Gold Stocks Forming Bullish Consolidation

Commodities / Gold and Silver Stocks 2019 Jul 16, 2019 - 09:35 AM GMTBy: Jordan_Roy_Byrne

Gold and gold stocks especially continue to shrug off bits and pieces of bad news.

Gold and gold stocks especially continue to shrug off bits and pieces of bad news.

No escalation in the trade war? The selloff lasted one day and the sector rebounded strongly the following day.

Strong headline jobs number? Again, the weakness was a buying opportunity.

This past week there was more.

The June CPI report came in hotter than expected, which could mitigate the degree the Fed eases in the future. Also, bond yields in the US have risen the entire week.

No dice.

Gold closed the week at $1412/oz while the gold stocks closed just inches from new highs on the daily charts.

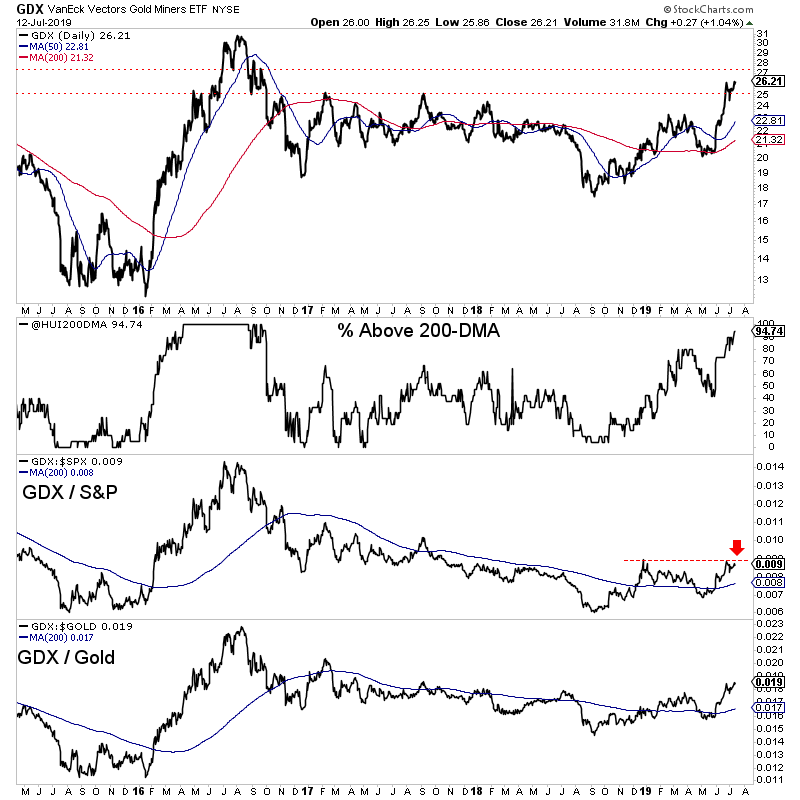

Turning to the technicals of the gold stocks, we see both underlying and relative strength.

Nearly 95% of the large miners closed above the 200-day moving average. Meanwhile GDX relative to both the S&P 500 and Gold is above a rising 200-day moving average. The GDX to Gold ratio is at a 2-year high while the GDX to S&P 500 ratio is very close to a new 52-week high.

GDX w/ Indicators

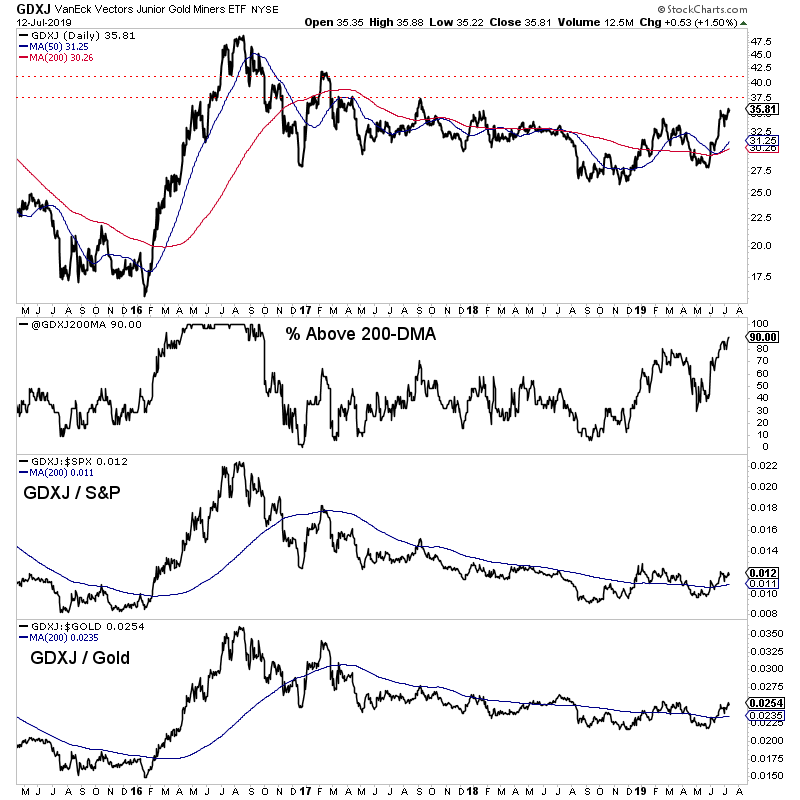

GDXJ is lagging GDX a bit but it is coming around.

90% of the ETF closed above the 200-day moving average. That is the highest reading in nearly three years.

GDXJ relative to the S&P and Gold has turned bullish and is holding above upward sloping 200-day moving averages.

GDXJ w/ Indicators

The immediate upside targets for GDX and GDXJ are GDX $27.50 and GDXJ $37.50. The next level of targets would be GDX $30 and GDXJ $41.

Gold has endured some selling in the $1420-$1425/oz range but has remained bid around $1400/oz. A daily close above $1420/oz would remove much of the resistance from here to the low $1500s.

For investors in the juniors and seniors, continue to hold your winners and focus your capital on fresh opportunities and value plays that could move with the next leg higher.

To learn what stocks we are buying and have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.