Falling Trade Deficit is Good for Stocks: True or False?

Stock-Markets / Stock Markets 2019 Apr 07, 2019 - 12:27 PM GMTBy: EWI

A common claim from economic and stock market observers is that a rising trade deficit is injurious to the economy -- hence, bearish for stocks. On the other hand, a falling trade deficit is commonly believed to be bullish for stocks.

A common claim from economic and stock market observers is that a rising trade deficit is injurious to the economy -- hence, bearish for stocks. On the other hand, a falling trade deficit is commonly believed to be bullish for stocks.

Sounds like common sense, but the price action of the main stock indexes often defy reason.

For example, on March 27, CNBC reported, "The U.S. trade deficit fell much more than expected in January to $51.15 billion, from a forecast $57 billion. The decline of 14.6 percent represented the sharpest drop since March 2018... ." Yet on the day the news was released, the main U.S. stock indexes closed lower.

Over the years, countless economists and investors have been baffled when the stock market has risen on bad news and fallen when the news was good. This has happened time and time again with news regarding the expansion or contraction of the trade deficit.

Consider the following news items from the past four decades and contextual comments in brackets (courtesy of Robert Prechter's 2017 book The Socionomic Theory of Finance):

March 28, 1981

The Commerce Department... reported the nation's balance of trade deficit had improved in February. [The second of back-to-back recessions began just five months later.]

March 1, 1984

"... the trade deficit is an economic disaster," said [a] chief economist. [An eight-year boom was just getting going.]

April 12, 1985

The secretary of state said, "We can break the back of the trade deficit only through...a stronger worldwide recovery...." [Precisely the opposite was true; the trade deficit rose during the strong worldwide recovery.]

May 26, 1990

The better-than-expected trade performance sent many economists scurrying to revise their trade forecasts. [A recession started a month later.]

February 22, 2002

The nation's trade deficit narrowed by 11.4 percent in December. [The stock market was peaking and collapsed to new lows in October.]

February 15, 2008

[A chief economist] said that the smaller December trade deficit will help to boost overall economic growth. [The second-worst financial crash and economic contraction in a hundred years were already underway.]

And, on July 14, 2010, USA Today said:

Rising trade deficit could drag down U.S. recovery.

But, as we know, the economic recovery continued.

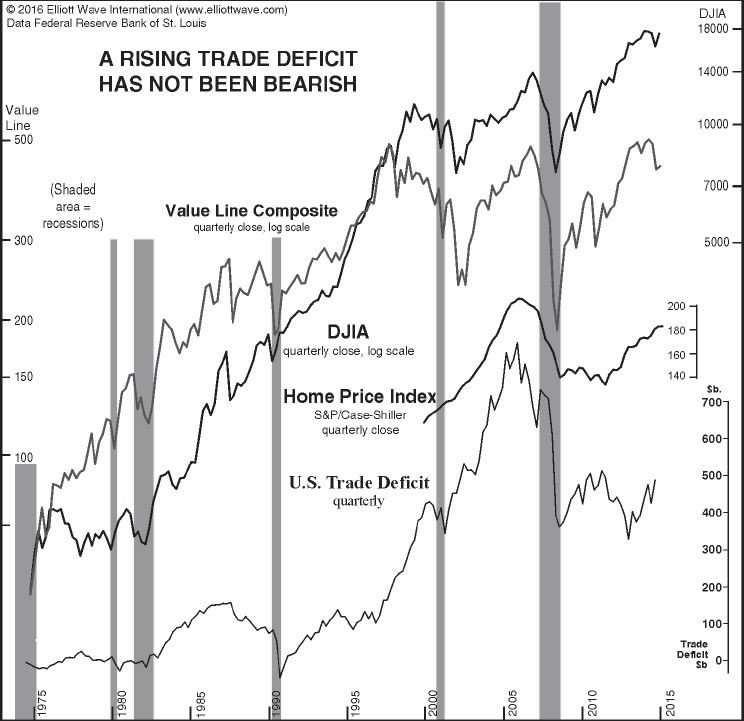

The below chart and commentary provide even more evidence.

As published in The Socionomic Theory of Finance

The chart reveals that had economists reversed their statements and expressed relief whenever the trade deficit began to expand and concern whenever it began to shrink, they would have quite accurately negotiated the ups and downs of the stock market and the economy over the past 40 years. The relationship, if there is one, is precisely the opposite of the one they believe is there. Over the span of these data, there has been a consistently positive--not negative--correlation among the stock market, the economy and the trade deficit.

The trade deficit’s widely presumed effect is 100% myth.

This is just one misconception in a long list of market myths… Do earnings really drive stock prices? Can the FDIC actually protect you? Is portfolio diversification a smart move? Read our free report "Market Myths Exposed" now and find out whether your portfolio is built on flawed foundations.

This article was syndicated by Elliott Wave International and was originally published under the headline Falling Trade Deficit is Good for Stocks: True or False?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.