Forex Market Charts and Setups: GOLD follows our Path Down

Stock-Markets / Financial Markets 2019 Jul 03, 2019 - 03:04 PM GMTBy: QUANTO

Global equities rose on Monday as the G20 summit in Osaka fuelled optimism that trade tensions will ease, while havens fell out of favour and oil rallied on an extension of production cuts by Opec+ countries. The agreement between the US and China to resume trade talks and halt the imposition of further tariffs, fed hopes that the trade war may be easing up. European stock indices followed their Asian peers higher, with the international Stoxx 600 up 0.9 per cent, led by sectors sensitive to the outlook for trade relations. The Stoxx index tracking carmakers rose 2.1 per cent and Frankfurt’s Xetra Dax 30, home to a range of exporters, was up 1.8 per cent. London’s FTSE 100 rose 0.9 per cent. S&P 500 futures tipped US stocks to open up by over 1 per cent.

Global equities rose on Monday as the G20 summit in Osaka fuelled optimism that trade tensions will ease, while havens fell out of favour and oil rallied on an extension of production cuts by Opec+ countries. The agreement between the US and China to resume trade talks and halt the imposition of further tariffs, fed hopes that the trade war may be easing up. European stock indices followed their Asian peers higher, with the international Stoxx 600 up 0.9 per cent, led by sectors sensitive to the outlook for trade relations. The Stoxx index tracking carmakers rose 2.1 per cent and Frankfurt’s Xetra Dax 30, home to a range of exporters, was up 1.8 per cent. London’s FTSE 100 rose 0.9 per cent. S&P 500 futures tipped US stocks to open up by over 1 per cent.

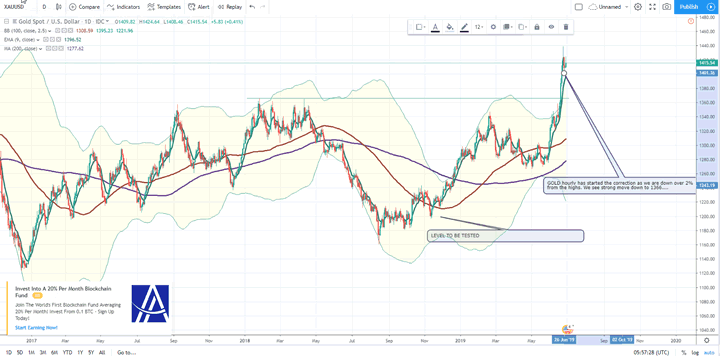

The move out of havens was brisk and set gold on course for its biggest single fall in a calendar year, down 1.7 per cent to $1,385.70. Japan’s yen weakened by 0.5 per cent to ¥108.38 per dollar. The yield on 10-year US Treasuries rose by 4.5 basis points as investors move out of the debt gathered pace, taking it to 2.0447 per cent. We had suggested the short gold trade here: GOLD TO FALL 10%. Currently Gold has cracked 1385.

Trade impact from US Tariff

US Trade tariff erected against Europe and China have severely impacted trade imports from US. This has been at the height of global slowdown seen across sectors.

Further evidence of manufacturing impact in Europe and Asia are visible in falling PMI. Globally, housing prices have also started to fall. Evidence of the deteriorating housing market is on show every weekend in Sydney and Melbourne, where once bustling Saturday housing auctions now struggle to attract even a handful of buyers. Just four in every 10 homes put up for sale in December were sold in the traditional roadside auctions. Prices in Australia’s two biggest cities have fallen 12 per cent and 9 per cent respectively from peaks achieved in 2017. Shane Oliver, AMP economist, predicts that prices could fall by as much as 25 per cent from their peak levels. Unemployment in Australia fell to 5 per cent in December, its lowest rate since 2011. But there are growing concerns that a weakening housing market is hitting household consumption, with retail sales unexpectedly falling by 0.4 per cent in December, compared with the previous month.

The European Central Bank has sounded the alarm about the impact of trade tensions and Brexit, only weeks after it stopped expanding its €2.6tn quantitative easing programme. Some of the biggest questions hang over Europe. The European Commission on Thursday slashed its growth forecast for this year to 1.3 per cent from 1.9 per cent, marking down outlooks for major economies including Germany. It is now predicting the weakest expansion in Italy for five years.

All of the above have led to policy uncertainity around the world. The uncertainity among central bankers is at its highest since 2008.

