Stock Market SPX 3000 Dream is Pushed Away: Pullback of 5-10% is Coming

Stock-Markets / Stock Markets 2019 Jul 10, 2019 - 06:25 AM GMTBy: QUANTO

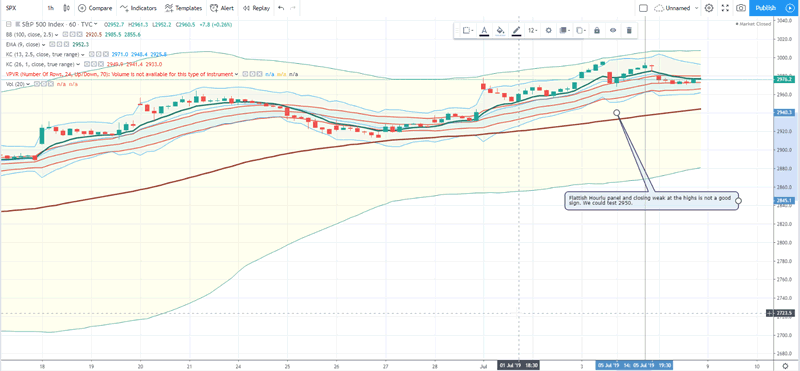

US SPX came in touching distance of 3000 mark. However it again backed off and this time went over 20 handles lower. The lack of conviction at the top is suggestive of a major pullback coming. We think US market could pull back by over 5% in next two months.

US SPX came in touching distance of 3000 mark. However it again backed off and this time went over 20 handles lower. The lack of conviction at the top is suggestive of a major pullback coming. We think US market could pull back by over 5% in next two months.

The 10-year Treasury note yield TMUBMUSD10Y, -0.68% fell 1.4 basis points to 2.030%, after staging its biggest daily climb in around seven months, while the 30-year bond yield TMUBMUSD30Y, -0.45% slipped by 2.9 basis points to 2.520%. The 2-year note rate TMUBMUSD02Y, -1.26% was up 0.5 basis point to 1.875%, its highest level in around a month. Debt prices move in the opposite direction of yields.

DB Job cut: Tip of iceberg A dark day for Germany’s biggest lender, as Deutsche Bank DB, -6.10% unveiled the biggest restructuring probably of any bank since the aftermath of the 2008 financial crash. The troubled German giant—which once hoped to be Europe’s answer to Wall Street titans like J.P. Morgan or Goldman Sachs—is to reduce head count by 18,000 and call time on a big chunk of its global investment banking ambitions. This earnings season, zero is the number to beat. Expectations couldn’t be much lower, reports Barron’s.

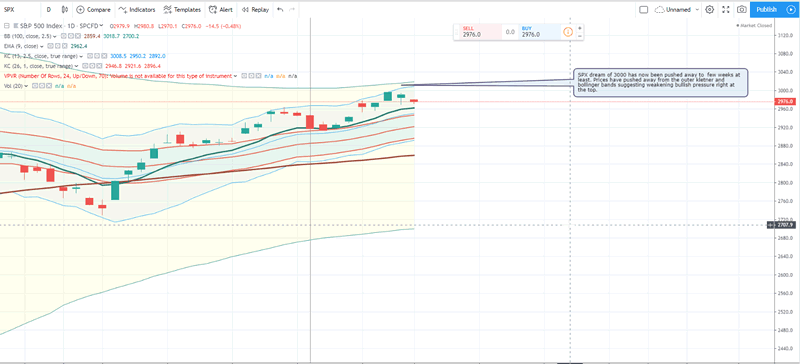

SPX Charts

SPX Hourly

SPX dream of 3000 has now been pushed away to few weeks at least. Prices have pushed away from the outer kletner and bollinger bands suggesting weakening bullish pressure right at the top.

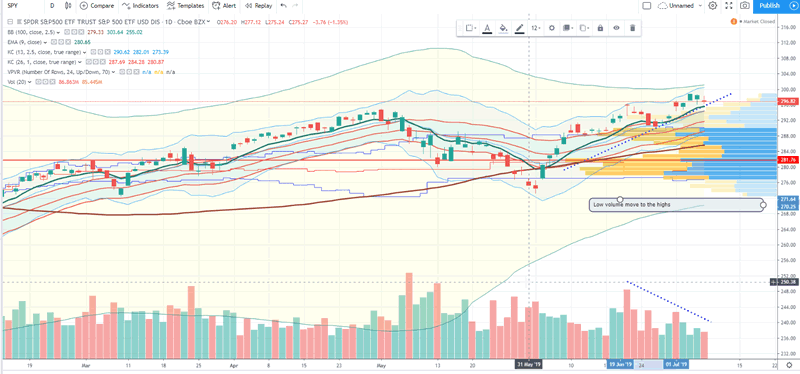

Low Volume Metlup

The ETF SPY shows low volume and conviction near the top.

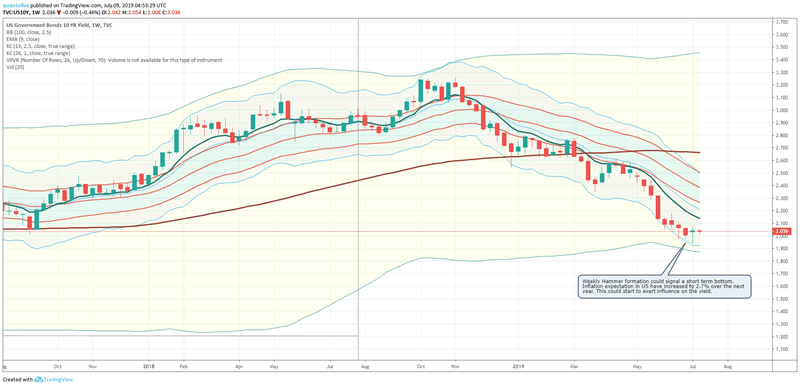

10 Year yield at 2.03% is in downtrend

Weekly Hammer formation could signal a short term bottom. Inflation expectation in US have increased to 2.7% over the next year. This could start to exert influence on the yield.

