Cyclical Commodities Continue to Weaken, Gold Moves in Relation

Commodities / Commodities Trading Nov 12, 2018 - 03:05 PM GMTBy: Gary_Tanashian

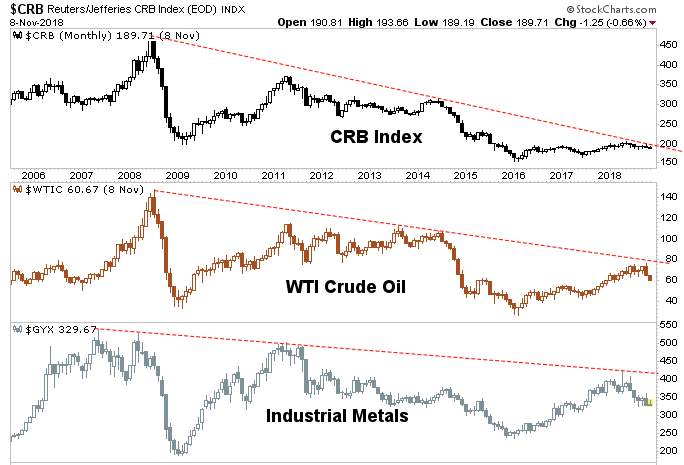

Crude Oil and Industrial Metals continue downward. This is significant per this NFTRH monthly chart showing these items and the broad CRB itself having hit trend lines from the 2008 highs. These pullbacks from long-term trend lines are notable and qualify cyclical commodities as risk indicators for the cyclical macro.

Crude Oil and Industrial Metals continue downward. This is significant per this NFTRH monthly chart showing these items and the broad CRB itself having hit trend lines from the 2008 highs. These pullbacks from long-term trend lines are notable and qualify cyclical commodities as risk indicators for the cyclical macro.

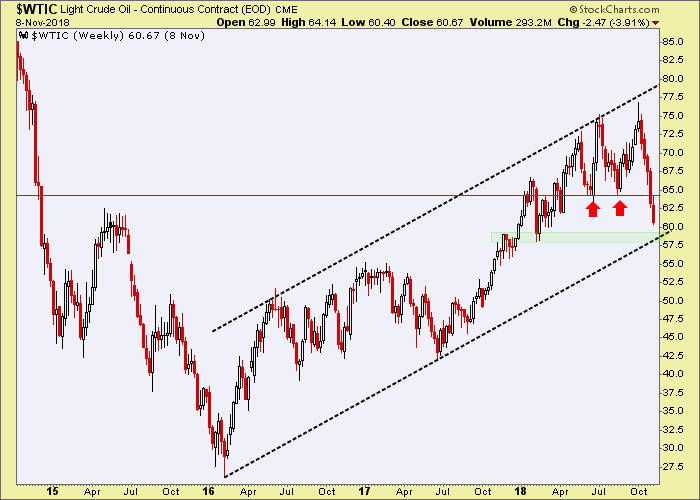

Here is oil’s weekly view. Key support was lost last week as noted in this article: Positive Implications for Gold Miners if Crude Oil Breaks Down. I expect currently oversold WTI to rally from the noted support area, but remain ‘not bullish’ on this cyclical commodity (and remain in scouting mode for the upcoming gold miner buying opportunity).

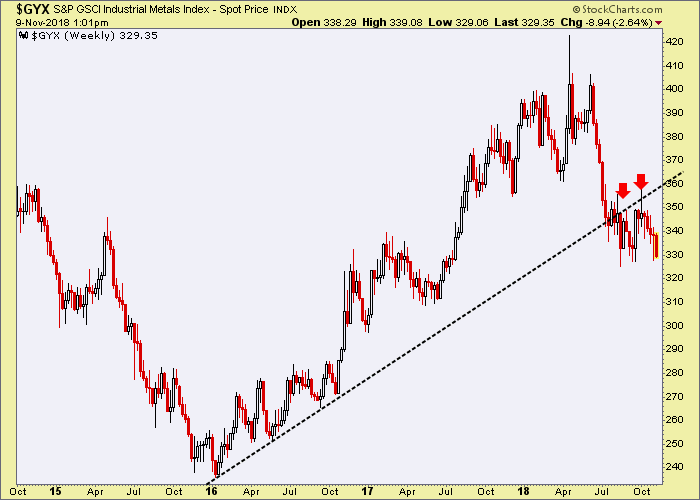

Industrial Metals have made a classic breakdown, retest and a potential failure in progress.

