When Stock Market Computer Herds Hit Exits

Stock-Markets / Stock Markets 2018 Nov 22, 2018 - 12:37 PM GMTBy: Doug_Wakefield

"In a 2010 study of the 2010 Flash Crash, the U.S. Securities and Exchange Commission and the Commodities Futures Trading Commission found that high frequency traders substantially increased volatility during the event and accelerated the crash...The Australian Securities and Investments Commission, the stock regulator in Australia, found in a 2012 study that during volatile markets high frequency traders reduce their liquidity supply and increase their liquidity demands....The Bank of Int'l Settlements looked at foreign exchange markets and concluded in a 2011 study that high frequency traders exacerbate volatility in stressed markets... The UK Gov't Office for Science published a large 2012 study of capital markets around the world and concluded that HFT/AT may cause instabilities in financial markets in specific circumstances.... High Frequency Trading: A Bibliography of Evidence -Based Research, March 2015

"In a 2010 study of the 2010 Flash Crash, the U.S. Securities and Exchange Commission and the Commodities Futures Trading Commission found that high frequency traders substantially increased volatility during the event and accelerated the crash...The Australian Securities and Investments Commission, the stock regulator in Australia, found in a 2012 study that during volatile markets high frequency traders reduce their liquidity supply and increase their liquidity demands....The Bank of Int'l Settlements looked at foreign exchange markets and concluded in a 2011 study that high frequency traders exacerbate volatility in stressed markets... The UK Gov't Office for Science published a large 2012 study of capital markets around the world and concluded that HFT/AT may cause instabilities in financial markets in specific circumstances.... High Frequency Trading: A Bibliography of Evidence -Based Research, March 2015

During the fall of 2005, while working on my research paper Riders on the Storm: Short Selling in Contrary Winds, I read very detailed research presented by Bruce Jacobs on the crash of 1987. Jacobs laid out the case for portfolio insurance being a major contributor to the 22% one day record decline on Monday, October 19th.1

The basic premise of this trading tool was to limit the losses of large money managers by buying stock market futures as the market was rising and selling market futures when it crossed a key threshold. 2

Sounds like a good idea, right? One problem; the fallacy of composition.

The fallacy of composition states it is an error to assume that what is true for a member is true for the whole. In other words, if you and a few friends have a signal to get you out of the market once it drops say 10%, then this should have little to no impact on the entire market. However, if your actions reflect a part of the largest and most informed money in the markets, your impact can now become THE MARKET.

I know, we are much smarter now. Our technology is far more sophisticated thus we assume this could never happen again. Right? Wrong.

If you have never studied or reviewed the lessons from the May 6, 2010 flash crash, I would strongly encourage you to do so now. Embedded in this text is a link to the SEC and CFTC’s report on the May 2010 flash crash.

A few lessons one can learn from merely reading the first few pages, is that today’s speed of light computer programs make decisions far faster than any human. In a mere 14 seconds that afternoon, high speed computer programs sold over 27,000 futures contracts back and forth between each other. This accounted for 49% of the trading volume while completing less than 1% of their buys (app. 200 contracts). 3 What did the public see? A 3% drop in the S&P 500 in 4 minutes before recovering.

Consider these comments from the section, “Lessons Learned”:

“One key lesson is that under stressed market conditions, the automated execution of a large sell order can trigger extreme price movements, especially if the automated execution algorithm does not take prices into account. Moreover, the interaction between automated execution programs and algorithmic trading strategies can quickly erode liquidity and result in disorderly markets.” 4 [change to red text mine]

