US House Prices Trend Forecast 2019 to 2021

Housing-Market / US Housing Jul 20, 2019 - 03:36 PM GMTBy: Nadeem_Walayat

This is the final analysis in my US housing market series that concludes in a detailed multi-year trend forecast.

This is the final analysis in my US housing market series that concludes in a detailed multi-year trend forecast.

- Current State

- Momentum Analysis

- US ECONOMY - GDP

- Unemployment

- Inflation

- Producer Prices Index

- Yield Curve

- US Debt

- QE4EVER!

- DEMOGRAPHICS

- US Home Builders Index (XHB)

- US Housing Market Real Terms BUY / SELL Indicator

- US House Prices 2019 to 2021 Trend Forecast Conclusion

- Peering into the Mists of Time

Formulating a US House Prices Forecast

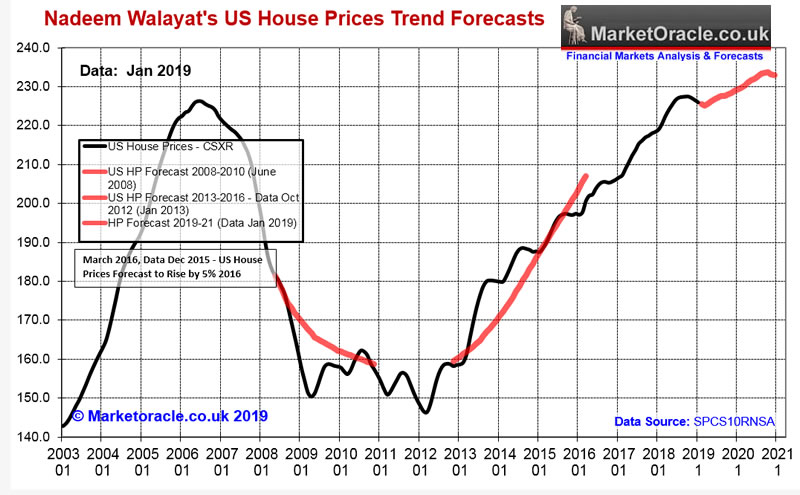

Momentum , economic and trend analysis paints an overall bullish picture for US house prices, one of first a continuation of the correction coming into 2019 that resolves in a resumption of the bull run into the end of 2020 that was targeting house price inflation of about +7% over these 2 full years of data into early 2021. Which would convert into the Case Shiller 10 city Index (SPCS10RNSA ) rising from 225.9 (Jan 2019 data) to about 242 (Jan 2021 data).

However, against this we have a near certain Imminent real terms SELL Signal, that implies to expect a much tougher 2019 and a shallower bounce into the end of 2020, which will likely see house prices entering into a significant down trend going into 2021. So US house prices will be lucky to achieve even half 7%.

US House Prices 2019 to 2021 Trend Forecast Conclusion

Therefore my forecast conclusion is for a relatively weak continuation of the US housing bull market into late 2020 at a much shallower pace than experienced in recent years for a likely gain of just 3% over the next 2 years (Jan 2019 to Jan 2021) before entering into a downtrend going into 2021 i.e. Case Shiller 10 city Index (SPCS10RNSA ) rising from 225.9 (Jan 2019 data) to 232.4 (Jan 2021 data) as illustrated by my trend forecast graph.

Peering into the Mists of Time

Standing here in April 2019, late 2020 and 2021 look set to be a tough time for the US economy, house prices, and the stock market, markets that tend to discount the future i.e. not wait for GDP to start falling before they take a tumble. Which is good because any drops in target stocks will provide another opportunity to invest in the machine intelligence mega-trend.

The whole of this analysis was first made available to Patrons who support my work: https://www.patreon.com/posts/us-house-prices-26484438

So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis :

- Gold and Silver Trend Analysis Update

- China Stock Market SSEC

- NASDAQ

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

- Dow Stock Market Trend Forecast July 2019 Update

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

- Silver Investing Trend Analysis and Price Forecast 2019

- Next British Prime Minister Tory Leadership Betfair Betting Markets

- Gold Price Trend Forecast Summer 2019

- Stock Market US China Trade War Panic! Trend Forecast May 2019 Update

- US House Prices Trend Forecast 2019 to 2021

- Bitcoin Price Trend Forecast 2019 Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

And ensure you are subscribed to my FREE Newsletter to get my public analysis in your email in box (only requirement is an email address).

Your analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.