Are US Real Estate ETF’s The Next Big Trade? Part II

Housing-Market / US Housing Jul 02, 2019 - 03:40 PM GMTBy: Chris_Vermeulen

In part I of this research post, we highlighted how the shifting landscape of the US real estate market may be setting up an incredible trading opportunity for technical traders. It is our belief that the continued capital shift which has been driving foreign investment into US assets, real estate, and other investments may be shifting away from US real estate as tell-tale signs of stress are starting to show. Foreclosures and price drops are one of the first signs that stress exists in the markets and we believe the real estate segment could be setting up for an incredible trade opportunity.

In part I of this research post, we highlighted how the shifting landscape of the US real estate market may be setting up an incredible trading opportunity for technical traders. It is our belief that the continued capital shift which has been driving foreign investment into US assets, real estate, and other investments may be shifting away from US real estate as tell-tale signs of stress are starting to show. Foreclosures and price drops are one of the first signs that stress exists in the markets and we believe the real estate segment could be setting up for an incredible trade opportunity.

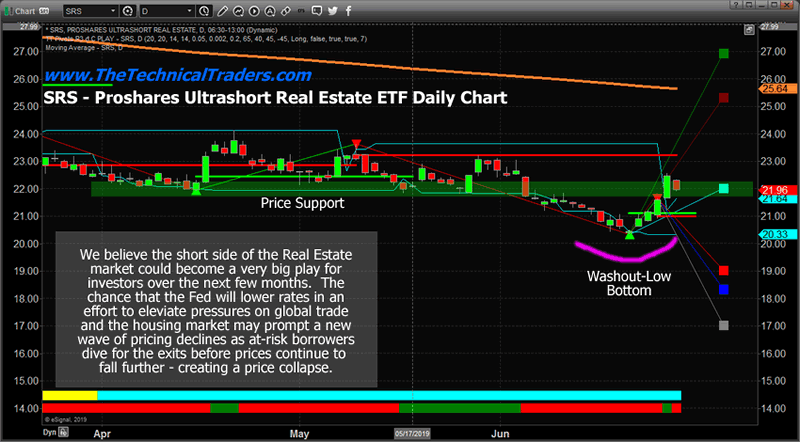

SRS, the Proshares Ultrashort Real Estate EFT has recently completed a unique “washout low” price bottom that we believe may become an incredible trading opportunity for technical traders. If the US Fed pushes the market into a panic mode, sellers will become even more desperate to offload their homes and buyers will become even more discerning in terms of selecting what and when to buy.

Our opinion is that the recent “washout low” price bottom in SRS is very likely to be a unique “scouting party” low/bottom that may set up a very big move to the upside over the next 4 to 12+ months. If our research is correct, the continued forward navigation for the US Fed, global central banks and the average consumers buying and selling homes is about to become very volatile.

If SRS moves above the $25.50 level, our first upside Fibonacci price target and clears the $24.25 previous peak set in April 2019, it would be a very clear indication that a risk trade in Real Estate is back in play. Ideally, price holding above the $21.65 level would provide a very clear level of support negating any future price weakness below $21.50.

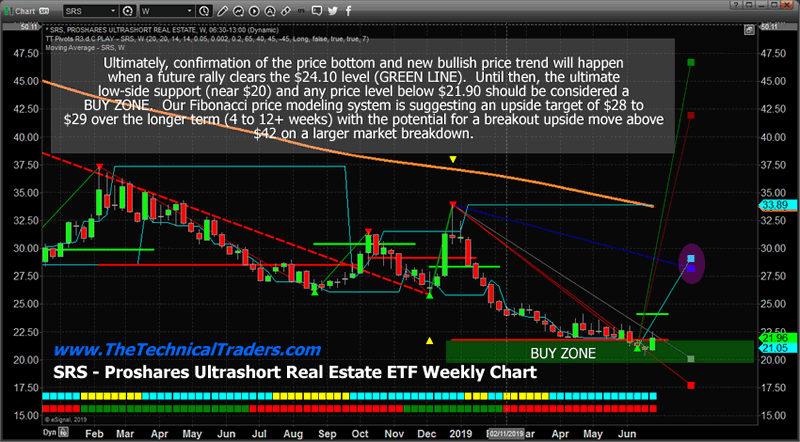

This weekly SRS chart highlights what we believe to be the optimal BUY ZONE and the upside price targets near $28 to $29. Since the bottom in 2009-10, after the credit market crisis, we have not seen any substantial risk in the Real Estate market for over 8+ years. Now, though, it is our opinion that this risk trade is very real and that technical trader should be aware of this potential move and what it means to protect assets and wealth.

If our research proves to be accurate and any future move by the US Fed will prompt a “rush to the exits” by home sellers, then there is really only one course of action left for us to consider. Either the Fed will reduce rates, buying some at-risk sellers a bit of time before a rush to sell overwhelms the markets and prices begin a fast decline in an attempt to secure quick buyers; or the Fed will leave rates at current levels where at-risk sellers will continue to attempt to offload their homes to any willing buyers before declining prices and panicked sellers start the “race to the bottom” in terms of pricing.

CONCLUDING THOUGHTS:

Real Estate has already run through the price advance cycle and the price maturity cycle. There is really only one cycle left to unfold at this point – the “price revaluation cycle”. This is where the opportunity lies with our suggested SRS trade setup.

We believe this bottom in SRS will result in a few more weeks of trading near price support (above $20 and below $22.50) where traders will be able to acquire their positions. The bigger move will happen as risk becomes more evident – very similar to what has recently happened in Gold. Once that risk is visible to traders/investors, the upside potentials ($28+ to $42+) won’t seem so illogical any longer.

I can tell you that huge moves are about to start unfolding not only in real estate, but metals, stocks, and currencies. Some of these super cycles are going to last years. Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you to visit my Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible, get a FREE BAR OF GOLD and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next set of crisis’.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.