Stock Market Hype and Hope Ends This Week

Stock-Markets / Stock Markets 2019 Jul 09, 2019 - 06:44 AM GMTBy: Graham_Summers

The two biggest catalysts for the stock market rally are over.

The two biggest catalysts for the stock market rally are over.

Those catalysts were:

1) The hope of a Fed rate cut.

2) The hope of a Trade Deal between China and the US.

Regarding #1, the Fed June meeting resulted in no rate cuts. And last week’s jobs numbers greatly reduce the likelihood of a rate cut hitting in July.

Moreover, the Fed doesn’t meet in August. Which means the soonest the Fed would be able to cut rates would be September.

Regarding #2, the much-hyped meeting between Presidents Trump and Jinping at the G-20 meeting came and went. Despite all the hype and proclamations of success, a Trade Deal was not reached. In fact, it looks as though whatever points were agreed upon have already fallen apart.

This means… we are now in the window for a major market drop.

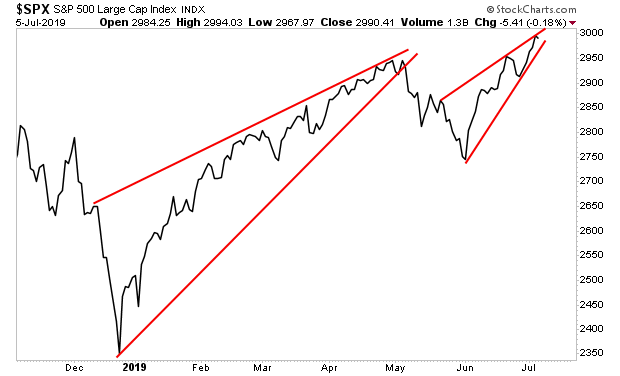

Stocks are completing their second bearish rising wedge formation of the year. The last one occurred right before the May drop. Given that this second wedge was both shorter and faster, the move will be even more violent.

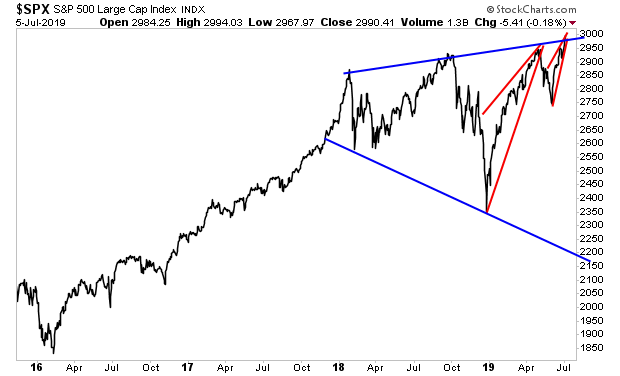

Indeed, this is happening right as stocks slam into the overhead resistance on the megaphone pattern (blue lines) that stocks have formed over the last three years.

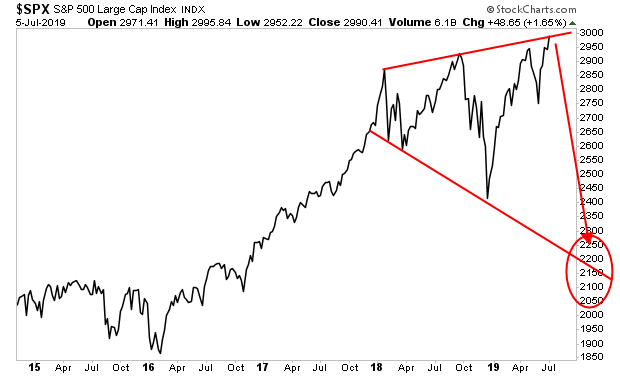

Stocks should now drop to 2,900. But if they can’t hold that level, the door opens to something TRULY nasty.

BE READY!

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.