Warning: This Stock Market Rig is Going to End Terribly

Stock-Markets / Stock Markets 2019 Jan 09, 2019 - 04:55 PM GMTBy: Graham_Summers

This is getting old.

This is getting old.

The PPT is now juicing Oil higher, because doing so relieves stress in the junk bond market (a large percentage of junk bond issuers are shale companies that require higher Oil prices to be profitable).

This, in turn, is sending a “all clear” signal to stocks, inducing algos to buy indiscriminately.

Put simply, the formula for this market rig is:

Buy Oil futures, because it will drive Junk Bonds higher, and stocks will follow.

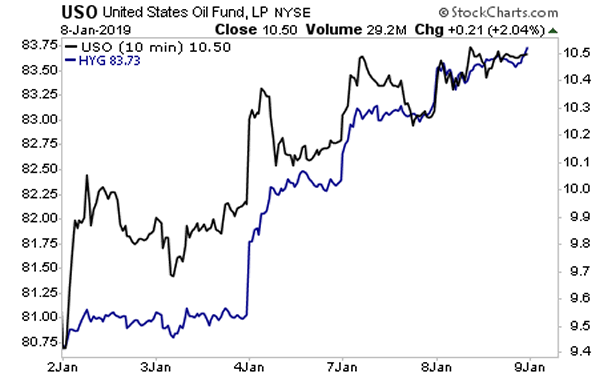

You can see the rig right here in plain sight… Oil (black line) pulling Junk Bonds higher (blue line) almost tick for tick.

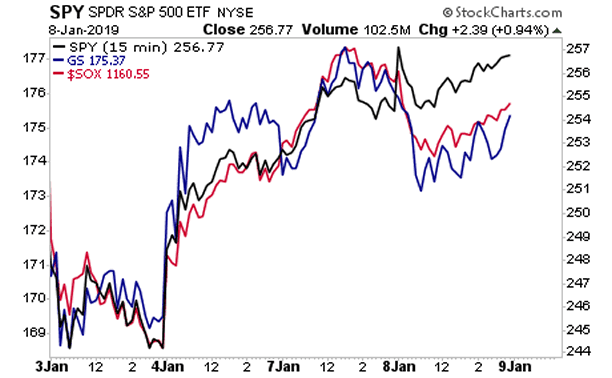

Critical market internals suggest this rig is now coming to an end. Two major market leaders (Goldman Sachs and the Semiconductor index) have not only been lagging on this latest bounce, but both were DOWN yesterday despite stocks rising 1%.

Sure, stocks might bounce a little higher, but at the end of the day, it is clear that corporate profits have peaked, the economy is rolling over, and the Fed is tightening.

Which of these is likely to be better six months from now? What exactly makes stocks an attractive investment right now?

In chart form… what has changed about this?

A Crash is coming… and 99% of investors will panic when it hits… but not those who have downloaded our 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.