Gold’s Not An Investment – You Won’t Get Rich

Commodities / Gold and Silver 2018 Dec 17, 2018 - 05:03 PM GMTBy: Kelsey_Williams

Perception of gold as an investment is fundamentally flawed. No matter the detail behind the analysis, gold is not an investment.

Perception of gold as an investment is fundamentally flawed. No matter the detail behind the analysis, gold is not an investment.

investment…a thing that is worth buying because it may be profitable or useful in the future.

Lets suppose you are at the grocery store and you see that butter is on sale for $2.00 per pound. Normally you pay $3.00 per pound or more.

Since you use butter in your cooking and eating, and buy butter regularly, you place the butter in your cart and express thanks for such good fortune. But why not take advantage of the sale? You buy an additional one month supply and place it in your cart.

Have you made an ‘investment’ in butter?

According to the definition above, the answer is yes. This is true even if the butter were not on sale; and even if you had only purchased your usual amount.

Your consumption of butter makes it “worth buying because it may be…”useful in the future”.

In this particular instance, since the butter was on sale, and since you purchased additional amounts for later use, there is also an implied profit motive.

Which is more important – the profit potential or the future use of the butter?

Definitely, the use of the butter in the future is more important. If you did not use or consume butter at all, would you buy it just because it is on sale? Likely not.

The reason you buy it is because your use and consumption of the butter – now, or in the future – represents value to you.

So why do people invest in stocks? Because companies, in general, provide goods and services of a productive nature that add value to our economy – today, and in the future. Over longer periods of time, it becomes value added. Which means that there is profit potential, even without price discrepancies, or bargain sales.

The explanations above, and their fundamentals, are independent of the measure of value used to quote their price.

For example, whether we measure the price of butter, or Amazon stock, in dollars or other currencies, beads, grains, or gold, does not affect the value of the butter or stock. The value comes from the use and consumption, or the added convenience, efficiency, comfort, satisfaction, and complimentary benefits to our standard of living.

The price of anything is an implied measure of its value; but to whom? If the finest men’s suit that money can buy is of no interest to me because I don’t wear suits, then it has no value to me at any price.

This is true of most useable and consumable retail items. Hence, the technical application of the definition of ‘investment’ in our first example re: butter, is probably not how most people view their purchase of groceries or clothes.

But it is definitely germane to our example of stocks. And real estate, too.

You might purchase a piece of property now, with the intention of building a house on it in a couple of years. The property has value to you because of how you intend to use it later on. And, depending on other fundamentals, there is also profit potential.

So what about gold? In gold’s case, there is no shortage of people who believe that gold is an investment. Can we apply the definition of investment to gold? Might it ”be profitable or useful in the future”?

If gold is an investment, what is its value? Can we consume it, like butter? Obviously not. What about its use in the manufacture of jewelry? Is that an indication of gold’s value? Partially, yes; but on a secondary basis.

Gold’s primary value is in its use as money. As such, it is not an investment. It is ‘real’ money because it satisfies the three specific properties necessary for something to be money: a measure of value, a medium of exchange, a store of value.

In order for anything to be money, it must be all three of the above. Throughout five thousand years or recorded history, gold stands alone in that regard. The U.S. dollar and other paper currencies are not money because they are not ‘stores of value’. They are substitutes for money.

So, if it does have value, might we ‘invest’ in gold because it “may be profitable or useful in the future”? Possibly. Quite a few people do. But why?

Gold is not consumable. We don’t eat it, or otherwise use it up. And there is no value added, as in the case of companies which produce goods and services which, over time, add benefits and enjoyment to our standard of living.

So, why invest in it?

Most people invest in something because they expect the price to go up. Hence, they will make a profit (an investment is something that is “worth buying because it may be profitable in the future”). Well and good. But what makes something potentially profitable in the future? We understand the fundamentals that affect various investments in stocks and real estate. At least there is reason to believe that those fundamentals can eventually lead to expected profits.

If gold is truly an investment, then it should respond similarly, IF the fundamentals are correctly identified and are in effect at the time. Otherwise, there is no profit potential.

So what are those fundamentals? Here are the things that a majority of people consider fundamentals, or driving factors, that affect or influence the price of gold: interest rates, stock market, economic conditions, social unrest, political turmoil, currency exchange rates, war.

