The Global Economy Has Run Off a Cliff… and the Stock Markets Know It

Stock-Markets / Stock Markets 2019 Feb 07, 2019 - 10:45 AM GMTBy: Graham_Summers

Stocks continue to live in la la land.

While the media and investment herd celebrate a V-shaped stock recovery based on the Fed admitting things are far worse than previously known, more and more signals are appearing that the global economy has run off a cliff.

Germany and France are bordering on recession. Italy is definitively already in recession. Japan is on the verge of another contraction. And China is facing a systemic collapse (real GDP growth is 2%, not the ridiculous 6% they claim).

Meanwhile, in the US, profit margins have peaked, and corporations are facing massive headwinds as the credit cycle turns. General Motors and Nvidia are the two latest economic bellwethers to lower guidance for 2019. They join Caterpillar, Amazon, Apple, Samsung, LG, Fed Ex, Johnson & Johnson, Nautilus, Tesla, Tailored Brands, Signet Jewelers, Delta, Skyworks, Macy’s, Kohl’s, and American Airlines.

Put simply, every single sector in the economy has lowered forward guidance. This means they believe that 2019 will be far worse that was previously expected… just like the Fed.

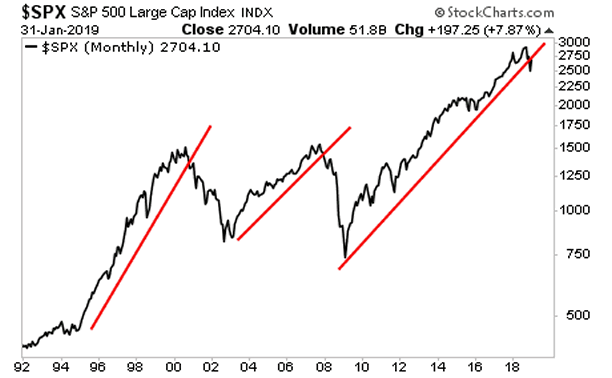

Meanwhile investors are piling into stocks as if we’re going to new highs. The whole mess is very reminiscent of 2000 and 2007: both were periods in which investors completely ignored the fact the economy had come off the rails and piled into extremely an overbought/ overvalued stock market.

We all remember how that ended. By the way, the stock market has just broken its monthly trendline just as it did during those years as well.

A Crash is coming…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.