Rising US Home Prices and Falling Sales

Housing-Market / US Housing Dec 08, 2018 - 07:39 PM GMTBy: Harry_Dent

Did you watch my video two Fridays ago? If not, check it out here. I explained how gold bugs are giving you dangerous advice about gold as an investment.

Did you watch my video two Fridays ago? If not, check it out here. I explained how gold bugs are giving you dangerous advice about gold as an investment.

But gold isn’t the only investment that people mistakenly make because they’re told the wrong thing.

Real estate is another one.

In fact, I’d go as far as to say that buying real estate because its value “always goes up” is possibly even more dangerous than buying gold as a hedge during a deflationary season like the one we’re in now. That’s because housing becomes illiquid in the blink of an eye!

But, as usual, people get suckered into the real estate myth because they’re desperate to get something for nothing. They just don’t realize they’re about to be handed the bill…

In the last real estate bubble, we saw both rising demand and rising supply driven by ultra-strong demographics, falling interest rates, and ultra-liberal (a.k.a. idiotic) lending practices.

As I talked to you about recently, home sales and homebuilder stock prices peaked 26 months before stock prices did.

This time around we have a different scenario…

The Millennial demographics aren’t as strong as the Baby Boom and the environment doesn’t look as attractive for housing and appreciation prospects.

Plus, lending standards are tighter and mortgage rates have been rising since September 2017.

But there is something else going on…

Homebuilders have been much more conservative in building new homes. I’m not surprised after they got their asses whacked in the 2006 to 2012 bubble burst.

But to add insult to injury, older Baby Boomers are holding onto their homes for longer, which is exactly what I’d expect older people to do.

Both these things are limiting supply.

That’s caused prices to rise while mortgages are costing more.

This, in turn, has caused sales to fall…

There’s just not enough inventory of affordable homes.

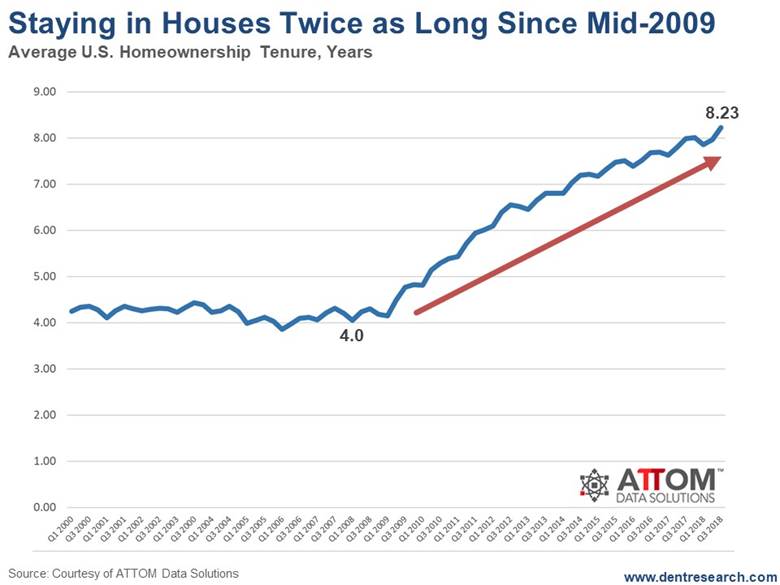

Look at this chart. It shows something very interesting…

The average tenure for homeowners before selling, from 2000 through mid-2009, was about 4.2 years (rangebound between 3.9 and 4.4).

Since then, that tenure has shot straight up into 2018. It’s now about twice as long, at 8.23 years…

Why?

The biggest part of this surge occurred between mid-2009 and mid-2012 when home prices were still scraping bottom, so it wasn’t the rising prices and appreciation that tempted buyers.

At first it was a better economy and existing households felt better about keeping their house. But by 2012 forward, it was simply the Baby Boomers aging and doing the predictable thing – not moving.

It’s no secret that younger households move much more than older ones. They’re seeking career opportunities and better neighborhoods for their kids. Us geriatrics don’t need to bother and the hassle of moving gives us the shits.

In 2009, the peak Boomers were 48 years old.

Between the ages of 46 (high school graduation) and 51 (peak college tuition), our kids are leaving the nest. After that, we either keep our home forever, or we downsize into a smaller home… which we then keep forever…

And here’s the thing…

This trend of Boomers staying in their homes is NOT going to slow down, except for some forced selling due to defaults in the next downturn ahead.

On the other hand, the last Boomer trend, of dying and becoming sellers, is just starting to accelerate. That changes everything.

My point is this: While this latest real estate bubble formed for different reasons than the last one, it’ll have the same outcome. The Baby Boomers will make sure of that.

This present bubble is peaking because of limited supply in a still-overstimulated economy.

Once that ends, by early 2020 at the latest, supply will explode… and prices will get buried along with later stage aging Baby Boomers who sell because they die!

In other words, this under-supply is going to rather quickly switch to oversupply. How many people are going to see that coming?

If you know of any young families who want to own a home, offer them this suggestion: wait to buy one much cheaper about three to five years from now.

And for us older folds, seriously consider selling and downsizing NOW while the sun is still shining on prices!

Do yourself a favor: Do the opposite of what everyone is doing at your age. Don’t listen to your neighbors at cocktail parties.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.