Trade Negotiation in Jeopardy After China Reneged its Commitment

Stock-Markets / Financial Markets 2019 May 09, 2019 - 05:09 PM GMT Summary

Summary

- The odds of trade war escalation rises after Trump sent a pair of tweets threatening to increase tariffs to Chinese goods.

- If there is no deal by this Friday, the tariffs to Chinese goods will rise to 25% from 10% on $300 billion. Additional $325 billion of Chinese goods will also get 25% tariff.

- The rapid deterioration is due to the reversal of China’s commitment to address the U.S. core complaints.

- U.S companies with huge presence and sales in China, like Apple, can suffer if there’s trade war escalation.

- Elliott Wave Analysis on Apple suggests another major correction can happen.

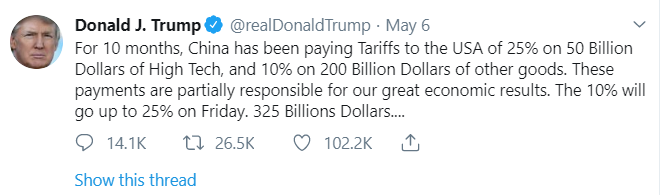

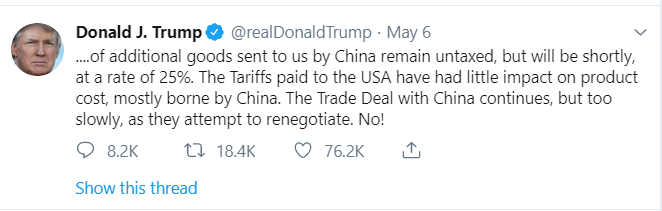

Over the weekend, President Trump sent a pair of tweets threatening to increase tariffs from 10% to 25% on $200 billion of Chinese goods. This increase will happen on Friday this week. In addition, Trump also said he will implement 25% tariff on $325 billion additional Chinese goods.

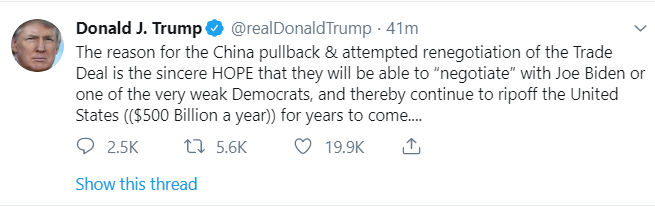

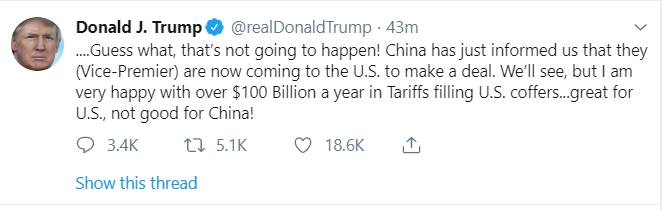

Trump sent a pair of tweets again today provoking China by saying he’s very happy with the additional tariffs

These tweets left no room for the U.S. to back down. U.S. Trade Representative Robert Lighthizer also made it clear that additional tariffs will apply this Friday despite the ongoing talk. Lighthizer is one of China hawks in Trump administration. He has pushed for an enforcement mechanism

News start to surface that the U.S. lose their patience after China backtracks their commitments to address U.S. complaints. Beijing returned a draft agreement to Washington late on Friday night with reversal to concessions on core U.S demands. The U.S. complaints center on the areas of intellectual property and forced technology transfer. There are several other areas such as market access for cloud computing firm and also currency manipulation. China has apparently gone back on all the major concessions it had made during the negotiation.

Chinese negotiators said they could not change the domestic laws, as such changes will be major and can’t be done quickly. They also accuse the U.S demands becoming harsher as the negotiations drag on. Although Vice Premier Liu He will still visit Washington on Thursday, the odds that the two sides can reconcile after this event seems to be slim at this stage.

For months, investors and market seem to believe that the two largest economies are close to making a deal. The markets are trading at near high or all-time high when President Trump sent the tweet on Sunday. The news immediately sent the stock market and commodities into free fall on Monday open. The sell-off can continue if there’s no deal by Friday.

$AAPL Apple Elliott Wave Daily Chart

Apple has a lot of stake if the U.S and China trade war escalates. China is one of the company’s biggest markets. Revenue from Greater China market made up 20% of Apple’s total revenue of $229.2 billion. In terms of operating profit, Greater China accounted for 21.9% of Apple’s total operating profit in the last financial year. China is also one of the manufacturing base for Apple’s products, such as iPhone, iPad, and Macbook.

Apple had a big 39% drop from October 3, 2018 high last year. It has recovered nicely after bottoming on January 3, 2019 low. However, it’s now at the area where it can end the cycle from January 3, 2019 low and turn lower in 3 waves at least. If the U.S. escalates the trade war this week, the stock can start to turn lower and at least pullback in 3 waves to correct cycle from January 3, 2019 low.

Conclusion

The months long trade negotiation between China and U.S. is wrapping up this week. Recent deterioration of the talk due to China’s reversal of its commitment is a cause of concern for investors. The rising odds of escalation this week sent the stock market and commodities tumbling. The selloff can potentially continue if there’s no agreement by this week. U.S. companies with significant stake in China, such as Apple, can suffer in the case of a trade war escalation.

To see the latest count in U.S stocks and Indices, forex, and commodities, feel free to join with the 14 days FREE Trial.

By EWFHendra

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2019 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.