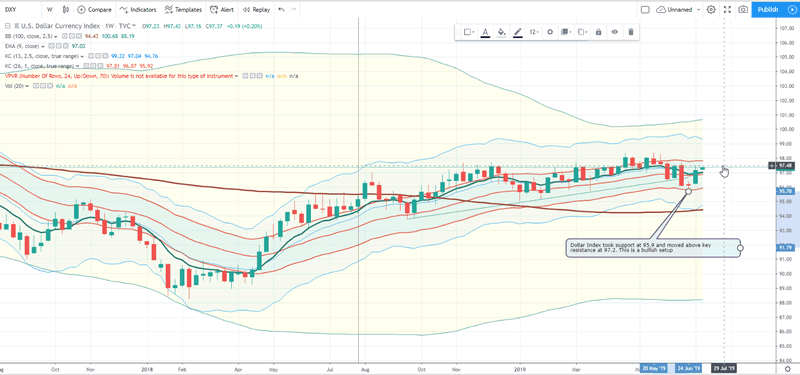

Dollar Index: Above resistance

Dollar Index took support at 95.9 and moved above key resistance at 97.2. This is a bullish setup and we could see dollar move higher very quickly. Be long the dollar against EUR, GBP, CAD and AUD.

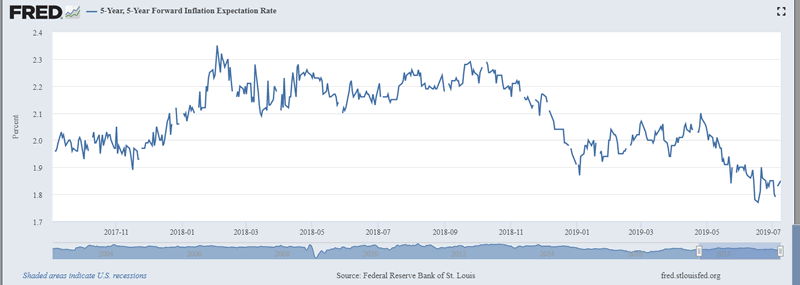

US Inflation expectation has stabilised at 1.85% for 5 year forward expectation

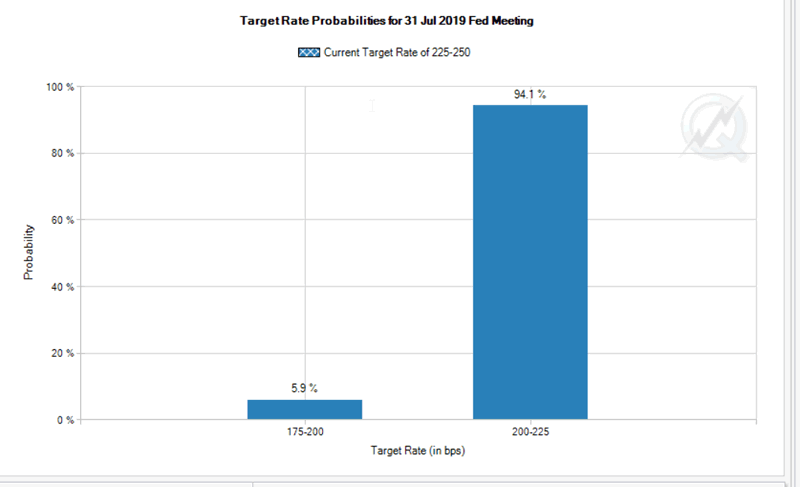

FED Rate cut expectation is hovering at 94% for a 25 bps cut in July. About 6% expect a 50 bps cut. However the data is not supportive of a rate cut and we could see this change after Powell testimony.

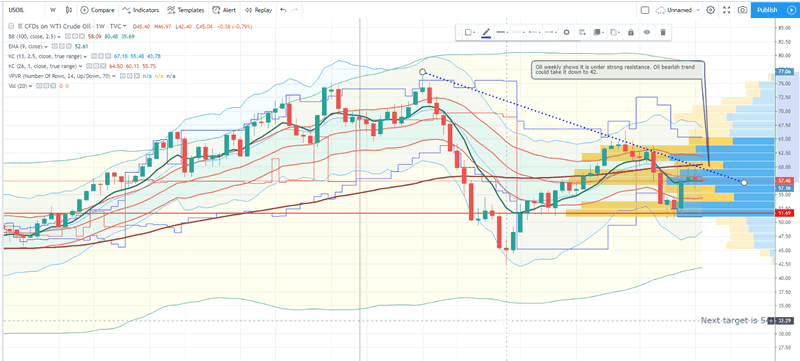

Oil Weekly

Gold weekly

Gold weekly shows hammer patter for last two weeks. Therefore it is indecision. It could retest 1450 before ultimately falling to 1350. Further research and daily setups provided here: Daily Setups

QUANTO trading system is automated trading system. May returns = +22% Jun returns = +10% July ongoing = +3%

Please contact us for more info on how to get started.

Source: https://quanto.live/2019/07/09/spx-3000-dream-is-pushed-away/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.