UK House Prices 2019 No Deal BrExit 30% Crash Warning!

Housing-Market / UK Housing Nov 30, 2018 - 03:07 AM GMTBy: Nadeem_Walayat

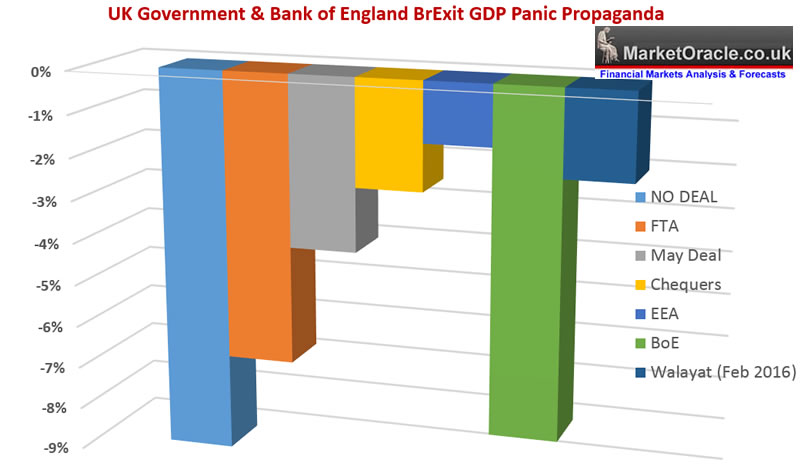

Within hours of the UK Government publishing it's dire economic forecast of a NO DEAL BrExit resulting in a loss of 9% of GDP, albeit as a deviation from trend over 15 years. Britain's central bank, the Bank of England set forth it's own NO DEAL economic armageddon forecasts, warning of an immediate economic collapse on a scale twice that of the 2008 Financial Crisis. A 25% collapse in sterling, a collapse in GDP of 8%, inflation soaring to over 6.5% and a 30% CRASH in UK house prices. Though it should be noted that none of similar fear mongering pre EU referendum materialised as the UK economy continued to grow on a similar trend trajectory to what it was on as before the EU Referendum BrExit result.

Within hours of the UK Government publishing it's dire economic forecast of a NO DEAL BrExit resulting in a loss of 9% of GDP, albeit as a deviation from trend over 15 years. Britain's central bank, the Bank of England set forth it's own NO DEAL economic armageddon forecasts, warning of an immediate economic collapse on a scale twice that of the 2008 Financial Crisis. A 25% collapse in sterling, a collapse in GDP of 8%, inflation soaring to over 6.5% and a 30% CRASH in UK house prices. Though it should be noted that none of similar fear mongering pre EU referendum materialised as the UK economy continued to grow on a similar trend trajectory to what it was on as before the EU Referendum BrExit result.

Here's a summary of the Bank of England's No Deal CRASH warnings.

Here's a summary of the Bank of England's No Deal CRASH warnings.

- Economic crash, GDP 8% drop

- UK house prices 30% crash

- Sterling 25% crash

- Commercial property 50% crash

- Unemployment soars to 7.5%

- Inflation soars to 6.5%

- Bank of England raises interest rates to 5.5%

Whilst here's a summary of the of UK Government and Bank of England's forecasts of what they expect to happen to the UK post Brexit coupled with my own forecast as of Feb 2016.

And here's a reminder of Operation Fear at work BEFORE the EU Referendum which we had Mark Carney warning of a recession if the people of Britain voted for FREEDOM on 23rd June 2016. A recession that NEVER materialised!

13 May 2016 - Mark Carney Warns of 'Technical Recession' if British People Vote for BREXIT Freedom

Mr Carney stated the June 23 vote as "the elephant in the room that would mean a materially lower path for growth and a notably higher path for inflation. The pound could fall sharply following a vote to leave, pushing up inflation as imports became more expensive. Although a weaker pound would boost exports, this would not offset the damage inflicted by Brexit, as higher inflation hits incomes and living standards.

A vote to leave the EU could have material effects on the exchange rate, demand and supply potential. The consequences could possibly include a technical recession."

Whilst the Bank of England MPC warned : The most significant risks to the MPC’s forecast concern the referendum. A vote to leave the EU could materially alter the outlook for output and inflation, and therefore the appropriate setting of monetary policy. Households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise. At the same time, supply growth is likely to be lower over the forecast period, reflecting slower capital accumulation and the need to reallocate resources. Sterling is also likely to depreciate further, perhaps sharply. This combination of influences on demand, supply and the exchange rate could lead to a materially lower path for growth and a notably higher path for inflation than in the central projections set out in the May Inflation Report. In such circumstances, the MPC would face a trade-off between stabilising inflation on the one hand and output and employment on the other. The implications for the direction of monetary policy will depend on the relative magnitudes of the demand, supply and exchange rate effects. Whatever the outcome of the referendum and its consequences, the MPC will take whatever action is needed to ensure that inflation expectations remain well anchored and inflation returns to the target over the appropriate horizon.