But none of these things are fundamental factors relative to the price of gold. Repeat – none.

There is only one thing that is correlated, or in any way applicable to gold’s price action. That one thing is the value of the U.S. dollar.

Gold is priced in U.S. dollars and trades in gold are settled in U.S. dollars because of the hegemony of the dollar and its role as the world’s reserve currency.

Gold is original money. It was money before paper currencies. The U.S. dollar and all paper currencies are substitutes for original money, i.e., gold. And all governments inflate and destroy their own currencies.

Over the past century, the U.S. dollar has lost more than ninety-eight percent of its value (purchasing power). And, over that same century, the price of gold has increased sixty-fold, or fifty-nine hundred percent.

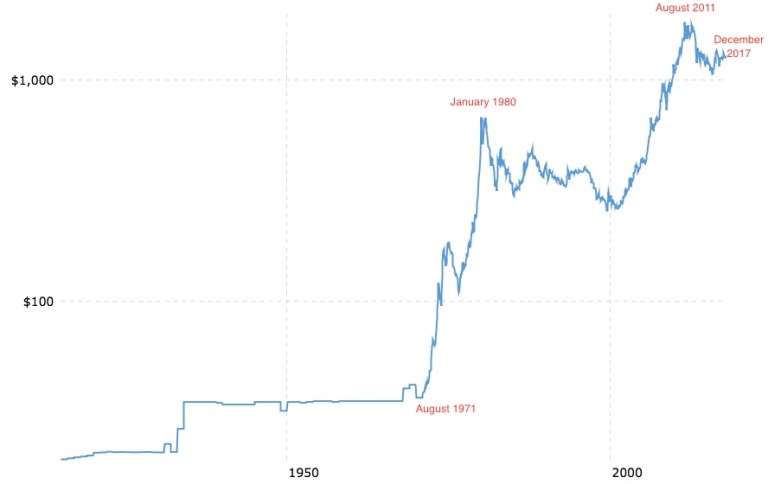

In other words, higher gold prices are a direct reflection of a weakening U.S. dollar. This can be seen on the chart below…

The huge increase in gold’s price does not represent an increase in its value. Gold’s value does not change; it is constant. The value of one ounce of gold today in terms of its purchasing power is pretty much the same as it was one hundred years ago. In fact, it is the same as it was a thousand years ago, or more.

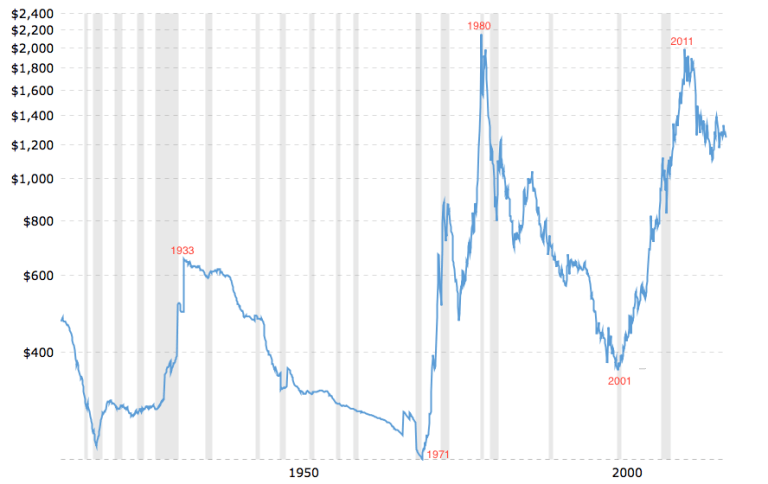

This can be better seen on a different chart. This one pictures the same price history, but on an inflation-adjusted basis…

There are five major turning points for gold’s price that are reflected on the charts. All five turning points (1933, 1971, 1980, 2001, 2011) coincided with changes in direction of the relative value of the U.S. dollar.

