Deflationary Assets Surge in Performance Over Inflationary Assets

Stock-Markets / Financial Markets 2019 May 17, 2019 - 03:51 PM GMTBy: Donald_W_Dony

Deflationary assets (financials, technology, industrials, healthcare and consumer products) are outperforming inflationary assets (commodities), once again.

Deflationary sectors have been dominant over inflationary assets for most of the last seven years. Outside of the short-term surge in performance from commodities in 2016, deflationary assets have held the top performance spot for most of the period from 2012 to 2019.

Recent price action from deflationary sectors solidifies that lead with a new 52-week high over inflationary assets (Chart 1).

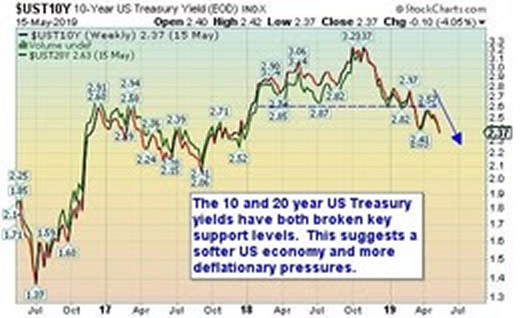

Some of the expected consequences of a deflationary dominated environment is depressed bond yields (Chart 2) and a strengthen US dollar.

Fixed income yields typically expand during periods of inflationary pressure, but during deflationary periods, bond yields are much more contained and bond prices rise.

As an example, the 10 year and 20 year US Treasury yields recently reversed their 2018 rise and dipped below key support levels suggesting lower yield levels are coming. This is good news for bond holders as prices are expected to advance again.

Another key element of a deflationary environment is the general strength in the US dollar compared to other world currencies.

The $US has risen over 32% from its low in 2011. This compares to a 25% loss in value of the Euro, a 24% loss on the Swiss France and a 30% loss on the Japanese Yen.

Bottom line: A deflationary investing environment offers many benefits over an inflationary dominated arena. Such as stock markets typically have longer extend advances, volatility is normally low and bond prices usually strengthen.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2018 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.