Bailout Cost per US Tax Payer Analysis

Personal_Finance / Credit Crisis Bailouts Sep 30, 2008 - 09:07 AM GMTBy: Richard_Shaw

Pre-Vote Commentary- The bailout of Wall Street may not have ultimate costs as high as the nominal bailout amount, but the interest payments on the debt will come due immediately, and the recoveries from Wall Street, if any, will take many years.

Pre-Vote Commentary- The bailout of Wall Street may not have ultimate costs as high as the nominal bailout amount, but the interest payments on the debt will come due immediately, and the recoveries from Wall Street, if any, will take many years.

The impact of the bailout which will surely happen in one form or the other, will impact taxes, interest rates, the exchange rate of the Dollar, imports and exports, foreign direct investment both in and out of the US, corporate sales and profits, and a long list of economic and investment dimensions too long to mention and to unknowable to predict.

You can bet that your investments will be heavily impacted — fixed income (proxies AGG and IEF), domestic equities (proxies SPY and VTI), international equities (proxies EFA and EEM), real estate (proxy VNQ), commodities (proxies DJP, USO and GLD), currencies (proxies UUP and UDN) and other types of investments will all be impacted.

It's too soon for us to come up with investment or disinvestment recommendations we're willing to publish. However, one big factor in how things play out is the size of the tab for the bailout on a per investor basis.

We've noodled some costs we'd like to share with you here.

Per Taxpayer Annual Costs:

Who will pay how much and for how long for the bailout?

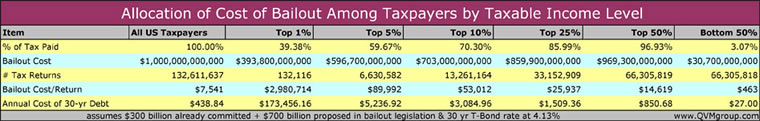

With the assumptions below, how much would taxpayers in each bracket have to pay per year for 30 years to support the debt service on the bonds issued for the bailout, assuming 30-year amortization of a sinking fund?

- if the total bailout is $1 trillion (the prior $300 billion already paid out, plus the $700 billion proposed to be paid out),

- and if the money is borrowed by the US using 30-year Treasury bonds,

- and if the interest rate is the 4.13% rate for 30-yr bonds today

- and if taxpayers are burdened to the same degree that they currently pay taxes

- then WOW!

The annual cost per average taxpayer is $439, but the distribution among income segments is tremendously skewed.

The bill for the top 1% of taxpayers is a shocking $173,000 per year. The annual bill for the bottom 50% of taxpayers is an easy $27. The image below shows the annual cost for the following income segments of taxpayers based on 2005 tax demographics from the IRS:

- top 1%,

- top 5%,

- top 10%,

- top 25%,

- top 50%

- bottom 50%.

Good luck to us all.

P.S. We don't know all the history behind mark-to-market accounting rules, but wouldn't temporarily creating more asset valuation flexibility in this locked-up credit market improve capital ratios and reduce the capital infusion requirements, reducing the size of the needed bailout, and grease the wheels of credit a bit?

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.