Credit-impaired Mortgage Decline, but so Have Shorter-term Interest Rates

Housing-Market / Mortgages Apr 03, 2019 - 02:25 PM GMTBy: MoneyFacts

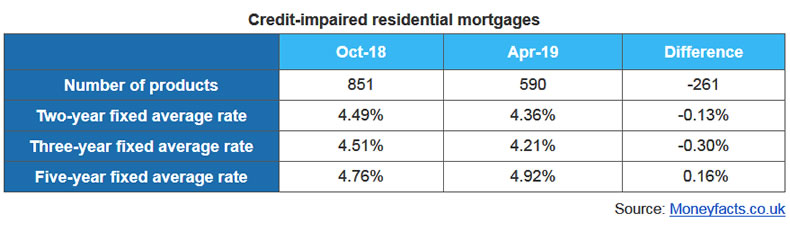

The latest research from Moneyfacts.co.uk shows that the number of credit-impaired residential mortgages has decreased by 261 to 590 products over the past six months. However, although choice is becoming more limited overall, the average credit-impaired two-year fixed rate mortgage has fallen by 0.13% to 4.36% since October last year while the average three-year rate has fallen by 0.30% over the same period.

Darren Cook, Finance Expert at Moneyfacts.co.uk, said:

“Credit-impaired mortgages are an essential option to those borrowers who have experienced minor financial issues and were previously excluded from negotiating a new mortgage deal due to a lack of product availability following the financial crisis.

“Even though credit-impaired mortgages are riskier than their full status resident mortgage counterparts, the current credit-impaired mortgage market is by no means the same type of lending environment that presented itself before the onset of the financial crisis. Back in August 2007, when lending principles and regulatory guidelines were much looser than they are today, there were 5,106 credit-impaired deals available – nearly 10 times as many as there are now – which accounted for a whopping 55% of the entire residential mortgage market.

“Despite the reduction in choice over the past six months, the average credit-impaired two-year fixed rate has fallen by 0.13% from 4.49% to stand at 4.36% today, which will be good news for some borrowers, as providers appear to not be increasing rates for short-term fixed deals, even with the current economic uncertainties.

“However, the average two-year fixed credit-impaired rate is still a far cry from the average two-year fixed rate of 2.48% available to full status borrowers. Not only this, but those borrowers who are looking to apply for a credit-impaired mortgage and lock their fixed rate in for a little longer may notice rates increasing, as the average five-year fixed rate has increased by 0.16% from 4.76% to 4.92% in the past six months.

“The credit-impaired mortgage market is considered a specialist lending sector, so it is no surprise that, according to Moneyfacts research, 91% of the total number of credit-impaired mortgage products are only available through a mortgage broker. It is clear that any borrower seeking a credit-impaired mortgage would be wise to speak to a mortgage broker first, regardless of whether or not it is required.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.