Sri Lanka’s Short Term Outlook Is Hazy: Limited Pockets of Value Present

Economics / Asian Economies Jan 03, 2019 - 04:01 PM GMTBy: Dylan_Waller

Sri Lanka 2019-2020 Outlook: Neutral Outlook for the Equity Market/Looking Elsewhere

Sri Lanka 2019-2020 Outlook: Neutral Outlook for the Equity Market/Looking Elsewhere

The recent political crisis in Sri Lanka, coupled with its less favorable external position, has resulted in the depreciation of its currency and sell off in the stock market this year. Moody’s downgraded Sri Lanka’s sovereign credit to B2, while other countries funding Sri Lanka previously announced concerns due to the rising political risks. These issues all came at a time when Sri Lanka’s economy was beginning to rebound somewhat from the lows of 2017, though growth has still not been able to break 4% in recent quarters. Poor Q3 performance further exacerbates economic concern for the market, which should now not see a meaningful rebound until 2020. Sri Lanka’s external debt still remains a looming issue, and foreign exchange reserves have also been depleted somewhat in recent months compared to historical norms. FX reserves currently only cover around 3.8 months of imports and 54% of the country’s short term external debt. Notably, the increased political clarity seen in recent weeks will result in a gradual release of funding that was put on hold due to the political uncertainty, and paints a brighter economic picture. This would include funding from Japan, Millenium Challenge Corporation, and the IMF.

The economic downturn coupled with the recent rise in political risks has resulted in increasingly compelling stock market valuation, as well as a great spread between bond yields in Sri Lanka and other frontier markets. Jeffries notes that 40% of the index trades below book value, and that 35% of the index trades between 5-10x PE, which displays that there is some value to be found in the stock market. MSCI Sri Lanka IMI currently trades at around 7.5x PE. However, the macro picture is not very bright, political concerns were only recently improved, and the government still has sizeable macro concerns to address. The only merit ahead really is selective value investing ( banking) or in the country’s bond market, which has a notably higher yield compared to other frontier markets, and the yield will likely remain above 10% in the coming years.

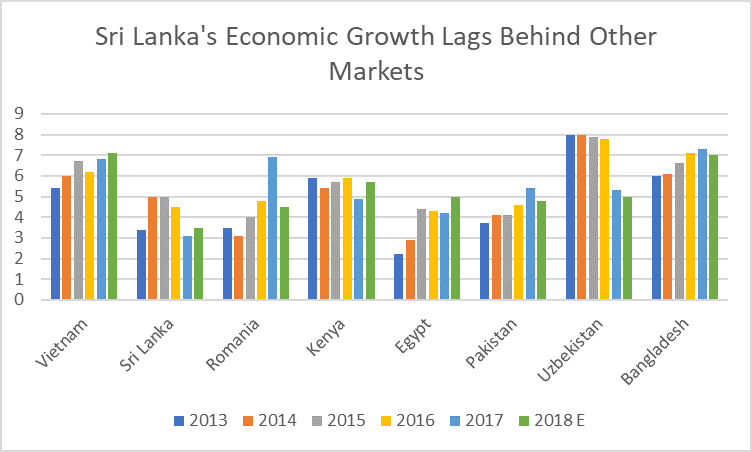

Key challenges ahead for the government now are more economic in nature, and include dealing with issues such as the upcoming budget, credit down rating, economic slowdown, and fiscal consolidation. While Sri Lanka will see some economic recovery ahead through 2019-2020, the improvement is not that significant, and other frontier markets in South Asia are more attractive ( particularly Bangladesh). It is clear to see that Sri Lanka’s export performance during 2018 has not been very favorable and that other frontier markets such as Bangladesh and Vietnam have better external positions and are better positioned to benefit from the trade war. Despite the slight political improvements seen in recent months, Sri Lanka’s stock market does not offer strong opportunity at the moment, despite compelling valuation found in certain sectors, and other markets should be consider in light of the heightened risk in frontier and emerging markets. I retain preference for other markets with favorable/improving macro outlooks, including Vietnam, Egypt and Uzbekistan.

