While You Were Distracted By Stocks, the Fed Made Its Move…

Stock-Markets / Stock Markets 2019 Apr 19, 2019 - 03:21 PM GMTBy: Graham_Summers

This move in the markets is effectively finished… and the Fed’s secret plan is complete

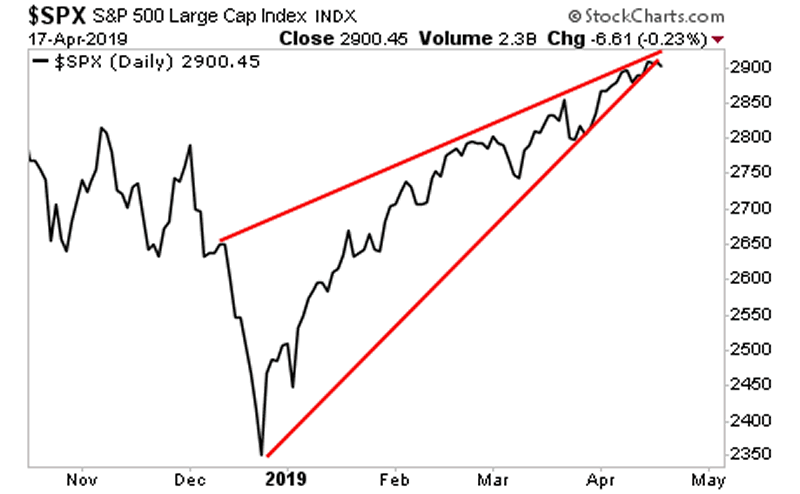

The S&P 500 is right at the very tip of the rising bearish wedge formation I’ve been tracking since early January 2019.

The market meltdown in December did what it needed to do… terrify everyone, including the President into “signing off” on the Fed implementing more aggressive monetary policy.

In the last two months, we’ve seen Fed officials recommend:

1) QE should become a regular monetary policy, not one used exclusively during crises (goodbye Purchasing Power of the $USD).

2) NIRP (NEGATIVE interest rates) should be implemented during the next economic downturn (this is where banks charge YOU money for keeping your cash there)

3) Treasury yields should be “capped” meaning the Fed stops them from rising above certain levels using QE (if you were planning on interest income, those days are over, capped bond yields means capped interest rates across the board).

Without December’s stock market meltdown, these ideas would never have been taken seriously… but now that everyone is scared to death about their portfolios being annihilated, the Fed will be able to unfold its plan to incinerate savings and no one will complain.

As far as financial heists go, this one was darn near flawless. It allowed the Fed to launch its campaign to push for cash grabs, NIRP and even wealth taxes in the US….

All of this was months in the making…

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.