We have some trading charts in key forex pairs below.

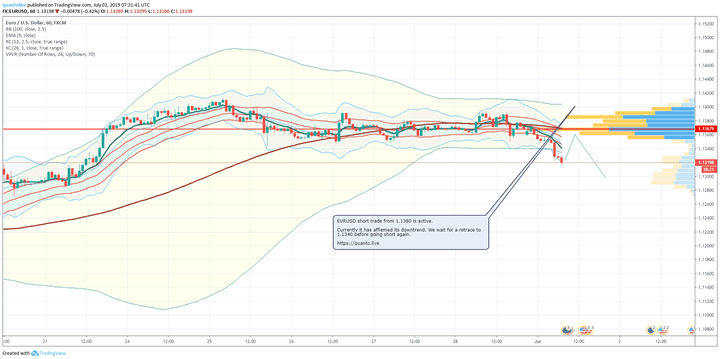

EURUSD hourly charts

EURUSD hourly shows the continuation of the

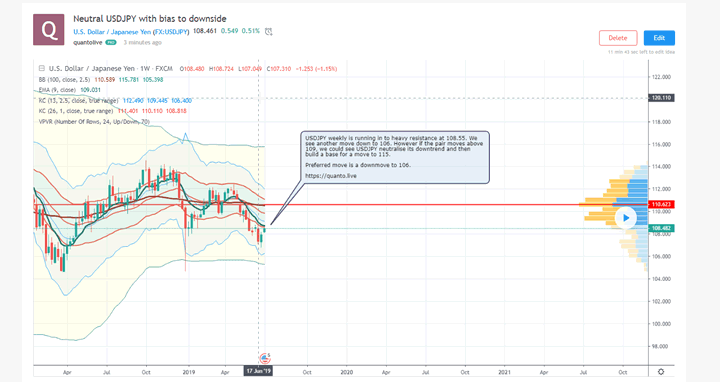

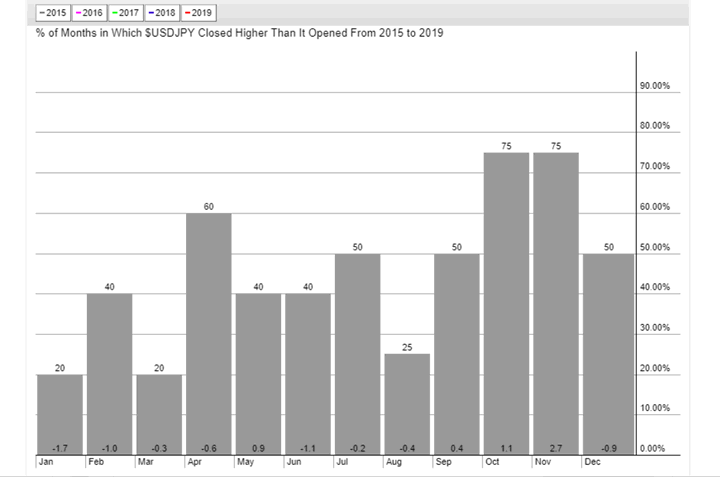

USDJPY weekly is running in to heavy resistance at 108.55. We see another move down to 106. However if the pair moves above 109, we could see USDJPY neutralise its downtrend and then build a base for a move to 115. Preferred move is a downmove to 106.