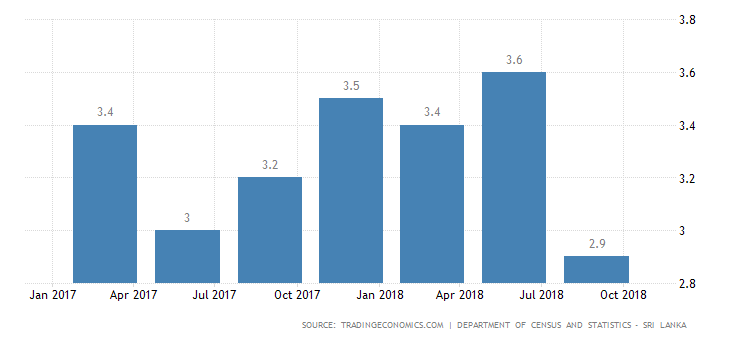

Macro Conditions Remain Neutral Agriculture improves but all other areas of the economy experienced lacklustre growth: Even though agriculture conditions have continued to improve from the slowdown in 2017, the economy has been burdened by the slowdown of the industries and services sector, which both account for over 80% of GDP. Sri Lanka’s economy only grew by 2.9% during Q3 this year, as nearly all sectors experienced a slowdown in growth. Public investment during H1 2018 fell by 7.5% YoY, which negatively impacted construction growth. Growth is also likely to be further stalled by recent rate hikes and fiscal consolidation efforts, and will fall below 4% during 2018. Export growth has stalled, and the political risks that escalated in recent months also posed a threat to its GSP concessions ( EU threatened to remove after having reinstated them in 2017). Sri Lanka has also been vulnerable to poor performance in the US export market, and has not really been a beneficiary of the trade war like other markets such as Bangladesh and Vietnam. However, the country’s export revenue still rose by 5.6% YoY during 9M 2018, which was primarily driven by the growth of industrial exports. Sri Lanka is targeting $5 billion in apparel exports compared to its previous target of 5.5 bn on the back of a slowdown in orders from the US. Sri Lanka’s growth momentum will not likely pick up until 2019-2020 though growth will still remain well below 5%. Therefore, Sri Lanka is not very attractive with the frontier market space in terms of economic characteristics, and still has a higher level of political risk.

Q3 Growth Fell Below 3%

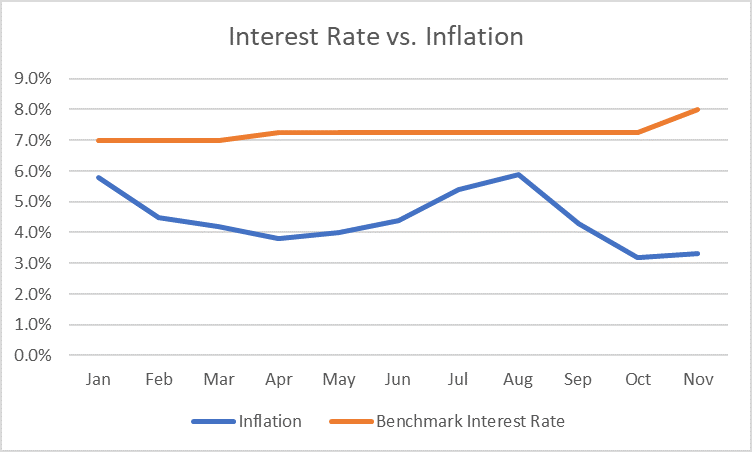

On a positive note, inflation in Sri Lanka has continued to improve substantially and is well in line with the IMF’s target. Sri Lanka’s inflation rate during November 2018 was only 3.3% well below the 2018 peak of 5.8-5.9%. Notable, food and nonalcoholic beverage prices declined by 1% YoY during November, which largely supported the decline in inflation. Unfortunately, the poor performance of the rupee has been a burden for the economy, and the Central Bank rose the benchmark interest rate by 75 bps to 8% despite the notable improvement seen in inflation. Moreover, economic growth has also stalled even despite the absence of rate hikes experienced in previous years. Inflation will likely remain between 4-6% in the next 2 years, in line with the central bank’s targets.

