Can Gold Swim in a Crosscurrent?

Commodities / Gold and Silver 2018 Dec 28, 2018 - 02:50 PM GMTBy: Arkadiusz_Sieron

Powell noticed some crosscurrents in the path of the US economy. Will it stay on the surface? And is gold a good swimmer?

Powell noticed some crosscurrents in the path of the US economy. Will it stay on the surface? And is gold a good swimmer?

Crosscurrents Cause Fewer Hikes

We hope that you enjoyed Christmas. As we promised last week, we will analyze the post-meeting Powell’s press conference today. The Fed Chair remained optimistic about the US economy, which “has continued to perform well.” However, “some crosscurrents have emerged.” Powell meant the moderation of global growth, increased financial market volatility, and tightened financial conditions. As a consequence, the Fed now sees only two instead of three hikes in 2019:

Many FOMC participants had expected that economic conditions would likely call for about three more rate increases in 2019. We have brought that down a bit and now think it is more likely that the economy will grow in a way that will call for two interest rate increases over the course of next year.

Well, it seems that either Powell feared Trump’s anger or he followed Greenspan, Bernanke and Yellen, and introduced its own put, after all. Trump and Wall Street 1:0 Powell and Co.

Have You Shifted Tone, Mr. Powell?

When it comes to the Q&S session, the journalists touched on interesting issues. A few of them were about still subdued inflation despite strong economic growth and low unemployment rate. The funny thing is that the Fed undershot its inflation target for the seventh year straight. Unfortunately, Powell dodged the question, but he sent another dovish signal, saying that “So, I do think that gives the Committee the ability to be patient in moving forward.” Excellent, gold adores patience, it’s eternal asset.

Another fascinating set of questions was about the neutral interest rate. One journalist pointed out that in October, Powell said that interest rates were a long way from neutral. While a month later, he argued that interest rates were just below neutral. Again, Powell did not actually explained the reasons for that change. Moreover, he modified his stance again, saying that “we’re at the lower end of the range of neutral”. Another month, another change!

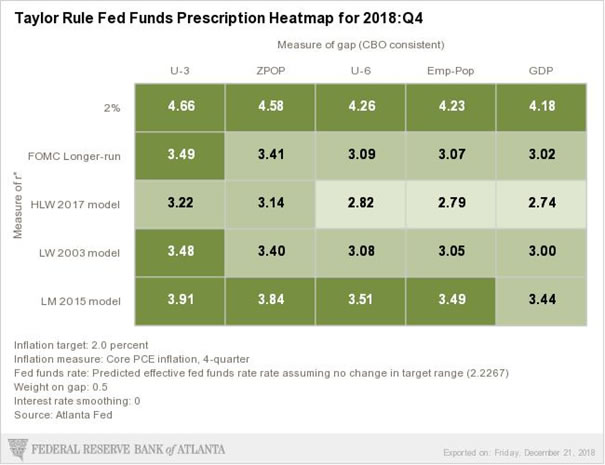

However, it’s a strange statement. We, of course, do not know what models Powell uses. But please take a look at the heatmap of the Taylor rule prescriptions for the federal funds rate below. It was prepared by the Atlanta Fed.

As one can see, no measure of the neutral interest rate (each row reflects different method of estimating r*) places the Fed at the lower end of the range of neutral. So, according to the Fed’s own estimations, and contrary to Powell’s remarks, the US monetary policy is still accommodative. It’s good news for the gold market.

Implications for Gold

Overall, Powell’s press conference was rather dovish. Although he tried to assure that the recent development “have not fundamentally altered the outlook”, the FOMC slashed its projected number of hikes from 3 to 2 next year. Moreover, although it contradicts the Atlanta Fed’s models, Powell claimed that the federal funds rate had actually achieved the range of neutral rate. If the interest rates are within that range – while inflation is subdued, and economic growth is slowing down, so there is no need to be restrictive – it means that the Fed is behind the peak of its tightening cycle.

From the fundamental point of view, it is a positive change for the gold market. Less aggressive Fed means weaker support for the US dollar. If we add the possibility that the ECB will finally raise its interest rates in the second half of 2019, it turns out that gold may perform better next year.

Anyway, 2019 will be very interesting. For example, please remember that there will be press conference for each FOMC meeting. In the January edition of the Market Overview, we will elaborate on 2019 outlook for the gold market. Stay tuned – and Happy New Year!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.