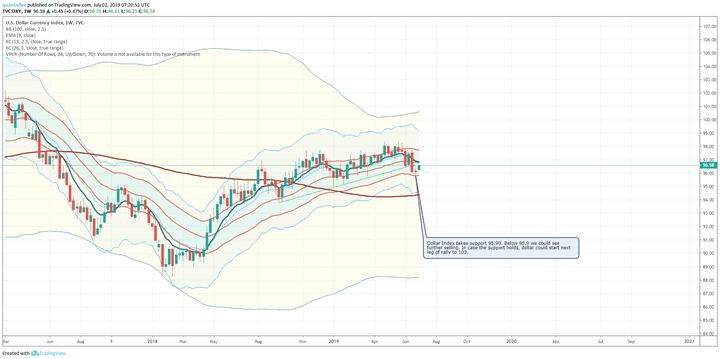

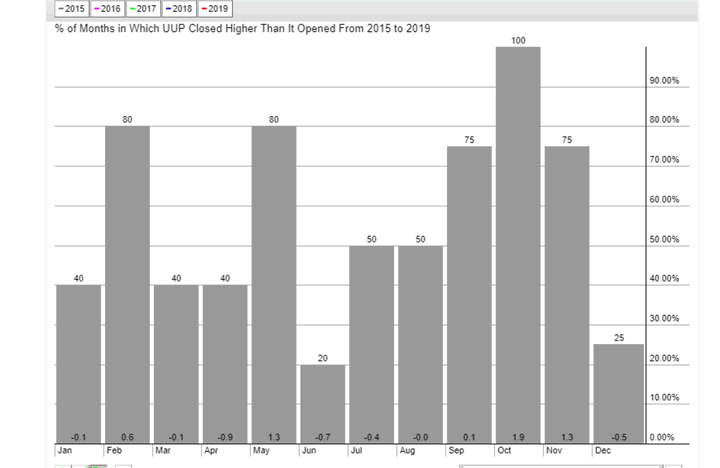

Dollar Index

Dollar Index is holding last week 95.9 support. Only above 97.5 can we assume the dollar has restarted its uptrend. US government bonds have screamed higher, stocks have hit record highs and derivatives have lurched in anticipation that the US Federal Reserve will soon embark on significant cuts to benchmark interest rates — a complete U-turn from expectations at the start of this year. Derivatives markets show investors are expecting interest-rate cuts of up to half a percentage point as soon as July, and a total of 0.75 percentage points by the end of this year. Analysts say base rates could move even lower if trade relations deteriorate following the meeting between Mr Trump and Chinese president Xi Jinping this weekend at the G20 leaders’ summit in Osaka, Japan. However despite the developing bearishness around the dollar, we also note that the world is starting to crater down a slower growth. Investors are finding increasingly difficult to chase yield either in China or in Europe. All markets are cooling down. This means cash will come to the cleanest of all, US Dollar. Thus we may not see a quick weakening in the dollar.

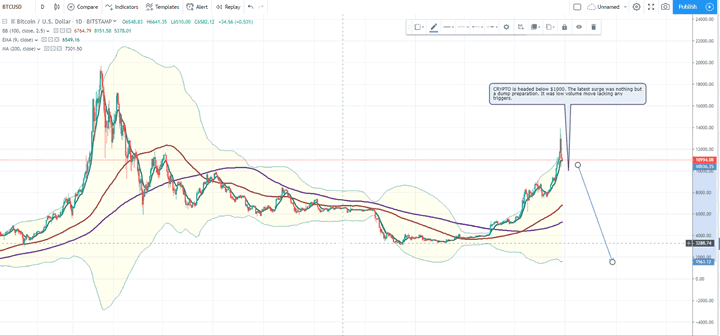

Bitcoin fell nearly $2,000 in a matter of minutes in a sharp crash, a reminder of the cryptocurrency’s volatility even as it has soared this month to its highest level since last year’s boom-and-bust cycle. In late New York trading hours on Wednesday, bitcoin fell from $13,850 to under $11,900 in under an hour, according to Refinitiv data. That took some of the sheen off a rally that has seen bitcoin jump from just over $5,000 at the beginning of May, evoking memories of the cryptocurrency’s last boom-and-bust cycle. By Thursday morning in London bitcoin was tumbling again and trading at around $11,500.

GOLD

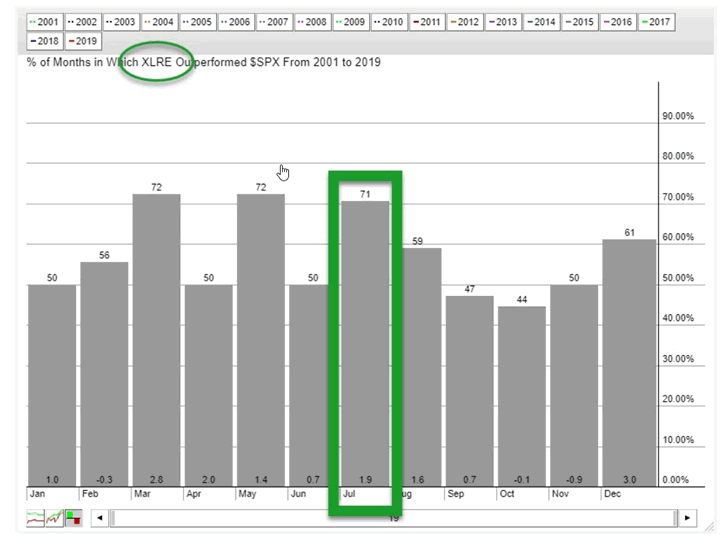

Sector Outperformance

In terms of US Sectors performance in July, real estate sector has been attractive option. Falling yields and easing financcial conditions, are pouring billions into the real estate ETF. More than 70% of time, the sector has risen in July.

