How Market Valuation Affects Future Stock Returns

Stock-Markets / Stock Market Valuations Mar 27, 2019 - 07:44 PM GMTBy: John_Mauldin

The price/earnings ratio (P/E) has a multiplier effect on stock returns. Over 10–20 years, it can dramatically increase or decrease your total return.

The price/earnings ratio (P/E) has a multiplier effect on stock returns. Over 10–20 years, it can dramatically increase or decrease your total return.

In the secular bear market of the 1960s and ‘70s, shrinking P/E ate away almost all the return from earnings growth and dividend yield.

In the 1980s and ‘90s, rising P/E more than doubled the return for investors.

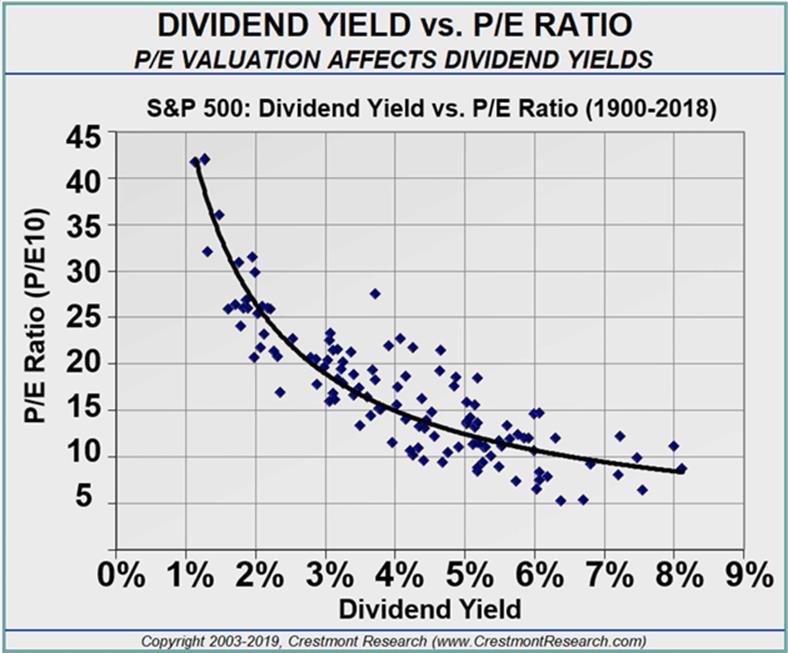

But P/E’s effect goes beyond earnings and capital gains. It has a big effect on dividend yield, too.

The chart below shows a high correlation between P/E ratio and dividend yield. Historically, High P/E leads to low dividend yields and low P/E leads to high dividend yields.

For example, the same dividend yield is twice as big under P/E at 10 than it is under a 20 P/E.

Bottom line: a low P/E raises the odds of both higher returns and higher dividend yields.

So, where is today’s market on the valuation spectrum?

Fairly Valued or Overvalued?

Actual reported earnings show that today’s P/E stands near 20 and up to 30 in a few instances.

The long-term historical average is around 15. P/E has declined below 10 only during periods of high inflation or significant deflation. And when inflation is low and stable, it rises toward the mid-20s.

That means P/E is now above average. The question is: is it fairly valued?

