Gold Stocks “Launch” is in Line With Fundamentals

Commodities / Gold & Silver 2019 Jun 15, 2019 - 03:53 PM GMTBy: Gary_Tanashian

I make the point in the title because the real fundamentals that matter for the gold stock sector must be in line at the beginning of a real bull phase or bull market for the sector. I make that point with the example of Q1 2016, when a very powerful gold stock “launch” erupted but in Q2 of that year we (NFTRH) were already advising a degrading of those fundamentals. A public article I wrote referenced this on May 30, 2016.

I make the point in the title because the real fundamentals that matter for the gold stock sector must be in line at the beginning of a real bull phase or bull market for the sector. I make that point with the example of Q1 2016, when a very powerful gold stock “launch” erupted but in Q2 of that year we (NFTRH) were already advising a degrading of those fundamentals. A public article I wrote referenced this on May 30, 2016.

AMAT Chirps, b2b Ramps, Yellen Hawks and Gold’s Fundamentals Erode

What had happened in 2016 was that gold bottomed first, followed by the miners and silver. But then the whole raft of cyclical assets (commodities, stocks, etc.) bottomed and turned up. A cyclical party soon regenerated and the counter-cyclical gold stock sector was sent back to the hell it came from.

So again let’s take a look at our visual that roughly represents the correct macro backdrop for a bullish fundamental view on gold stocks. The larger the planet, the more important the fundamental aspect. Gold/Commodities should be a somewhat larger planet but work with me here. :-)

Add in the important component of the Fed and its increasing odds of 2019 rate cuts and well, you’ve got the right backdrop for an undervalued sector (as we’ve been noting for months in NFTRH using unique comparisons of the gold/commodities and gold/oil ratios to the HUI index) to finally gain traction in the eyes of the wider investment community.

Hence we noted the launch in this NFTRH subscriber update (now public) on June 3rd. Check out the entire post, but below is an excerpted bit.

NFTRH; The Nature of the Gold Stock Launch

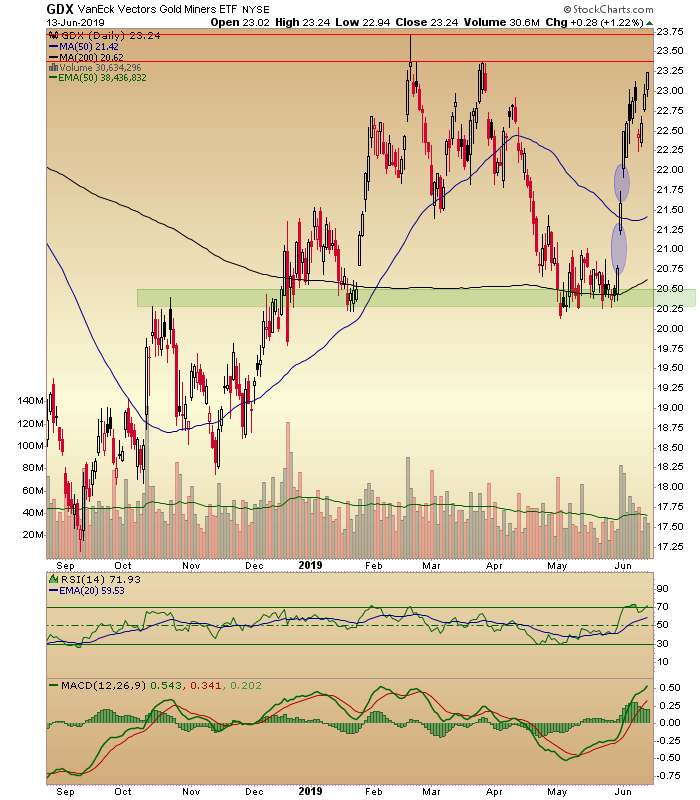

The pullbacks will come and they will be harsh. But if this is a launch, as would be indicated by the fundamentals slamming into gear, it’s a buy/add the pullbacks situation. I’ll be keeping a close watch on the funda because if they remain strong I’ll remain strong. If not, I won’t. Right now they are strong and this launch from support reflects that.

Unfortunately, all too many people are obsessed with inflation as the key fundamental for gold and worse yet, gold stocks. That is a pure canard and anyone pounding the table on cyclical inflation as a reason to own gold or the gold miners that leverage gold’s relationships to cyclical assets is guiding incorrectly. Is it any wonder that so many have been routinely put off sides since mid-2016?

I have stated my case (and it’s a case put forth by a few quality others, most notably Bob Hoye) consistently and continue to do so. If the real fundamentals erode I’ll become weak on the sector. But that is not what is happening currently and so I am strong on the sector (and have waited a long while to be able to write that).

So this gappy “launch” on volume is nothing to fear. Vertical? Yup. Impulsive? Yup. Pullbacks to come? Oh yeah. Something to fear? No, not as long as the macro and sector fundamentals remain in line.

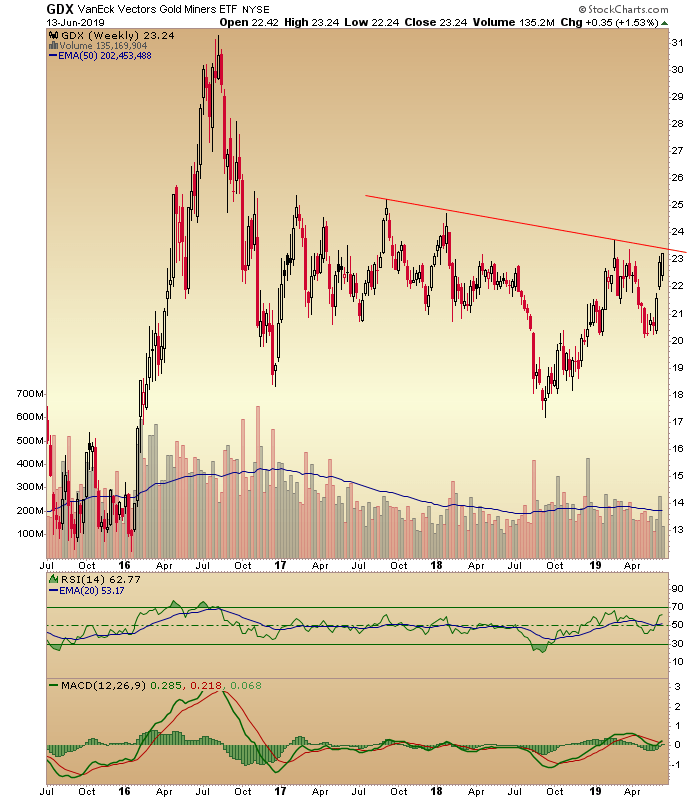

The weekly chart shows a point that might bring on some volatility. But again, if the fundamentals remain in hand volatility is your friend, not something to fear. Unfortunately for inflation-focused would-be gold bulls, nothing makes sense right now in the current disinflationary environment and so they will be paralyzed by confusion.

Meanwhile, I look forward to charting the best gold stocks I know of each week in NFTRH, from daily and weekly time frames along with the key fundamental charts and sector indicators. We’ve been waiting a long while for this and if those fundamentals stay in hand it’s going to be a rewarding 2019.

[edit] A few minutes after posting I came across this. It is a perfect example of what to completely ignore moving forward. Indeed, it comes with the gold stock sector generally approaching resistance. You can click the graphic if you want to read whatever the article is saying (I have not), but we must move forward on the fundamentals grinding into gear, not by inflammatory headlines, which are often short-term contrary indicators.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.