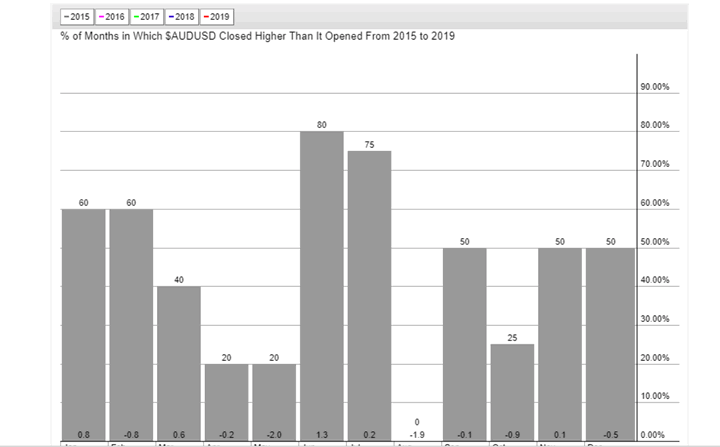

AUDUSD

AUDUSD has had a stellar July in the last 4 years. It has risen 75% of times but the rise has been a low 0.2%.

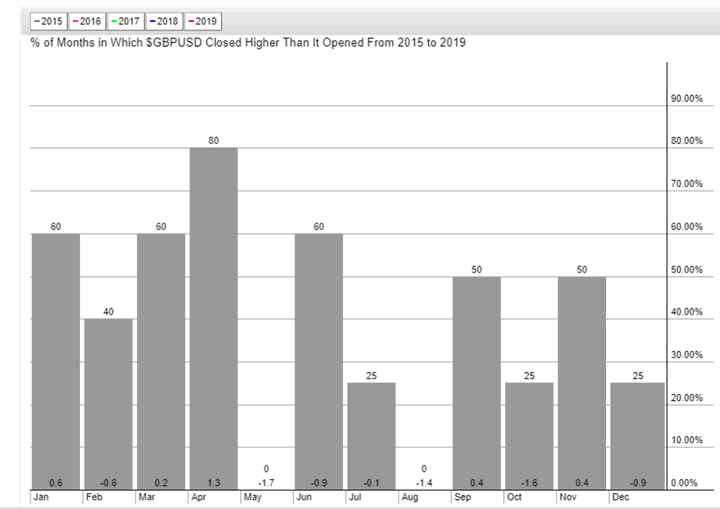

GBPUSD

GBPUSD record has been poor in July. On an average it has fallen 0.1% in July. It has risen in 25% of times only. Volatility has been low in July for GBPUSD owing to the summer vacation.

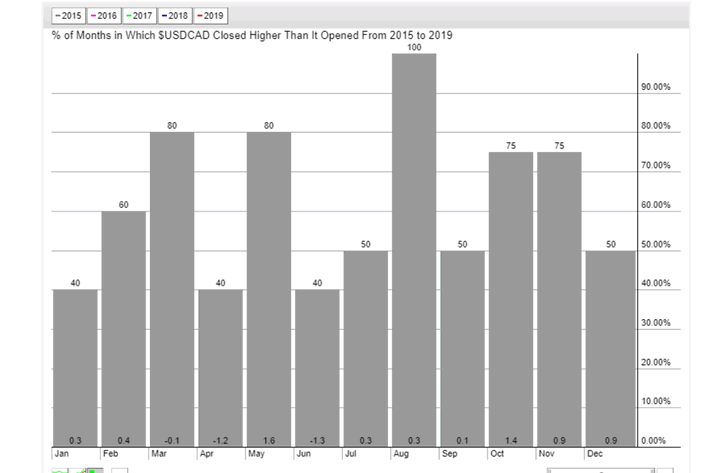

USDCAD

USDCAD has risen on an average 0.3% in July in the last 4 years.