The bottom line is that FREEDOM does carry a price, which I estimated BEFORE the EU referendum would cost about 2% of GDP:

03 Feb 2016 - David Chamberlain Cameron, Britain's Last Chance for Freedom From Emerging European Super State

The Price for Freedom

The truth is that a BREXIT WILL BE ECONOMICALLY PAINFUL despite all of the benefits of being outside of the E.U. The cost of BrExit will be anywhere from 2% to as high as 5% of GDP if the euro-zone is determined to make an example of Britain to act as a warning to others by raising punitive tariffs on trade. However remember that attaining FREEDOM ALWAYS carry's a PRICE, in which respect even the worst case scenario for a 5% loss of GDP in the grand scheme of things does not compare against the infinitely greater price the people of Britain paid for their freedom in both past World Wars and so it is now THIS generations turn to pay a price for the freedom of future generations.

What the people of Britain need to fully understand is that this really is their VERY LAST CHANCE for Freedom!

And confirmed in 2 extensive pieces of analysis following Britain's vote for BrExit, with my expectations that freedom would cost Britain 2% of GDP which has remained my forecast expectation since.

04 Jul 2016 - BrExit Implications for UK Economy, Interest Rates, Bonds, Markets, Debt & Deficit, Inflation...

04 Jul 2016 - BrExit Implications for UK Stock Market, Sterling GBP, House Prices and UK Politics...

1. UK Economy - 2% GDP Price for Freedom

The UK economy WILL take a hit as I have often warned to expect a loss of GDP of between 2% and 4% over the next 2 to 3 years depending on Europe's stance taken during the BrExit negotiations, where the early voices from the likes of Juncker are very threatening demanding that the UK immediately starts the process for leaving the EU by means of triggering Article 50. However, I think things will calm down and Europe will become more amicable than today's rhetoric because europe is structurally and symmetrically very weak that Brexit has just weakened further. So in terms of GDP the hit will probably turn out to be closer to 2% then 4% as more sensible heads start to prevail.

The bottom line is that the political and banking establishment elite remain determined to subvert BrExit through the heavy use of state economic propaganda of ever escalating warnings of financial armageddon that WILL NEVER materialise aimed towards either forcing Theresa May's disastrous deal or a Second Referendum onto the people of Britain.

So Yes there is a cost to FREEDOM, which in my long standing opinion is a price well worth paying and thus a NO DEAL Brexit IS in BEST interests of Britain regardless of what Operation Fear attempts to perpetuate.

UK House Prices

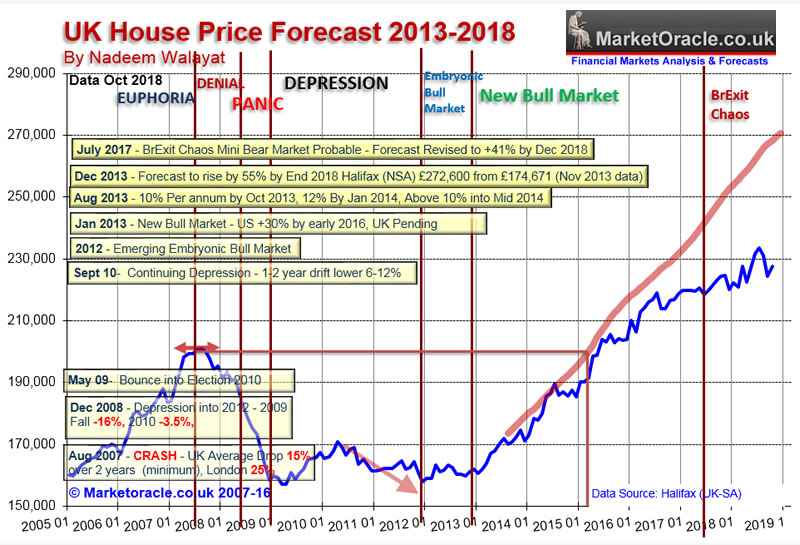

My 5 year house prices trend forecast published December 2013 is now nearing it's conclusion, ending on release of December 2018 data during early January 2019. Therefore this analysis seeks to update the current state of Britain's housing market and its direction of travel into 2019 as well as starting the ball rolling on a series of analysis on key aspects of Britain's housing market towards to conclude in my next multi-year UK house prices trend forecast that I aim to complete before the end of December 2018. With many lessons learned from my existing forecast the most notable of which is that making a 5 YEAR forecast is pushing the envelope far beyond that which can deliver an accurate outcome in the later years of a trend forecast.

30 Dec 2013 - UK House Prices Forecast 2014 to 2018, The Debt Fuelled Election Boom

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

A reminder that my original analysis and concluding trend forecast were made long before the likes of the EU Referendum were even a twinkle in David Cameron's eye, let alone the shock to the establishment when the people of Britain voted for BrExit despite the mass of money thrown at the REMAIN campaign, with the 'real' spend probably outnumbering the LEAVE by 5 to 1. Thus the establishment thought the referendum outcome was a done deal which is why all of the political pundits, bookies, financial markets and pollsters ALL got the outcome very badly wrong as my following video from the time illustrates the level of shock on BrExit night that delivered Theresa May as Britain's next Prime Minister as Brexiteer contenders backstabbed one other out of contention for the race for No 10.

