Why Are You Getting Stock Market Whipsawed

Stock-Markets / Stock Markets 2018 Dec 11, 2018 - 08:13 AM GMTBy: Avi_Gilburt

This past week was quite interesting, as well as volatile. On Monday, we had a huge gap up right into the initial resistance region we had on our charts in the 2810-15SPX region. In fact, the futures struck a high of 2813ES, and then turned down.

This past week was quite interesting, as well as volatile. On Monday, we had a huge gap up right into the initial resistance region we had on our charts in the 2810-15SPX region. In fact, the futures struck a high of 2813ES, and then turned down.

Well, when the trading day opened on Monday, analysts and market participants were quite certain that the “cause” of the rally was due to the dinner discussions the US President had with the Chinese President. And, based upon that dinner (and nothing more than that), everyone assumed that the market gapped up “bigly.”

Yet, within two trading days, not only was that gap undone, but the market proceeded to drop down to the point before the Fed Chairman’s speech which supposedly sent the market higher too. And, it did not stop there, as it even dropped back below the lows struck before Thanksgiving.

And, what was the reason given for this dramatic decline? As MarketWatch put it, it was due to “doubts surrounding the U.S. and China’s ability to achieve a concrete deal.”

Now, wait a second. Let me ask you two obvious questions. First, was there any difference in the news that occurred between Sunday and the rest of the week? The answer is “no.” So, is there really any substantive reason for the dramatic rally on Monday, or, even more so, the dramatic fall on into Thursday? The answer to that is “no” as well.

The second question I want to ask is if the gap up on Monday was due to the expectations regarding the US and Chinese talks, should that not have been the only thing that was retraced if investors really questioned the “cause” of the rally? Yet, we even retraced the rally that was supposedly “caused” by the Powell speech. Did the market also question the Powell speech too and that is why it was all retraced? Yet, I see no discussion of that fact despite that rally also being wiped out. The silence is quite deafening.

I was castigated recently for my continual pounding the table week after week about the true causes for market moves, which are not as clearly evident as so many believe.

Yet, week after week, the market provides us with example after example regarding the intellectual dishonesty on display which is inherent in attempting to relate market moves to the news of the moment. But, as we see week after week, the internal consistency one would expect from such analysis is constantly turned on its head, as we eventually see that there was no true causal relationship that can withstand the moment. It never holds up to true scrutiny.

I want to remind you of something Ralph Nelson Elliott said almost 80 years ago, and it still rings oh so true to this day:

“The causes of these cyclical changes seem clearly to have their origin in the immutable natural law that governs all things, including the various moods of human behavior. Causes, therefore, tend to become relatively unimportant in the long term progress of the cycle. This fundamental law cannot be subverted or set aside by statutes or restrictions. Current news and political developments are of only incidental importance, soon forgotten; their presumed influence on market trends is not as weighty as is commonly believed.” (emphasis added).

R.N. Elliott – Natures Law, 1940

But, to answer the question in the title of the article, the reason you are getting whipsawed is because this is simply the nature of the 4th wave through which we are navigating.

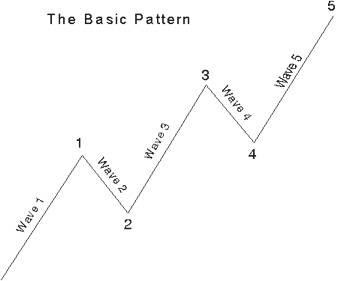

You see, the 4th wave is the most variable wave within the 5-wave Elliott Wave structure. So, the true nature of these 4th waves are whipsaw. This is even more applicable within the b-wave of the 4th wave a-b-c structures.

As I have also said many times in the past, one of the most powerful aspects of Elliott Wave analysis is that it provides context for the market trend like no other analysis methodology can. And, once we broke down below the 2880SPX support in early October, it provided us initial indications that the door opened to drop down to the 2600 region for the initial kick off of this 4th wave. It also provided us with initial indications that the nature of the market environment was changing.

So, if you understood the greater context for the market, then you would understand that whipsaw was to be expected. In fact, I had warned the members of ElliottWaveTrader.net to expect this type of market action. For this reason, I also suggested to them when we broke 2880SPX that it was time to reduce your long side positions, and I certainly did so myself.

Moreover, I also suggested that if they choose to trade this environment, they must use smaller position sizes as no one will be able to escape the inevitable whipsaw we see in this environment. And, the last suggestion I have continually made was that the goal for an investor during a 4th wave should be capital preservation. Once this 4th wave completes in 2019/20, you want to be able to re-deploy your cash as we approach the 2100/2200 region target I have outlined many times before.

But, fret not. I think you will see one more rally take hold in the coming months, which will give you one more opportunity to sell into before the major decline to 2100/2200 takes hold (potentially by the end of 2019 or early 2020). And, as long as any further weakness is able to hold over the 2400/2450 region of support, I will maintain this perspective.

So, if you are still questioning why you are getting whipsawed, it is likely because you do not understand the greater context of where we reside within the long-term stock market trend. I hope this has provided some illumination.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.