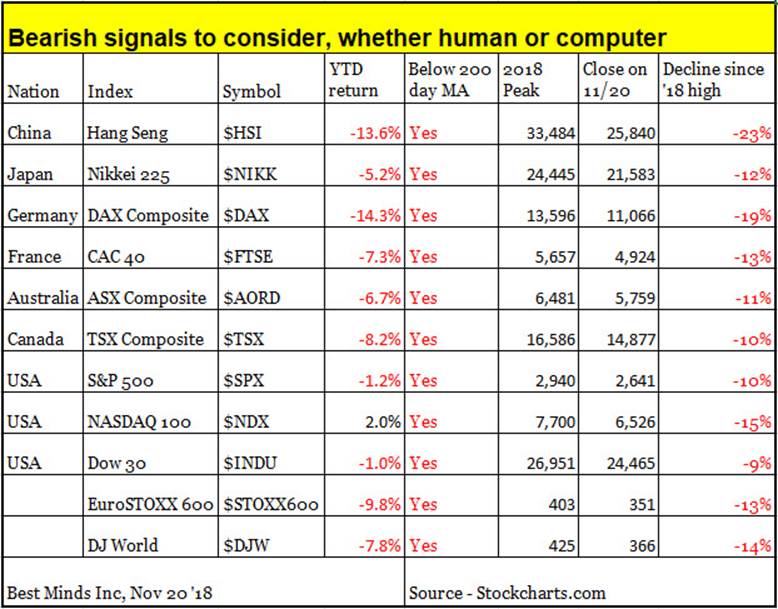

Knowing that the NASDAQ 100, S&P 500, and Dow Industrials produced their longest equity bull markets in American history as of this September, investors should not dismiss the recent big down days as merely another pull back. Maybe we will get a rally into 2019, but what if the all-time highs in Chinese and German stocks in January, and all-time highs by Canada, Australia, and the US between July and October are telling us the bust part of this credit cycle is here? Could trading computers “surprise” us and go from buyers to sellers?

A $30 Billion Computer is About to Start Selling Stocks, ZH, 11/14/18

This recent article asserts that UBS’ $30 billion computer, used for its Wealth Management clients, manages $2.4 trillion. Clearly only a tiny fraction of “investors” has this level of power in global markets.

It’s head of global asset allocation, Andreas Koester, stated that its quantitative – investing platform is close to reducing holdings from 50% to 20%. This is a sizeable amount to move out of equities as a defensive move.

With these massive computer trading platforms as buyers of stocks in the last few years, it was easy to ignore rising interest rates from 3 CENTURY lows (summer 2016), and central bankers REDUCING their balance sheets. However, with more signs of stress from real estate bubbles popping and warnings of a global economic slowdown, if trading computers herd as sellers, ignoring these realities will not be possible.

A Fifth of China’s Homes Are Empty. That’s 50 Million Apartments, Bloomberg, Nov 8 ‘18

BIS Warns Global Economy Risks Crisis ‘Relapse’, The Business Times,

9/24/18

Cycles have been around for centuries. No amount of market intervention and “assistance” will delay the cracking of a debt bubble forever. For this reason, every investor, big or small, should consider this comment:

“This is more like timing the big cycles right,” said Koester, who wouldn’t comment on the strategy’s performance or fees. “It’s not for being in and out every second week.”

When the dot.com bubble burst, the NASDAQ 100 fell 83% over the next 30 months before the bear cycle was complete.

When the banks cratered during the Great Recession, the KBW Bank Index fell 85% over the next 24 months.

To push these markets back to their 2018 all-time highs we also had to watch the largest intervention by central banks on record.

The Risks in Central Bank Balance Sheets are Clear, Bloomberg, 12/17/17

The numbers prove it; the debt bubble we have seen over the last decade is THE largest in market history.

Computers have no emotions. They merely react to buy and sell signals they have been programmed to monitor.

Source:

- Capital Ideas and Market Realities: Option Replication, Investor Behavior, and Stock Market Crashes (1999) Bruce I. Jacobs

- Here’s One Key Factor That Amplified the 1987 Stock – Market Crash, CBS MarketWatch, Oct 19, 2017 (30th anniversary)

- Findings Regarding the Market Events of May 6, 2010: Report of the Staffs of the CFTC (Chicago Futures Trading Commission) and SEC (Securities and Exchange Commission) to the Joint Advisory Committee on Emerging Regulatory Issues, Sept 30, 2010, pg 3

- Ibid, pg 6

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.