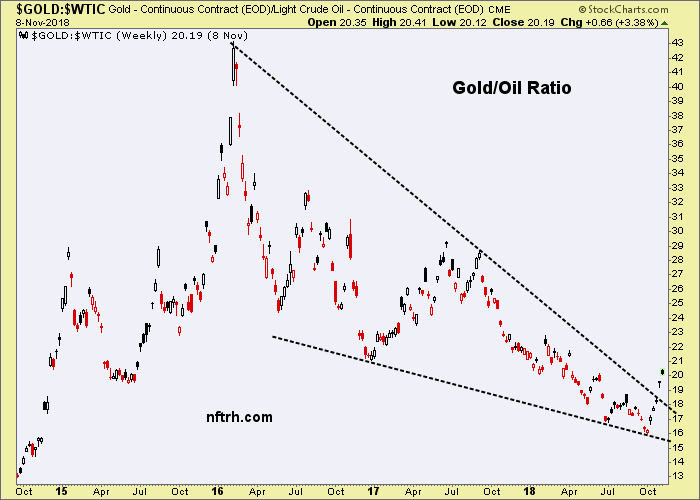

As for the counter-cyclicality implied above, here are the views of the counter-cyclical metal vs. these cyclical items. Gold/Oil has broken a long-term trend line. Sure, it’s early but a real move has to start somewhere. Again, reference the link above for the reasons this is important to the real investment case for gold mining.

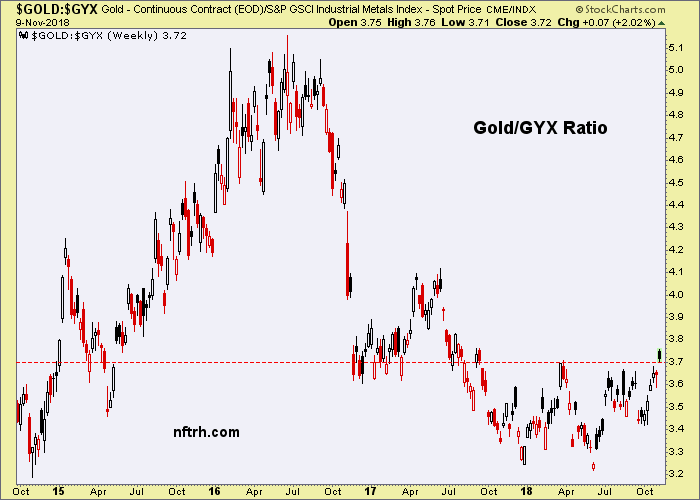

And here we have the counter-cyclical metal breaking out of a bottoming pattern vs. a basket of the most cyclical metals; those used in industrial applications during healthy economic phases. A successful breakout here in Au/GYX would be a warning on future global economic health.

Along with the negative implications for risk ‘on’ markets and the economic cycle, the above will guide on the right buying environment for the counter-cyclical gold mining sector. Again, reference the link above for the details, which are beyond the scope of this post.

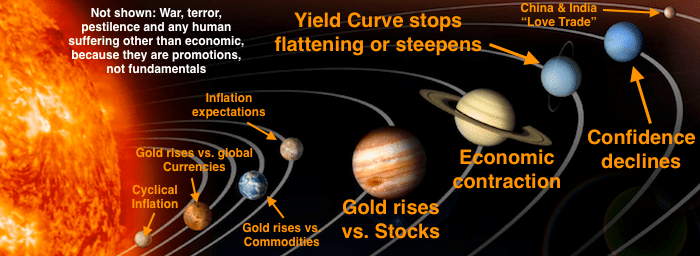

What is not beyond the scope of this post is our planetary view of the aspects of a counter-cyclical environment and hence, the right time to be getting defensive about the cyclical world and offensive about its counter condition.

As also noted in the above-linked article “we are in the heart of tax loss selling season with yet another losing year for gold stocks (as a whole, some quality operations did just fine) wrapping up. So this post is not implying people should run out and scoop ’em up hastily.”

It is time to be paying attention. The next 1-3 months are going to pivotal.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.