Dollar Index

The dollar index has a patchy record in July. It has declined about 0.4% on an average. It has risen only in 50% of July in the last 4 years.

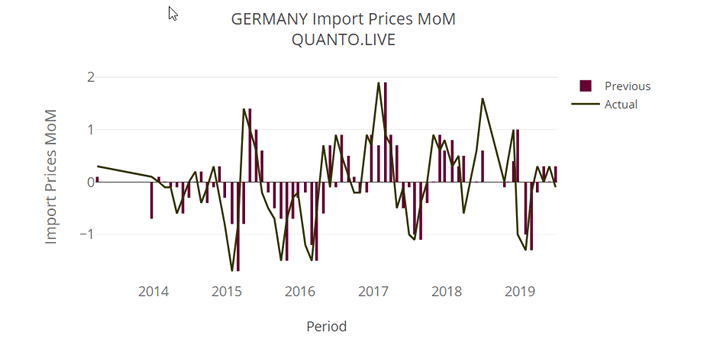

Fundamentals German Inflation

A major concern for ECB will be the the lackluster inflation in EU leading economy, Germany. Import prices fell 0.1%. This despote a weakening EUR compared to last year.

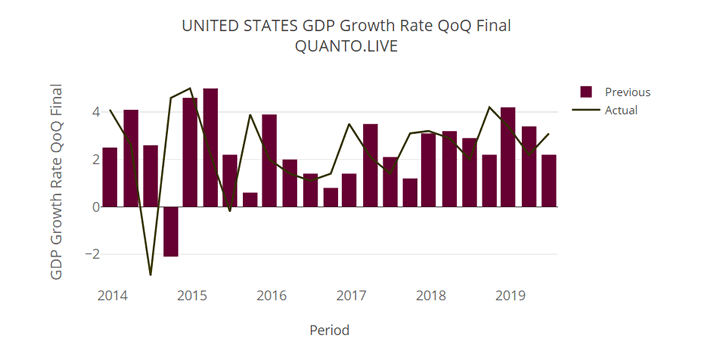

US GDP

US economy is in a sweet spot. GDP numberss are holding up for now. GDP grew 3.1%, an enviable number for a 20 trillion economy.

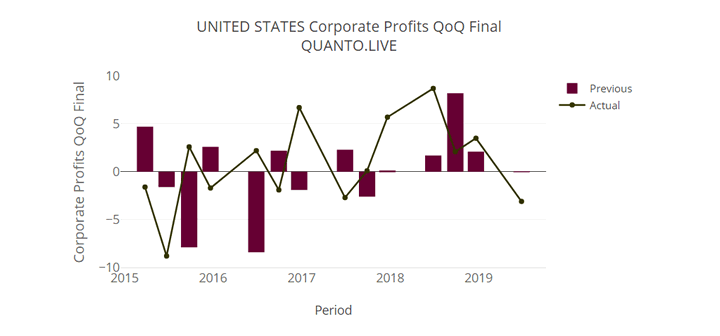

US Corporate profits

US earnings have been falling. This is a definite red flag for investors. While growth has held well, the companies have not enjoyed past profitability due to higher finance cost and raw material costs.

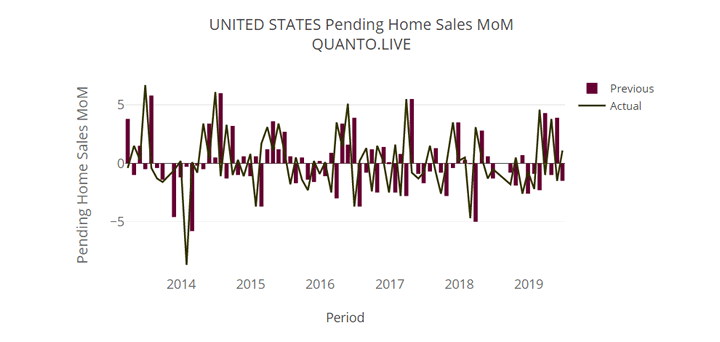

US Pending home sales

US Pending home sales have held well in positive territory. Higher yields have been dampner but sales are looking poised for further gains as yields fall.

About QUANTO.LIVE Team

Trading Performance

QUANTO is a trading system which combined Market Profile Theory and Kletner channels. It is hugely profitable. There was a trader back in If you would like to start right away, please contact us. Our email: Partners@quanto.live

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.