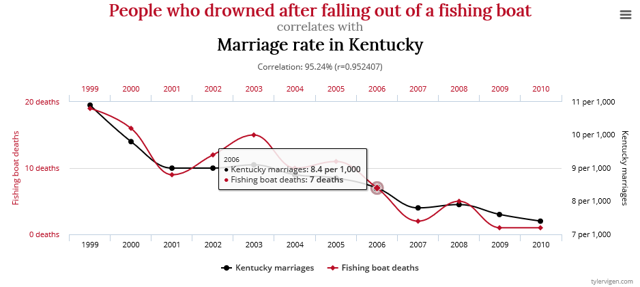

If I were to assume that correlation is akin to causation, then I would conclude that we need to see more drownings in Kentucky in order to cause the marriage rate to rise.

Source: http://www.tylervigen.com/spurious-correlations

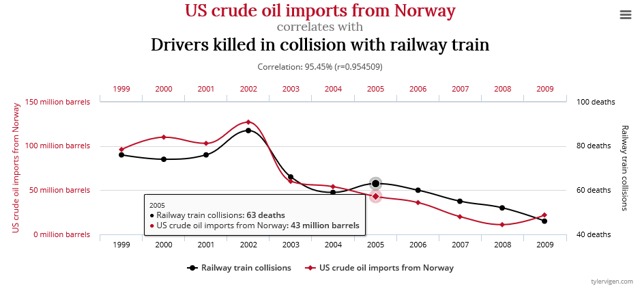

If I were to assume that correlation is akin to causation, then I would conclude that we need to lower the imports of crude oil from Norway even further in order to lower the deaths of drivers killed in collisions with railway trains.

Source: http://www.tylervigen.com/spurious-correlations

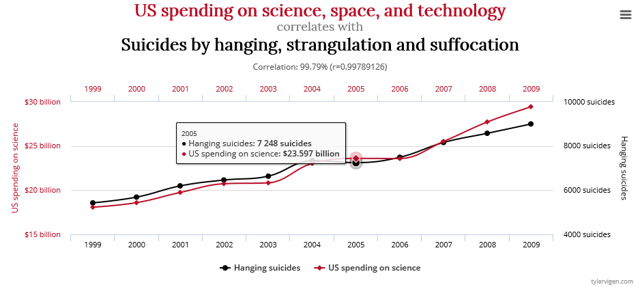

If I were to assume that correlation is akin to causation, then I would have to conclude that we need to lower the US spending on science, space and technology in order to lower the number of suicides from hanging, strangulation and suffocation.

Source: http://www.tylervigen.com/spurious-correlations

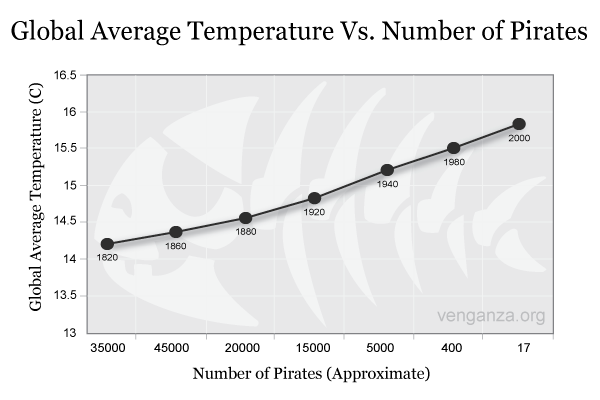

Lastly, for those that believe we are experiencing global warming, you will be quite pleased by a positive result thereof. When you look at the chart below chart, it is abundantly clear that a rise in temperature has reduced the pirate population in the world. So, while many of you may point to various negative implications of global warming, please realize that it has made sailing our seas much safer.

Source: Venganza.org

Are you starting to see my point?

Moreover, pointing out one or two periods of time wherein we experienced a large rate rise in deficit spending coinciding with a rally in gold does not mean that it was the cause of said rally in gold.

In fact, there are many times where we experienced large percentage increases in deficit spending without a resulting rally in gold. Moreover, there are other points in time that evidence a rally in gold despite falling deficit spending. And, one can glean these from the author's charts.

I mean, let’s just look at 2018 where we supposedly had a budget deficit that grew by 32% relative to the prior year’s deficit. And, what happened to gold in 2018?

Or, does the increase in deficit spending have to be related to only global warming effects? Could that be why 2018 saw a down year in gold with a strong rise in deficit spending?

Yet, the author provides no evidence that the rise in deficit spending that supposedly caused gold's rally during the years upon which he relies was related at all to global warming. In fact, there is no evidence at all that supports any relationship between global warming and gold rallies.

So, at the end of the day, I am still quite confident that tracking and investing in metals based upon sentiment is a much more reliable perspective than basing it upon budget deficits.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.