And then finally after 9 months of Theresa May wasting time decorating No 10 we had Article 50 triggered on 29th March 2017, the countdown to Britain gaining independence from the European Super state, in the form of a NO DEAL Brexit which has always been my consistent view of being the most probable outcome regardless of persistently spews out of mouths of journalists, politicians, and other establishment vested interests.

- The Brexit War! EU Fearing Collapse Set to Stoke Scottish Independence Proxy War

- The BrExit War, Game Theory Strategy for What UK Should Do to Win

Then came the consequences of Theresa May's disastrous decision to call a general election for the 8th of June that delivered Chaos and uncertainty' instead of 'strong and stable' which not only further shocked Britain's political and media establishment but also hit the UK economy hard, effectively suffering a heart attack with confidence fast evaporating as the economy slowed down which to this day makes a mockery of the Bank of England MPC clowns persisting in their talk of raising UK interest rates. And along with evaporating economic confidence has been the evaporation in confidence in Britians housing market that risks bringing a 5 year housing bull market to a premature end! And this is even before we see the chaos that will ensue once Theresa May finally quits as Prime Minister following her failure to manage Brexit, which will likely trigger trigger another chaos inducing general election!

Theresa May, the wrong person for the wrong job at the wrong time has even surprised me by just how badly she has steered Britain through the choppy Brexit Waters. For I had given her the benefit of the doubt up until the Catastrophic June 8th 2017 General Election, which despite reassuring utterances that continue to this day, in reality left her and the country crippled in the face of a Mafia style undemocratic European Union that has remained hell bent on the annihilation of the United Kingdom not just economically but structurally.

My view that The Tory Brexit Chaos would wreck the UK economy and cripple the UK housing market is not with the benefit of hindsight but has been my view virtually immediately following the disastrous June 8th 2017 general election outcome. As I warned near 18 months ago that Britain's house prices bull market faced impending doom, even a mini bear market that threw into doubt the remaining trend trajectory for my 5 year trend forecast that originally forecast a 55% rise in house prices over 5 years as my following article and accompanying video from July 2017 illustrate.

21 Jul 2017 - UK House Prices Momentum Crash Threatens Mini Bear Market 2017

UK house price momentum has been steadily falling since Mid 2016 after having chugging along nicely at 10% per annum for a good 3 years, now falling to the current low of just +0.7% after a brief rally into December 2016 towards 7%. This is a clear red warning flag that Britain's 4 1/2 year housing bull market is in serious trouble and may even be ending!

As for my current thoughts on the prospects for UK house prices for 2017. We'll I would not be surprised if UK house prices ended the year down by between -1% to -2%, a mini bear market that could be a harbinger of far worse to come during 2018.

UK House Prices Forecast Current State

The most recent UK average house prices data for October 2018 (£227,702) is currently showing a 15% deviation against my original forecast trend trajectory which implies to expect a 14% reduction in terms of the long-term trend forecast for a +55% rise in average UK house prices by the end of 2018 i.e. a +41% rise. This is inline with my revised forecast expectations as of July 2017 (UK House Prices Momentum Crash Threatens Mini Bear Market 2017).

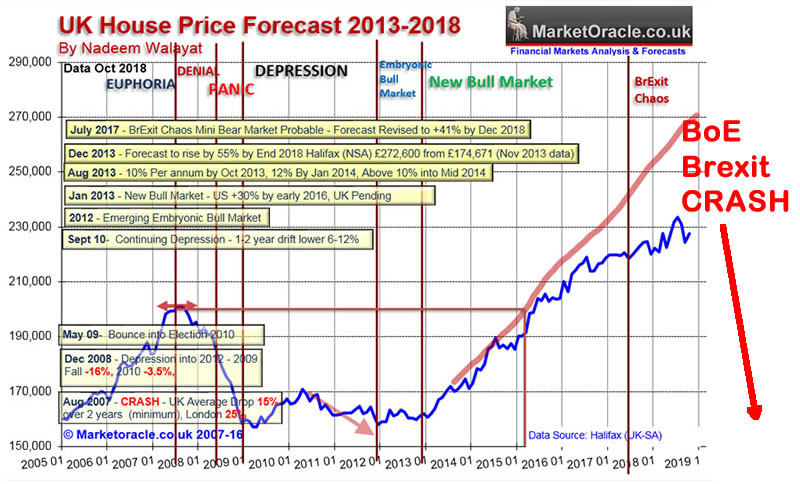

Bank of England 30% UK House Prices CRASH

The Bank of England is basically forecasting that a NO DEAL BrExit 30% CRASH would erase virtually the WHOLE of the bull market since the 2012 low, and would look like something like this:

UK House Prices Momentum Forecast 2019

So is a NO DEAL 30% crash in UK house prices even possible let alone probable as the Bank of England forecasts?

UK house prices momentum analysis has first been made available to patrons who support my work.

For immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.