Checking Gold Stocks Valuations

Commodities / Gold and Silver Stocks 2018 Oct 20, 2018 - 05:46 PM GMTBy: Jordan_Roy_Byrne

It’s no secret that gold mining stocks are historically cheap and have been for several years.

It’s no secret that gold mining stocks are historically cheap and have been for several years.

Traditional metrics like price to cash flow and price to book value showed that gold stocks in late 2015 were at arguably their cheapest points since the start of the bull market in the 1960s.

Other metrics showed gold stocks to be the cheapest since the Roosevelt administration.

It has been almost a year since we examined some of these charts and with the sector moving closer to another epic low, we wanted an update.

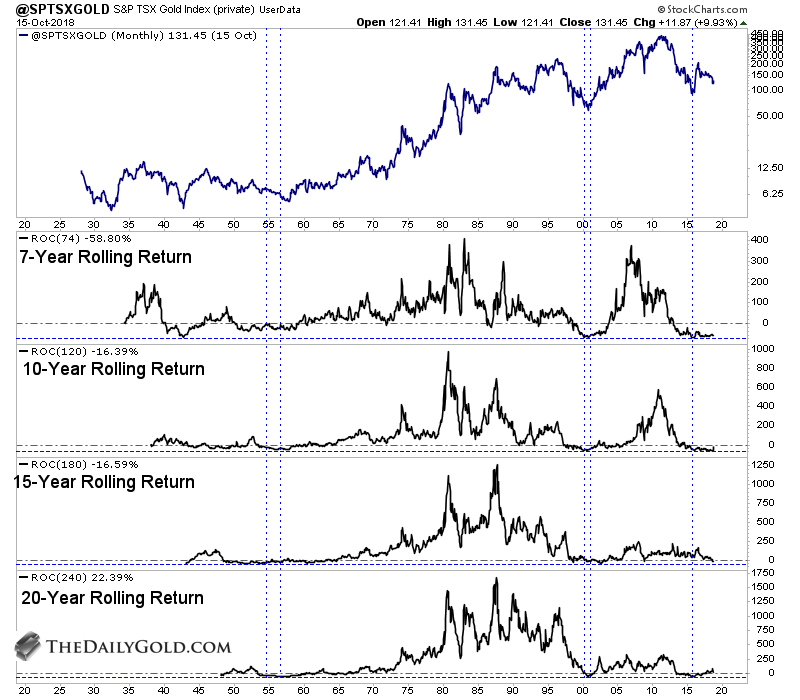

First, let’s look at the performance of gold stocks over various long-term periods. In the chart below we plot the monthly performance of the S&P TSX Gold Index over those periods.

Going back 60 years we find that gold stocks are (in the context of the past few years) at one of their most three depressed points. The other points were around 1960 and 2000.

Next, let’s see how gold stocks stack up against the stock market and Gold. We put both charts in the same image.

Prior to the current rally, the gold stocks relative to the stock market made new lows, which surpassed the 2015-2016 lows! The recent low marks at a minimum a 90-year low!

The gold stocks to Gold ratio is not quite as cheap. But when you look at the chart, you can see that ratio is not far from its own 90-year low.

These charts (and others) show an industry that is extremely and historically cheap. The setup for near term and long-term price appreciation is extremely bullish. Gold stocks are extremely volatile but they are in a position to generate strong returns and dramatically outperform US financial assets.

That begs the question.

Can gold stocks get and cheaper?

If not now then when is the right time to buy?

It’s certainly possible gold stocks could get even cheaper but probably only marginally so. They are already so cheap and so underowned that it’s impossible they become dramatically cheaper.

We are beating this point like a dead horse but the turning point for precious metals will be when the Federal Reserve ends its rate hikes. That is the time you want to be a strong buyer.

It’s still too soon for that but it’s likely coming sometime in 2019. To prepare for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.