Since gold is priced in U.S. dollars and since the U.S. dollar is in a state of perpetual decline, the U.S. dollar price of gold will continue to rise over time. There are ongoing subjective, changing valuations of the U.S. dollar from time-to-time and these changing valuations show up in the constantly fluctuating value of gold in U.S. dollars. But in the end, what really matters is what you can buy with your dollars, which – over time – is less and less. (See A Loaf Of Bread, A Gallon Of Gas, An Ounce Of Gold)

If gold is priced in anything other than dollars, its role and value stay the same. The only thing that changes is its measure of value, i.e., Chinese yuan, for example. This has nothing to do with gold’s only fundamental – it is real money. That does not change and is not modified in any way.

When gold is characterized as an investment, people buy it (invest in it) with expectations that it will “do something”. But they are likely to be disappointed. How often do we hear that gold’s value is affected by interest rates; or worse, that it moves inversely to the direction of interest rates?

All during the 1970s, while gold was increasing from $40.00 per ounce to a high of $850.00 per ounce, interest rates were rocketing higher. The yield on 10-year U.S. Treasury bonds exceeded 15 percent. There was a serious lack of demand for higher yielding investments. Makes you wonder when you hear statements like this: “Higher rates boost the value of the dollar by making U.S. assets more attractive to investors seeking yield.”

Then, during 2000-11, while gold increased from $250.00 per ounce to a high of $1900.00 per ounce, interest rates continued their long-term decline to historically low levels, even approaching zero percent, and, in some cases negative numbers.

Two ten-year periods of outsized gains in the price of gold. And interest rates were doing something exactly opposite during each period. There simply is no correlation between gold and interest rates.

Here is another example of a faulty assumption that led to disappointment.

“In late 1990, there was a good deal of speculation regarding the potential effects on gold of the impending Gulf War. There were some spurts upward in price and the anxiety increased as the target date for ‘action’ grew near. Almost simultaneously with the onset of bombing by U.S. forces, gold backed off sharply, giving up its formerly accumulated price gains and actually moving lower.

Most observers describe this turnabout as somewhat of a surprise. They attribute it to the quick and decisive action and results achieved. That is a convenient explanation but not necessarily an accurate one.

What mattered most for gold was the war’s impact on the value of the US dollar. Even a prolonged involvement would not necessarily have undermined the relative strength of the U.S. dollar.”

Gold’s price is not determined by interest rates, world events, political turmoil, or industrial demand. The only thing that you need to know in order to understand and appreciate gold for what it is, is to know and understand what is happening to the U.S. dollar.

Yes, but if the dollar suddenly goes in the tank, and gold shoots up to $10,000 per ounce, won’t that be profitable for holders of gold? No.

For gold’s price to go to $10,000.00 from here, and rapidly, there would need to be a corresponding drop in the value of the U.S. dollar. A drop that significant, and that quickly, would be readily apparent in the prices you pay for all goods and services.

You would need the ‘profits’ to pay for the incredibly more expensive items you normally buy, like butter. If butter is $25.00 per pound and gold is at $10,000.00 per ounce, you have not gained anything. You will be fortunate if you keep pace with the effects of inflation. You will not get rich.

This may sound discouraging to those who are holding on for the final blastoff, but it is consistent with gold’s price action as shown in the charts above.

Looking again at the first chart, we can see that the price of gold increased from $850.00 per ounce at its 1980 high point to $1900.00 per ounce at its 2011 high point. This translates to a gain of $1050.00 ($1900.00 – $850.00) per ounce, or one hundred twenty-three percent.

Unfortunately, on an inflation-adjusted basis (second chart), you would have a negative, net return of ten percent. In real terms, the price of gold did not even match its 1980 high. And this result is after waiting for thirty-one years.

Gold’s failure to make a new, inflation-adjusted high in 2011 is perfectly reasonable. Since gold is not an investment, we should not be expecting it to act like one. It does not, it cannot, and it will not.

There is an assumption that gold’s changing price indicates that its value is changing. Not so. It is the U.S. dollar’s relative value that is changing.

When gold was in everyday, practical use as money, it was the measure of value that was used to price the goods and services that people valued. Hence, people paid for flour, bacon, beans, dress material, and haircuts with fractional amounts of gold; or fractional units of currency that was convertible into gold.

Today we are trying to price real money (gold) with money substitutes (paper currencies) which have no value. That seems nonsensical.

Any problems arising from this are compounded by the fact that we price anything of value today in terms of money substitutes which have no value. That is not just nonsensical. It is financial suicide.

(also see: Gold And The Need To Explain Price Action)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.