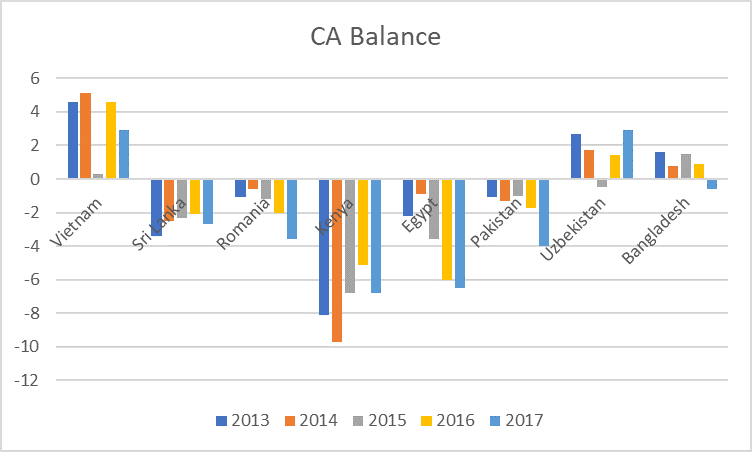

Political risks are lingering at a time of heightened macro risks and general EM turmoil: Though the current government has seen improvement in recent weeks, political risks are still very high at the moment, and the government currently faces a large number of macro risks to address on the back of an economic slowdown and rising global risks. Sri Lanka’s current account may also face pressure from the recent declined remittances, lacklustre exports growth, and the slowdown in tourism in recent months due to poor political sentiment.

Economic Indicators are Less Favorable

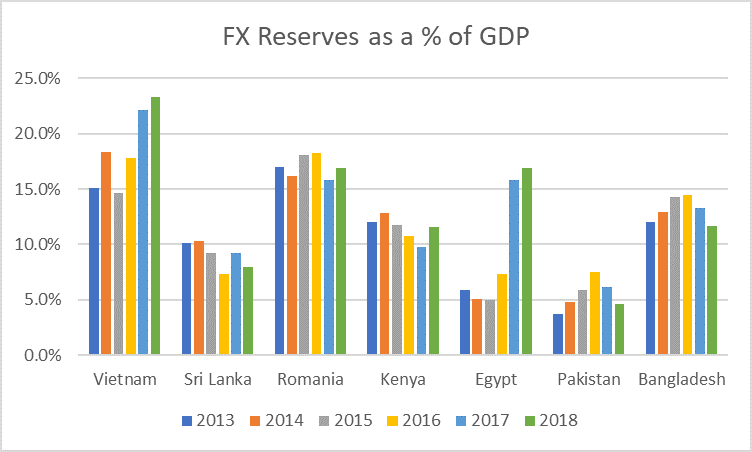

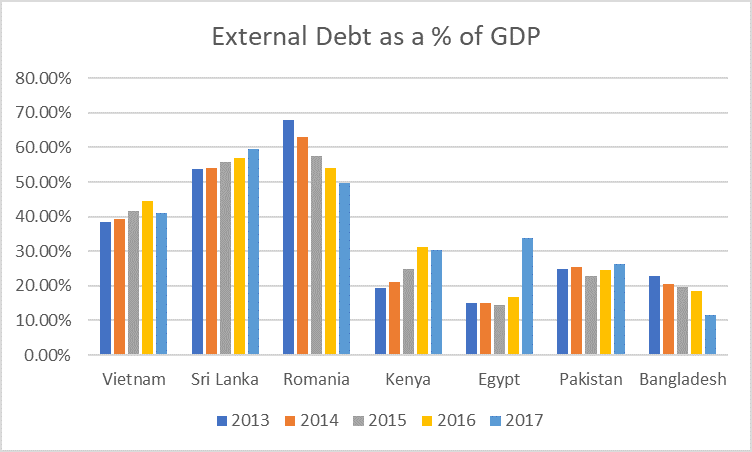

I included a comparison of macro indicators for markets that I cover below, which displays that Sri Lanka’s macro picture is neutral compared to other markets ( weakest in areas such as external debt, FX reserves, growth).

Sri Lanka’s economic growth has lagged behind other frontier and emerging markets and will not be able to break 5% before 2020.

Sri Lanka’s current account deficit will remain between 2-3% of GDP in the coming years. Short term concerns include a decrease in tourism and lacklustre export growth.

Note: Chart shows CA as a % of GDP.

FX reserves have declined in recent months. FX reserves as a % of GDP are low compared to some of its peers.

Sri Lanka’s high level of external debt remains a key risk.

Contact Information/Bio

I cover frontier and emerging markets with a focus on Vietnam, Sri Lanka and Egypt.

Email: dylanawaller@gmail.com

By Dylan Waller

Copyright 2019 © Dylan Waller - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.