Smart Gold Investors Ask: Crisis or Zombification?

Commodities / Gold & Silver 2019 May 31, 2019 - 06:12 PM GMTBy: Arkadiusz_Sieron

Many people worry about the replay of the last economic crisis. But what if we look not in the direction from which the threat will come? What if we fight the last war? We invite you to read our today’s article about the possibility that the endgame will not to be a 2008-style financial crisis, but a slow, painful and unstoppable zombification of the global economy. And find out how it would affect the gold market.

Many people worry about the replay of the last economic crisis. But what if we look not in the direction from which the threat will come? What if we fight the last war? We invite you to read our today’s article about the possibility that the endgame will not to be a 2008-style financial crisis, but a slow, painful and unstoppable zombification of the global economy. And find out how it would affect the gold market.

We know that there is still a lot of time to Halloween. But please come with us to the cemetery to meet some zombie friends – who knows, maybe we will learn something about the economy and the gold market from them?

The current expansion is probably the most hated period of prosperity. Since the very end of the Great Recession, the pundits have been worried about the next economic crisis. We were told that the recession was just around the corner (the sellers of precious metals often aroused such fears). We have been hearing it for ten years.

But this time is said to be different. The US yield curve has inverted (but only temporarily), and American industrial production has recently weakened further, China’s economy has slowed down, while the German engine has jammed. Our world has clearly moved from global synchronization to global slowdown. Shouldn’t we worry about recession, then?

Perhaps. But what if we look not in the direction from which the threat will come? What if we fight the last war? What if the endgame will not to be a 2008-style financial crisis, but a slow, painful and unstoppable zombification of the global economy? In other words, what if we are boiling frogs which do not feel the lethal heat?

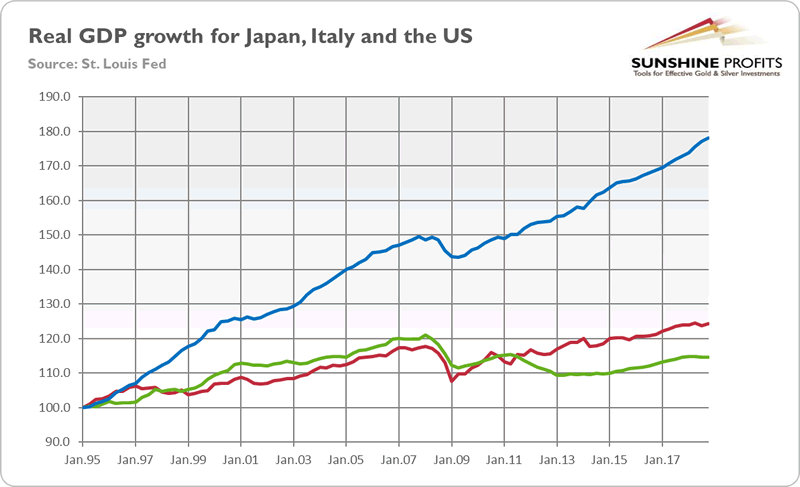

Just consider Japan. Its economy has risen just 25 percent from 1995, as one can see in the chart below. It has very old and ageing population and enormous public debt. Indeed, Japan – with the level of debt above 250 percent of GDP – leads the inglorious ranking of the most indebted countries in the world.

Chart 1: Real GDP growth for Japan (red line), Italy (green line) and the US (blue line) from 1995 to 2018 (Index: 1995 = 100)

Europe seems to follow Japan. Its population is also old and quickly ageing, while the economy is heavily dependent on the commercial banks. But the banking system is still fragile with high percentage of non-performing loans, especially in Italy– the country is also heavily indebted and experienced almost no real growth over the last twenty years (see the chart above).

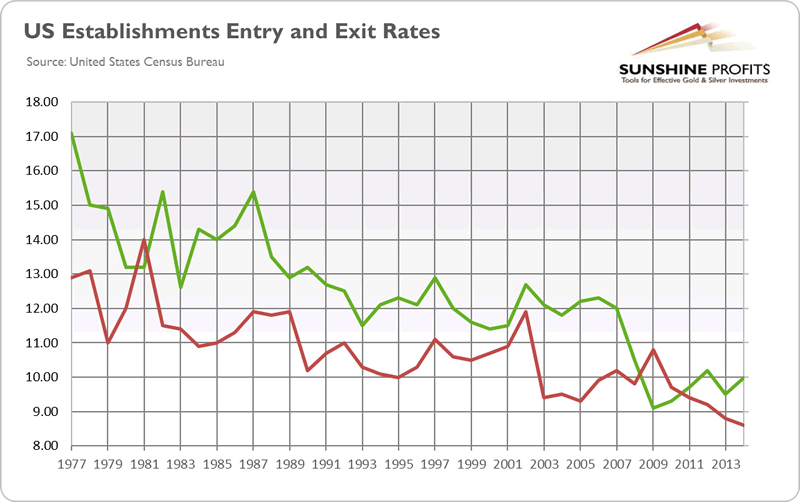

The situation in the US is better, but still disturbing. Just think about these developments: inflation is stubbornly low, the real interest rates remain in a downward trend, the labor productivity is sluggish, while both the public and private debts are accumulating. And the business dynamism, measured by the firm entry and exit rates, is on the decline since the Great Recession, as the chart below shows.

Chart 2: U.S. establishment entry rate (blue line) and exit rate (red line) from 1977 to 2014.

What would the zombification of the economy imply for the gold market? The full-blown crisis and deep recession would be much better for gold than slow petrification of the economy. You cannot fall if you did not take off the ground. In other words, the next global economic crisis is not imminent – instead, we could enjoy slower and slower growth, until the complete stagnation. Let’s repeat something we pointed out several times: that’s true that the current expansion is exceptionally long, but this is precisely because it is uniquely slow. If you are a snail, it takes more time to climb the mountain for you than for the rabbit.

However, zombification means low real interest rates. Gold shines when bond yields are low. And the greenback would depreciate then – at least against developing countries’ currencies. Moreover, the zombified economy is kept artificially alive by monetary and fiscal stimuli. The interest rates are low, while the debts are high. The room for further maneuver is limited, and the economy is more vulnerable to external shocks. Just think about Japan or Italy – these countries were not immune to the Great Recession. Actually, they suffered much more than the US when the crisis began.

The implication is that the zombification of the economy does not make the economy immune to the business cycle. The day of reckoning will still come, but it may come a bit later. But when it arrives, the negative consequences will be more severe. We do not mean necessarily deep recession, as central banks will do anything to support the economy, but that the followed recovery will be very soft. In the environment of no growth, zero interest rates, gold may flourish. Inflation may be not high, but it will be positive. So, we will face stagflation, which historically – remember the 1970s? – was positive for the yellow metal.

However, investors should acknowledge that Europe is much more zombified than the US, so – unfortunately for the gold prices – the greenback should remain the king of the fiat currencies.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.