Gold, Silver, Palladium, Platinum Relative Strength Ratios Hit Rare Extremes

Commodities / Gold & Silver 2019 Apr 03, 2019 - 02:48 PM GMTBy: MoneyMetals

It’s possible last week’s cascading selling rout in palladium ended its multi-year bull market. The formerly white-hot metal lost more than $200/oz (but is beginning to rebound).

For now, however, palladium prices remain in a long-term uptrend above the bullishly aligned 20-week and 50-week moving averages – and physical supply remains tight.

Regardless of whether the palladium market recovers to new highs in the weeks ahead, it is quite possible that it has peaked in relative strength terms versus its sister metal platinum.

A few days ago, platinum traded at a historically large discount of almost 50% versus palladium. That discount narrowed considerably last week with platinum managing to post a slight gain in dollar terms.

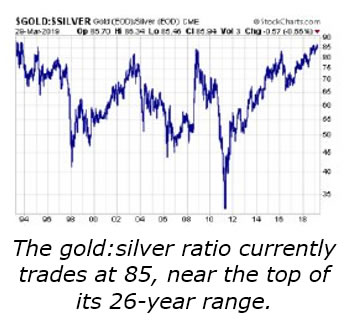

Another relative strength extreme that may be near a turning point is gold trading at 85 times the price of silver.

Another relative strength extreme that may be near a turning point is gold trading at 85 times the price of silver.

The gold:silver ratio ran up to its highest level since the early 1990s in last week’s trading, rendering silver a potential once-in-a-generation bargain opportunity among the money metals.

Silver is also deeply discounted versus the stock market. Last September, silver sunk to a 15-year low versus the S&P 500.

The tremendous strength in equities and bonds in the first quarter of 2019 makes silver once again stand out as extremely undervalued versus financial assets.

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2019 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.