Clock’s Ticking on Your Chance to Profit from the Yield Curve Inversion

Interest-Rates / Inverted Yield Curve Jun 17, 2019 - 04:19 PM GMTBy: Robert_Ross

The markets are in the middle of a once-in-a-decade event.

The markets are in the middle of a once-in-a-decade event.

And it says a lot about what you should do with your money right now.

I’m talking about a critical recession indicator called the yield curve inversion—or the Diamond Cross.

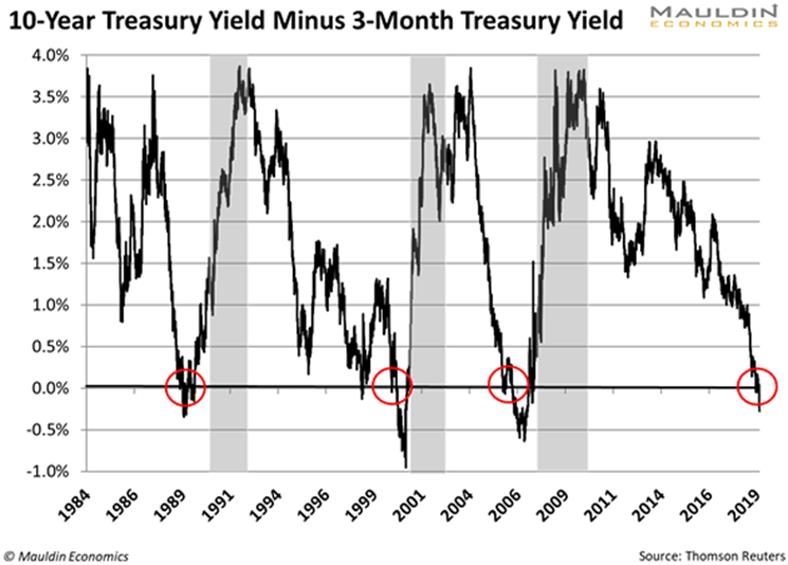

As you may recall, a Diamond Cross happens when the difference between the yield on the 10-year Treasury note and the 3-month Treasury bill is negative. This is a telltale sign that the economy is slowing.

The Diamond Cross popped up briefly in March, only to return on May 15. Last week, it was the steepest, or most severe it’s been since April 2007.

And I’m sure you remember where we landed 12 months after that…

The Crisis That Followed

By April 2008, the US was suffering through its worst economic slowdown since the Great Depression.

A lot of people were taken off guard. But investors who pay attention to the Diamond Cross shouldn’t have been surprised. That’s because the Diamond Cross has preceded every single recession over the past 50 years.

Today, we’re heading toward another recession. Just not immediately…

The Diamond Cross appeared an average of 18 months before the last three recessions, as you can see in the next chart. (Diamond Crosses are circled in red and recessions are highlighted in gray.)

I expect a similar gap this go ‘round.

Nevertheless, the Diamond Cross is a definite sign that investors are worried.

Here’s why…

These Are Strange Times

You probably know that US Treasuries are bonds issued by the US government—the safest lender on the planet. So, they’re about as “risk free” as you can get.

The US Treasury issues these bonds for different periods of time, ranging from three months to 30 years. This period is called the bond’s “maturity.”

Normally, investors demand higher yields for longer-term bonds. And for good reason.

See, you can predict short-term economic and geopolitical changes with some degree of certainty. But no one really knows what will happen in 10, 20, or 30 years.

Long-term bonds are a gamble on the unknown. So people demand higher yields.

But the Diamond Cross flips this all on its head. When it appears, like it did on May 15, it means investors are demanding higher yields for shorter-term bonds. That means they’re pessimistic about the short-term future.

Once again, this shouldn’t surprise anyone who’s been paying attention. The US economy has expanded continuously for almost nine years. That’s a long time.

Since the end of World War II, the US has hit a recession every five years, on average. So we’re long overdue.

But remember, a Diamond Cross appeared around 18 months before the last three recessions. So it’s coming, just not tomorrow.

In the meantime, I expect stocks to follow a similar pattern…

Stocks Should Climb Until September 2020

There’s an upside to all this: A Diamond Cross is always a positive sign for stocks in the short term.

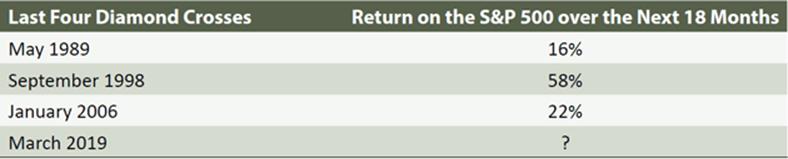

Just look at how the S&P 500 rose after the last Diamond Crosses:

At the 18-month mark after the last three Diamond Crosses, the S&P 500 had returned an average of 32%. Pretty respectable. For perspective, that’s the same return on the S&P since July 2016.

At this rate, stocks should continue to climb until September 2020 or so. That said, now is not the time buy with wild abandon.

A Word of Caution

Although stocks historically rise after the Diamond Cross, you still need to be picky.

This recession is coming, folks. So is the market downturn. You want to steer clear of excessive risk.

That means buying safe and reliable dividend-paying stocks—especially in resilient industries like consumer staples, defense, and utilities.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.