Gold Weakens After FOMC Minutes

Commodities / Gold & Silver 2019 Feb 21, 2019 - 06:52 PM GMTBy: Arkadiusz_Sieron

The recent minutes show that the Fed is divided over future rate hikes. How should gold investors react?

The recent minutes show that the Fed is divided over future rate hikes. How should gold investors react?

To Hike, or not to Hike, That Is The Question

As Chairman Powell has been good at communicating the US central bank’s plans, the recent FOMC minutes do not contain too many surprises. In January, the Fed took investors by surprise, saying that it could be patient on interest rates. The minutes elaborated on this, explaining that a patient approach offers many benefits – additional data would shed some light on the recent softness in inflation, would enable the Fed official to observe effects of past rate hikes and would allow time for a clearer picture of trade and fiscal policy, and the state of the global economy – and only few risks, as inflationary pressure is muted, while asset valuations less stretched:

Participants pointed to a variety of considerations that supported a patient approach to monetary policy at this juncture as an appropriate step in managing various risks and uncertainties in the outlook. With regard to the domestic economic picture, additional data would help policymakers gauge (…) whether the recent softness in core and total inflation and inflation compensation would persist, and the effect of the tightening of financial conditions on aggregate demand. (…) Participants noted that maintaining the current target range for the federal funds rate for a time posed few risks at this point.

However, the minutes show that the Fed is divided on how long it should be patient. One camp of several participants still opts for a federal funds rate hike later this year, if the economy evolves in line with expectations, while the several other officials argued that interest rate increases might be needed only if inflation was higher than expected:

Many participants suggested that it was not yet clear what adjustments to the target range for the federal funds rate may be appropriate later this year; several of these participants argued that rate increases might prove necessary only if inflation outcomes were higher than in their baseline outlook. Several other participants indicated that, if the economy evolved as they expected, they would view it as appropriate to raise the target range for the federal funds rate later this year.

Fed Wants to End Quantitative Tightening

Although divided on future interest rate hikes, the Fed is united when it comes to the end of quantitative tightening. The FOMC members want to stop reducing the balance sheet later this year (and to reinvest principal payments received from holdings of agency MBS into Treasury securities after the end of asset redemptions):

Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve's asset holdings later this year. (…) A substantial majority expected that when asset redemptions ended, the level of reserves would likely be somewhat larger than necessary for efficient and effective implementation of monetary policy.

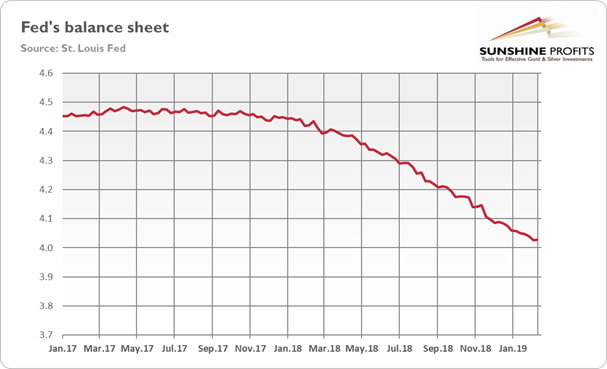

Some analysts were surprised by that announcement and considered the plan to leave the Fed’s balance sheet permanently bigger than it ever was in the past as a dovish action. However, it was clear for us a long time ago that the US central bank was not going to reduce its balance sheet to the pre-crisis level. First of all, the Fed’s operating regime changed since the Great Recession. Second, the US economy expanded since then, and therefore the amount of the Federal Reserve notes in circulation as well. Let’s look at the chart below. The Fed’s assets have already declined from $4.5 trillion to almost $4 trillion at the end of January.

Chart 1: Fed’s total assets from January 2017 to January 2019 (in trillions $)

As we showed in May 2017 edition of the Market Overview, the market expectations were that the level of the Fed’s assets would shrink to $3.5-4.0 trillion at the end of 2019. And this is precisely what is likely to happen. No surprises here.

Implications for Gold

The yellow metal weakened following the FOMC minutes, as one can see in the chart below.

Chart 2: Gold prices from February 19 to February 21, 2019.

If the FOMC minutes did not contain any surprises, why did the price of gold fall? Well, it might be just the case that gold traders took the opportunity to take some profits. However, we believe that the minutes were slightly more hawkish than the markets anticipated. You see, the markets concluded that the Fed ended its tightening cycle and do not expect any changes in the federal funds rate target this year. But the fact that the US central bank will pause for a few meetings, does not necessarily means that the Fed finished tightening of its monetary policy. After all, several FOMC members still believe that the further interest rate hike is the best course of action if the economy evolves as expected. Actually, the end of the balance-sheet runoff later this year will give the Fed more flexibility in terms of raising rates. Gold investors should recognize that if they do not want to be negatively surprised by the US central bank.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.