Is Gold Silence Golden?

Commodities / Gold and Silver 2018 Nov 15, 2018 - 06:53 AM GMTBy: Arkadiusz_Sieron

People say that speech is silver, silence is golden. Well, not always. The recent FOMC monetary policy statement is the best example. Lets’ read out today’s article and find out why.

People say that speech is silver, silence is golden. Well, not always. The recent FOMC monetary policy statement is the best example. Lets’ read out today’s article and find out why.

Nothing Changes in November

On Thursday, the FOMC published the monetary policy statement from its latest meeting that took place on November 7-8. In line with the expectations, the US central bank kept the federal funds rate unchanged at the target range of 2 to 2.25 percent:

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent.

OK, so the Fed held interest rates steady. But did the US central bank signal any shifts in its course? Not really. The statement was barely modified relatively to September. There were only two material changes. The first one concerned the growth of business investment, which had moderated from its rapid pace earlier this year (in September, the statement said that the growth had grown strongly). Of course, gold should welcome the slowdown in the growth of business investment, but that moderation is too early to panic and buy gold.

The second change was personal: Mary C. Daly is a new San Francisco Fed President (the former was John Williams, but he shifted to run the New York Fed) and she voted for the first time in the FOMC. We do not know whether she likes gold, but gold should like her. Daly is seen as dove more concerned about the labor market than inflation.

Is the November Statement Irrelevant for Gold?

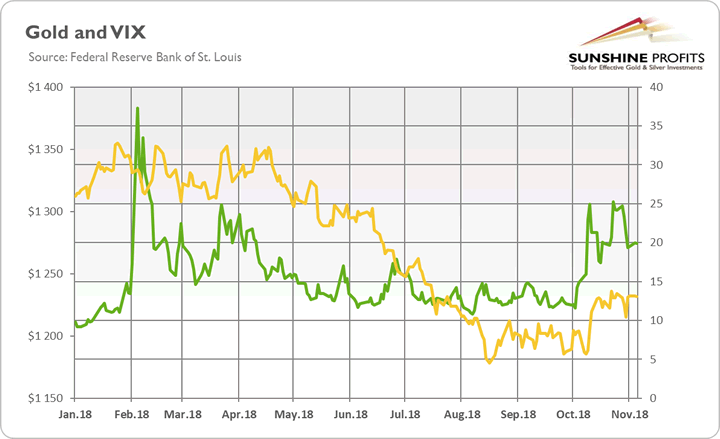

Does it mean, thus, that the statement is irrelevant for the economy and gold? Well, not necessarily. You see, sometimes silence speaks lauder than words. In other words, at times, what the Fed officials did not say might be more important to what they actually said. What we mean by that is the fact that the US central bank made no comment on the recent stock market turmoil (please note that it also appears to be unwavering in the face of criticism from Trump). Not a single word. And it still sees risks to the economic outlook as roughly balanced. Given the rise in the stock market volatility since September FOMC meeting (see the chart below), lack of any mention is hawkish (but this is what we expected: the stock market turmoil will be temporary without long-term repercussions). It turns out that silence is not always golden.

Chart 1: Gold prices (yellow line, left axis) and CBOE VIX index (green line, right axis) in 2018.

The lack of any shift in tone of the policy statement suggests that there might be no ‘Powell put’ (similar to ‘Greenspan put’). The Fed will not try to protect the stock market at all costs. Instead, it will continue its policy of gradual tightening of monetary policy. Indeed, the Fed is penciling in one more hike in 2018 and three rate hikes for 2019.

Implications for Gold

This is a problem for the yellow metal. We mean , of course, the divergent path of interest rates in 2019, as the market has already priced in a 76% probability that the committee will raise the federal funds rate to a range of 2.25% to 2.5% at its meeting in December 2018. But when it comes to the next year, the Fed forecasts three hikes, while the market expects only two hikes. We know that the US central bank has a poor track record when it comes to its forecasts (and impact on the economy as well), but this time it seems to be really determined to lift interest rates. Powell is not Yellen and the Fed under Powell is not the Fed under Yellen. Precious metals investors should not forget about it.The fact that the market lags behind the Fed creates the downside risk for gold. When investors adjust their expectations to reality, the bond yields may increase, while the price of the yellow metal may drop.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.