Credit Stress Interbank Money Market Freeze Evident In TAF, Ted Spread, Everywhere

Interest-Rates / Credit Crisis 2008 Sep 25, 2008 - 10:46 AM GMTBy: Mike_Shedlock

Credit dislocations continue to fester. Evidence can be found in corporate bonds, preferred shares, hybrids, the Ted Spread, and even in the most recent Term Auction Facility (TAF) auctions. Let's take a look.

Credit dislocations continue to fester. Evidence can be found in corporate bonds, preferred shares, hybrids, the Ted Spread, and even in the most recent Term Auction Facility (TAF) auctions. Let's take a look.

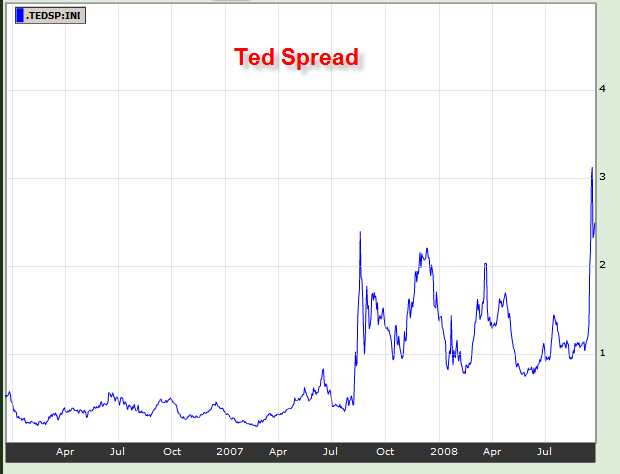

Inquiring minds are looking at a chart of the Ted Spread.

Chart courtesy of Bloomberg which has the closing value of 3.00 + 0.499.

The TED spread is the difference in yields between inter-bank and U.S. Government loans.

Initially, the TED spread was the difference between the interest rate for the three month U.S. Treasuries contract and three month Eurodollars contract as represented by the London Inter Bank Offered Rate (LIBOR). However, since the Chicago Mercantile Exchange dropped the T-bill futures, the TED spread is now calculated as the difference between the three month T-bill interest rate and three month LIBOR. The TED spread is a measure of liquidity and shows the degree to which banks are willing to lend money to one another.

The TED spread can be used as an indicator of credit risk. This is because U.S. T-bills are considered risk free while the LIBOR rate reflects the credit risk of lending to commercial banks. As the TED spread increases, the risk of default (also known as counterparty risk) is considered to be increasing, and investors will have a preference for safe investments.

Credit Market Misery

Professor Bennet Sedacca ha a few comments on Minyanville today in Credit Market Misery .

The credit market is getting eviscerated. Period. Whether it is corporates, preferreds or hybrids, spreads continue to blow out. The Goldman (GS) preferred I bought the other day at 11.5%? Gonzo. Thank you Warren.

Don't let the stock market fool you. The credit market is imploding.

The credit market has been a great leading indicator for stocks lately.

For a more detailed look into this topic, please see A Tale of Two Markets .

Stress In Term Auction facility

Inquiring minds just might be wondering how the Term Auction Facility (TAF) is performing. Let's take a look at the two most recent auctions.

TAF Release Date: September 10, 2008

On September 9, 2008, the Federal Reserve conducted an auction of $25 billion in 28-day credit through its Term Auction Facility. Following are the results of the auction:

Stop-out rate: 2.530 percent

Total propositions submitted: $46.237 billion

Total propositions accepted: $25.000

Bid/cover ratio: 1.85

Number of bidders: 53

TAF Release Date: September 23, 2008

On September 22, 2008, the Federal Reserve conducted an auction of $75 billion in 28-day credit through its Term Auction Facility. Following are the results of the auction:

Stop-out rate: 3.750 percent

Total propositions submitted: $133.562 billion

Total propositions accepted: $ 75.000 billion

Bid/cover ratio: 1.78

Number of bidders: 85

Note that the number of bidders soared from 53 to 85 and the yield went from 2.53% to a whopping 3.75%.

Inquiring minds might want a refresher course in the Term Auction Facility .

What is the Term Auction Facility ("TAF")?

In view of the pressures evident in short-term funding markets, the Board of Governors of the Federal Reserve System (the "Board") has approved the establishment of a temporary Term Auction Facility ("TAF") program in which the Federal Reserve will auction term funds to depository institutions.

The TAF is a credit facility that allows a depository institution to place a bid for an advance from its local Federal Reserve Bank at an interest rate that is determined as the result of an auction.

By allowing the Federal Reserve to inject term funds through a broader range of counterparties and against a broader range of collateral than open market operations, this facility could help ensure that liquidity provisions can be disseminated efficiently even when the unsecured interbank markets are under stress.

Demand For Cash Is Huge

The current discount rate is 2.25%. Banks are now willing to swap collateral with the Fed for 3.75%. Odds of that collateral being marked to market in these pawn shop swaps is virtually zero.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.