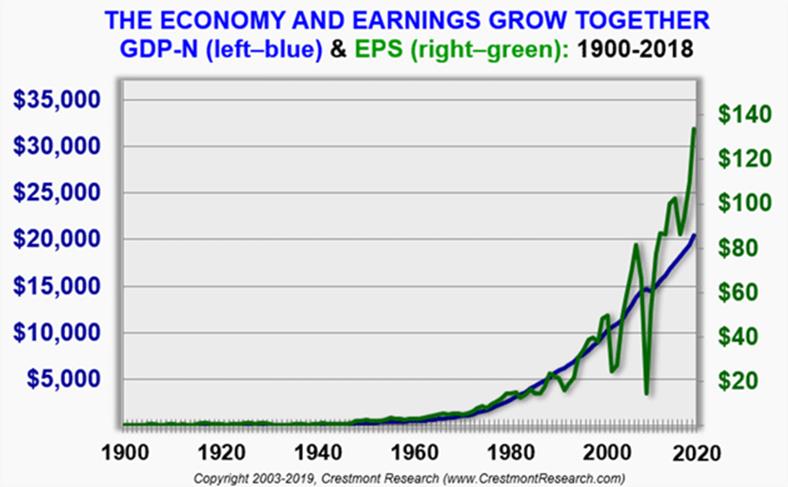

The next chart shows a long history of economic growth (measured with nominal gross domestic product) and earnings growth (measured with earnings per share for S&P 500 companies).

We see the effects of business cycle fluctuations in EPS around a steadier economic growth in GDP:

Some investors believe the elevated corporate earnings are unlikely to revert. They cite tax changes, trends in service industries, technology, and other causes.

Yet all those factors have affected the economy for more than a century. None have prevented business cycle-driven reversion.

Plus, if we were earlier in the cycle, P/E would be near 20 and the market would be fairly valued. That’s not the case today.

Using various methods to normalize the business cycle shows us that P/E now is near 30. As such, the market is at high risk of correction.

What to Do About It

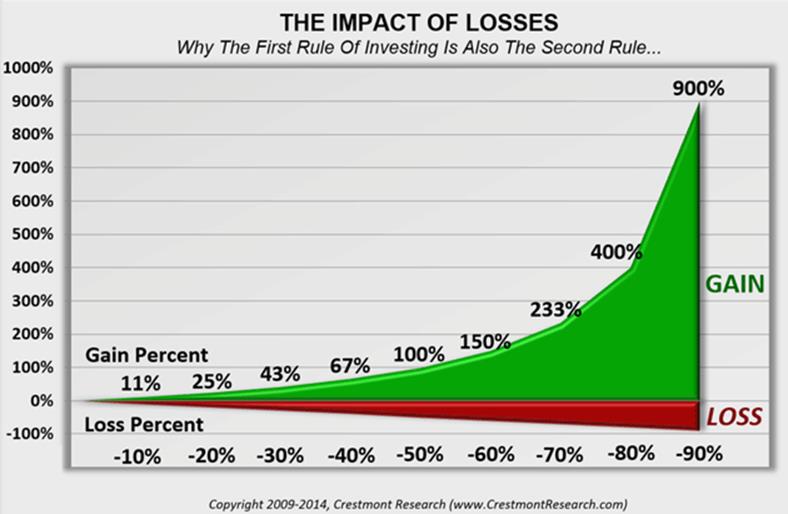

Warren Buffett’s first rule of investing is: “Never lose money.” His second rule is to never forget the first rule!

It’s true because losses have a disproportionate effect on future returns compared to gains.

The next chart shows how a small loss needs a larger gain to break even. Getting back where you started requires progressively higher gains as losses grow:

The relationship works in both directions. A 40% loss can wipe out a 67% gain. Likewise, a 40% loss requires a 67% gain to recover.

This disproportionate effect occurs because the loss occurs on the higher value.

There are many ways to manage portfolio risk and control losses, including:

- direct hedges (e.g., options),

- active management (e.g., dollar cost averaging, rebalancing, value investing),

- portfolio structure (e.g., diversification).

You can achieve diversification portfolio-wise in a number of ways.

First, hold securities not correlated with each other so the portfolio’s engines work independently.

Second, include holdings that are historically counter-correlated. These holdings are expected to zag when other holdings zig.

The goal is not to find direct offsets, but rather to expect that each component will deliver more upside than downside.

And don’t let this discourage you altogether.

The outlook of low returns is not destiny. It is only a statement of current market conditions. Recognizing it helps you better manage investment portfolios.

There are many options for your portfolio other than investing in highly valued stocks. Ask your investment advisor about such options.

Join hundreds of thousands of other readers of Thoughts from the Frontline

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.